Mississippi Credit Letter to Close Account

Description

How to fill out Credit Letter To Close Account?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest forms such as the Mississippi Credit Letter to Close Account within moments.

If you have an account, Log In and download the Mississippi Credit Letter to Close Account from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms within the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Mississippi Credit Letter to Close Account. Each template you added to your account has no expiration date and is yours forever. Thus, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the Mississippi Credit Letter to Close Account with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

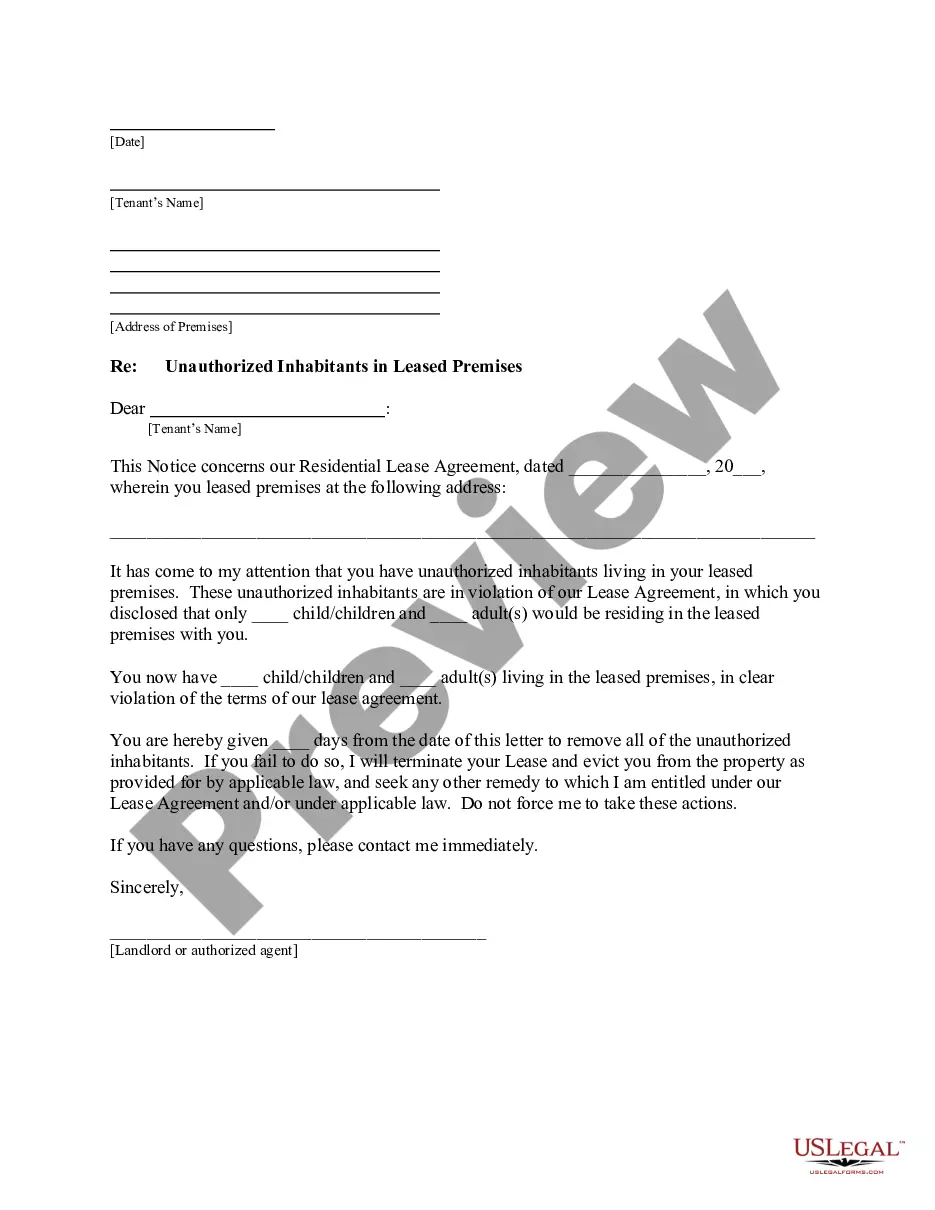

- Ensure you have selected the correct form for your locality/region. Click the Preview button to review the form's content.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your details to register for the account.

Form popularity

FAQ

To write a Mississippi Credit Letter to Close Account, start by addressing the letter to your financial institution. Clearly state your intention to close your account and include your account number for reference. It is helpful to sign and date the letter, and you may want to request a confirmation of account closure. By using a template from uslegalforms, you can ensure your letter meets all necessary requirements.

An authorization letter to close a bank account grants permission for the bank to proceed with the closure. In your letter, include your account number, a request for closure, and your signature to validate the authorization. Utilizing a Mississippi Credit Letter to Close Account can streamline this process, ensuring you cover essential elements and maintain a professional tone.

Writing a letter to close a credit card account involves stating your intent clearly and providing your account information. Begin with your name, address, and the credit card issuer's details. You can use a Mississippi Credit Letter to Close Account template to help structure your letter, ensuring it includes your request for account closure and instructions for any remaining balance.

To write a letter to close your account, start with your personal information, including your name and address. Next, specify the account type and number you wish to close. Include a request for confirmation of the closure, and consider using a Mississippi Credit Letter to Close Account template from USLegalForms for guidance, ensuring you cover all necessary details.

A closing account letter formally requests the closure of your account with a financial institution. For instance, a Mississippi Credit Letter to Close Account would include your account details, a request for closure, and a statement to confirm that you have no pending transactions. This letter serves as a record for both you and the institution, ensuring clarity in your request.

A credit card closure letter is an official document from your credit card issuer that confirms your account has been closed. This letter serves as proof for your records and can be helpful in case of future disputes. It typically includes details like the account number and the date of closure. Obtaining a Mississippi Credit Letter to Close Account can also reinforce your financial documentation.

To get a credit card closure letter, contact your credit card provider after closing your account. They will send you a formal letter confirming the closure of your account. This documentation is important for your financial records. Ensure you obtain a Mississippi Credit Letter to Close Account as part of this process.

You can request the closing of your credit card by contacting your card issuer directly. It is advisable to discuss any outstanding balances or rewards before proceeding. Request confirmation of the closure in writing. A Mississippi Credit Letter to Close Account can be beneficial for your financial records.

To get a bank closure letter, you should reach out to your bank's customer service or visit a nearby branch. Request the letter, and they will guide you through the process. This document is essential for your records, and you may want to ask for a Mississippi Credit Letter to Close Account to ensure proper documentation.

If you need statements for a closed credit card, contact your credit card company. They usually keep records for a certain period, so they can send you the statements upon request. Make sure to specify the dates for which you need the statements. Consider obtaining a Mississippi Credit Letter to Close Account to support your request.