Mississippi Collections Agreement - Self-Employed Independent Contractor

Description

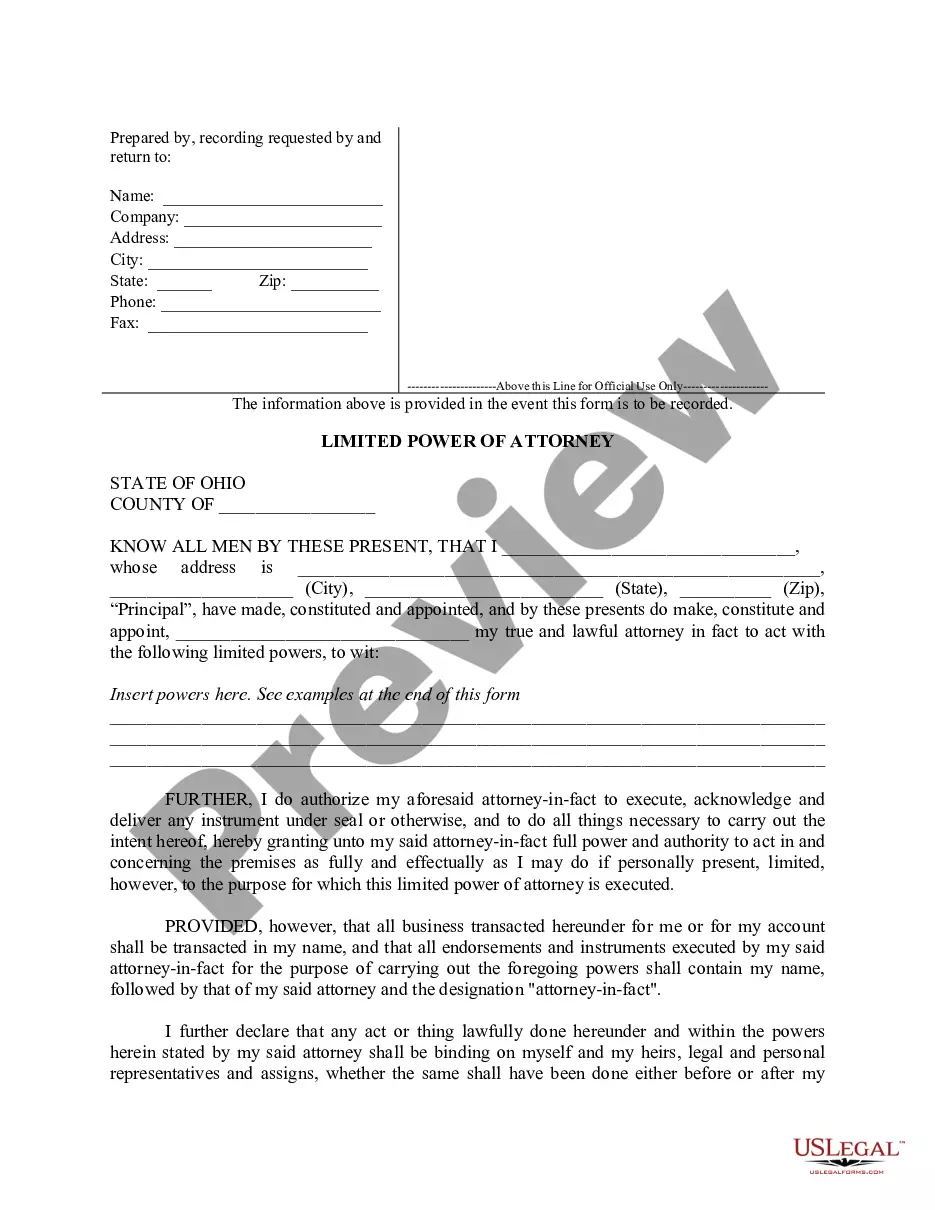

How to fill out Collections Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be challenging.

Of course, there are numerous templates accessible online, but how can you locate the legal form you need.

Make use of the US Legal Forms site. This service provides a wide array of templates, including the Mississippi Collections Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal needs.

You can preview the form using the Preview function and review the form summary to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are certain that the form is accurate, click on the Get now button to acquire the form. Choose the pricing plan you prefer and provide the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Mississippi Collections Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal documents where you can find various document templates. Use the service to obtain properly designed files that comply with state regulations.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Mississippi Collections Agreement - Self-Employed Independent Contractor.

- Use your account to access the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your location/state.

Form popularity

FAQ

As a self-employed independent contractor in Mississippi, receiving payments can be streamlined with a clear Mississippi Collections Agreement. This agreement outlines the payment terms, methods, and timeline, ensuring that both parties understand their responsibilities. You may choose to accept payments through bank transfers, checks, or popular payment platforms, making it convenient for you and your clients. By utilizing a solid agreement, you can foster trust and clarity in your business relationships.

Yes, an independent contractor can face legal action if they fail to meet the terms outlined in their contract. If a disagreement arises over work quality or project delivery, clients may seek recourse through legal channels. When using a Mississippi Collections Agreement - Self-Employed Independent Contractor, the risks of lawsuits can be minimized, as both parties have a clear understanding of their obligations. It's essential to protect yourself by drafting a comprehensive agreement that addresses potential disputes.

A basic independent contractor agreement outlines the terms of work between a client and a contractor. This document defines the scope of work, payment conditions, and expectations for both parties. In the context of Mississippi, a Mississippi Collections Agreement - Self-Employed Independent Contractor can help ensure clear communication and protection for both the contractor and the hiring party. By having this agreement in place, you can foster a professional relationship while reducing the risk of misunderstandings.

Recent changes in Mississippi's contractor laws focus on ensuring fairness and protection for independent contractors. These changes may include adjustments related to classification, benefits, and working conditions. Staying updated on these laws helps protect your rights and ensures compliance. For guidance, consider utilizing resources like UsLegalForms to craft your Mississippi Collections Agreement - Self-Employed Independent Contractor.

Mississippi does not specifically mandate an operating agreement for independent contractors. However, having a clearly defined operating agreement can help clarify expectations and responsibilities in your business relationships. Such an agreement can be immensely beneficial if you collaborate with other contractors or clients. Consider using templates from UsLegalForms to craft your operating agreement efficiently.

Mississippi does not have specific laws regarding breaks for independent contractors. However, as a self-employed individual, you generally have the freedom to set your own schedule. It is essential to manage your time effectively to avoid burnout. Always remember that maintaining a healthy work-life balance benefits both your productivity and well-being.

Starting July 1, 2025, new laws in Mississippi may outline additional regulations affecting independent contractors. These laws could impact tax obligations, rights, or benefits for self-employed individuals. Staying informed about these changes is essential for compliance and maximizing your rights as an independent contractor. Resources like UsLegalForms can help you prepare for these updates with relevant documentation.

Creating an independent contractor agreement in Mississippi involves clearly outlining the terms of your working relationship. Start by defining the scope of work, compensation structure, and deadlines. It is important to specify confidentiality clauses and intellectual property rights. Using a Mississippi Collections Agreement - Self-Employed Independent Contractor template from UsLegalForms can simplify this process and ensure all critical points are covered.

The independent contractor law in Mississippi classifies independent contractors as self-employed individuals who provide services under a contract agreement. This setup offers flexibility and autonomy in how you work. As a self-employed independent contractor, you are responsible for your taxes and expenses, unlike traditional employees. To ensure compliance, consider using a Mississippi Collections Agreement - Self-Employed Independent Contractor.

Independent contractors need to complete several forms to ensure compliance. Key documents typically include the independent contractor agreement, tax forms like the W-9, and any specific industry-related paperwork. Utilizing resources like US Legal Forms can simplify these processes, particularly for those referencing the Mississippi Collections Agreement - Self-Employed Independent Contractor.