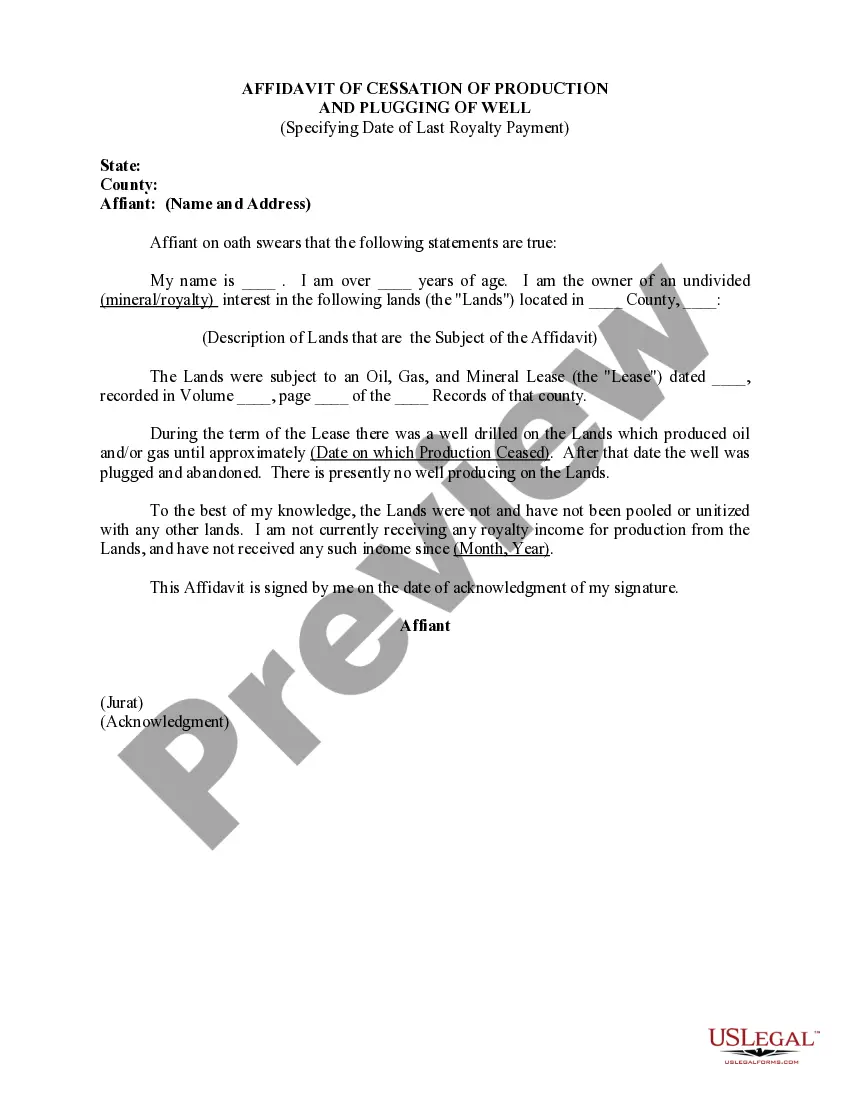

Mississippi Affidavit As to Termination of Production Payment

Description

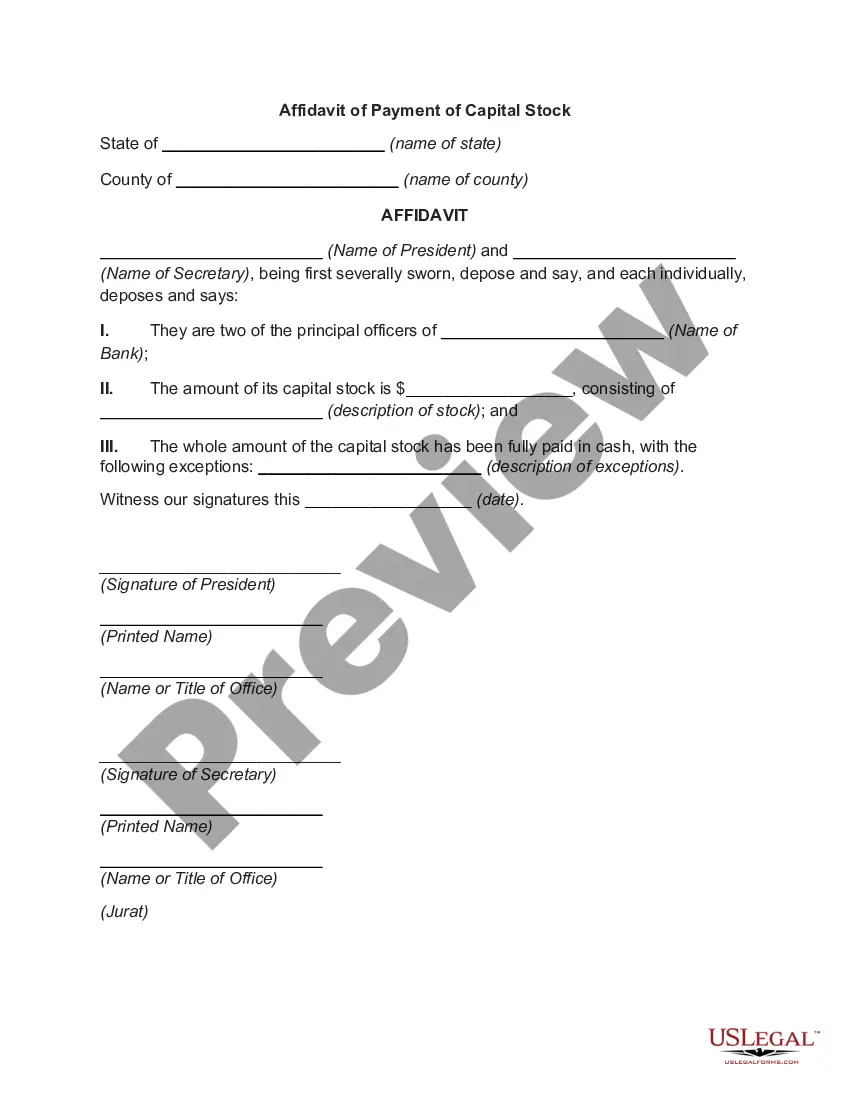

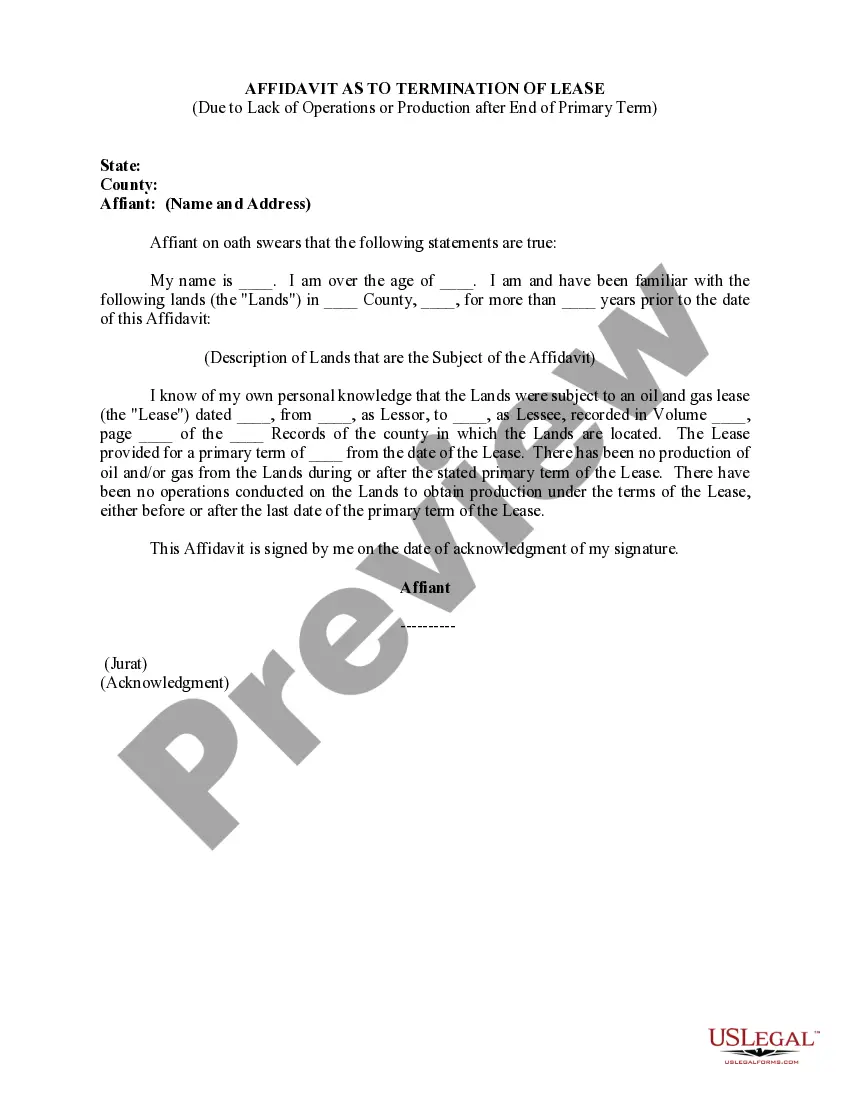

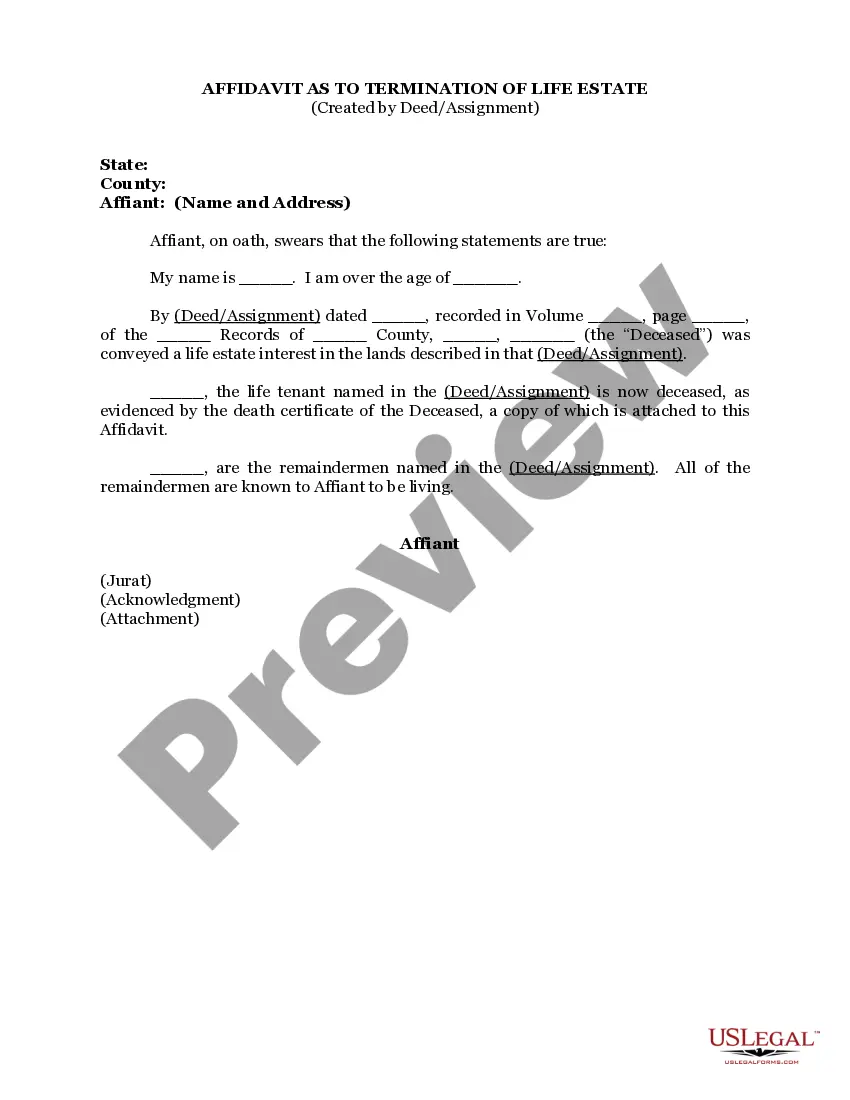

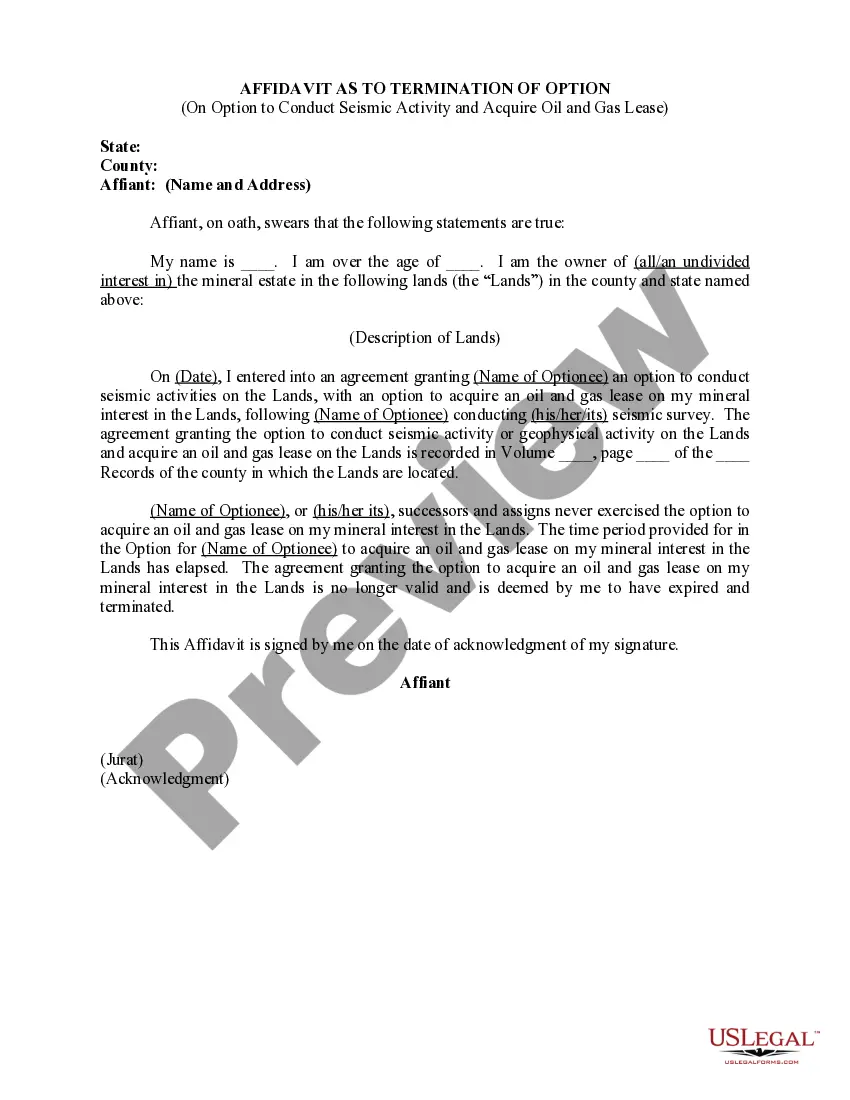

How to fill out Affidavit As To Termination Of Production Payment?

If you want to complete, down load, or print out authorized document layouts, use US Legal Forms, the biggest assortment of authorized varieties, which can be found on the web. Make use of the site`s simple and handy search to get the papers you require. Different layouts for organization and personal uses are categorized by groups and says, or search phrases. Use US Legal Forms to get the Mississippi Affidavit As to Termination of Production Payment in a handful of mouse clicks.

When you are presently a US Legal Forms consumer, log in to the profile and click the Acquire button to obtain the Mississippi Affidavit As to Termination of Production Payment. You can also access varieties you in the past delivered electronically from the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for that proper town/region.

- Step 2. Use the Review method to look through the form`s content. Don`t forget to read the explanation.

- Step 3. When you are unsatisfied together with the kind, make use of the Lookup area towards the top of the screen to find other models of your authorized kind template.

- Step 4. After you have identified the shape you require, click on the Purchase now button. Opt for the prices prepare you favor and include your accreditations to sign up to have an profile.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal profile to accomplish the deal.

- Step 6. Select the file format of your authorized kind and down load it on your gadget.

- Step 7. Total, modify and print out or signal the Mississippi Affidavit As to Termination of Production Payment.

Every single authorized document template you buy is yours eternally. You have acces to every kind you delivered electronically within your acccount. Select the My Forms section and choose a kind to print out or down load once more.

Remain competitive and down load, and print out the Mississippi Affidavit As to Termination of Production Payment with US Legal Forms. There are millions of skilled and status-certain varieties you can use for your organization or personal demands.

Form popularity

FAQ

If you have income earned from working in a state, you will generally have to report that income and pay taxes on it regardless of whether you are a resident.

Who Must File. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

The plaintiff must mail the defendant a copy of the summons and complaint, two copies of a notice and acknowledgement conforming substantially to Form 1B, and a postage paid envelope addressed to the sender. Upon receipt, the defendant may execute the acknowledgement of service under oath or by affirmation.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Generally, if Social Security benefits were your only income, your benefits are not taxable and you probably do not need to file a federal income tax return.

Sales of property, labor or services sold to, billed directly to, and payment is made directly by the United States Government, the state of Mississippi and its departments, institutions, counties and municipalities or departments or school districts of its counties and municipalities are exempt from sales tax.

If you are based outside Mississippi, but have sales tax nexus and are required to charge sales tax in Mississippi, you are a ?remote seller? and only required to charge ?use tax.? Use tax is very similar to sales tax except that it's charged by remote sellers. Mississippi's use tax rate is 7%.

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.