Mississippi Self-Employed Independent Contractor Construction Worker Contract

Description

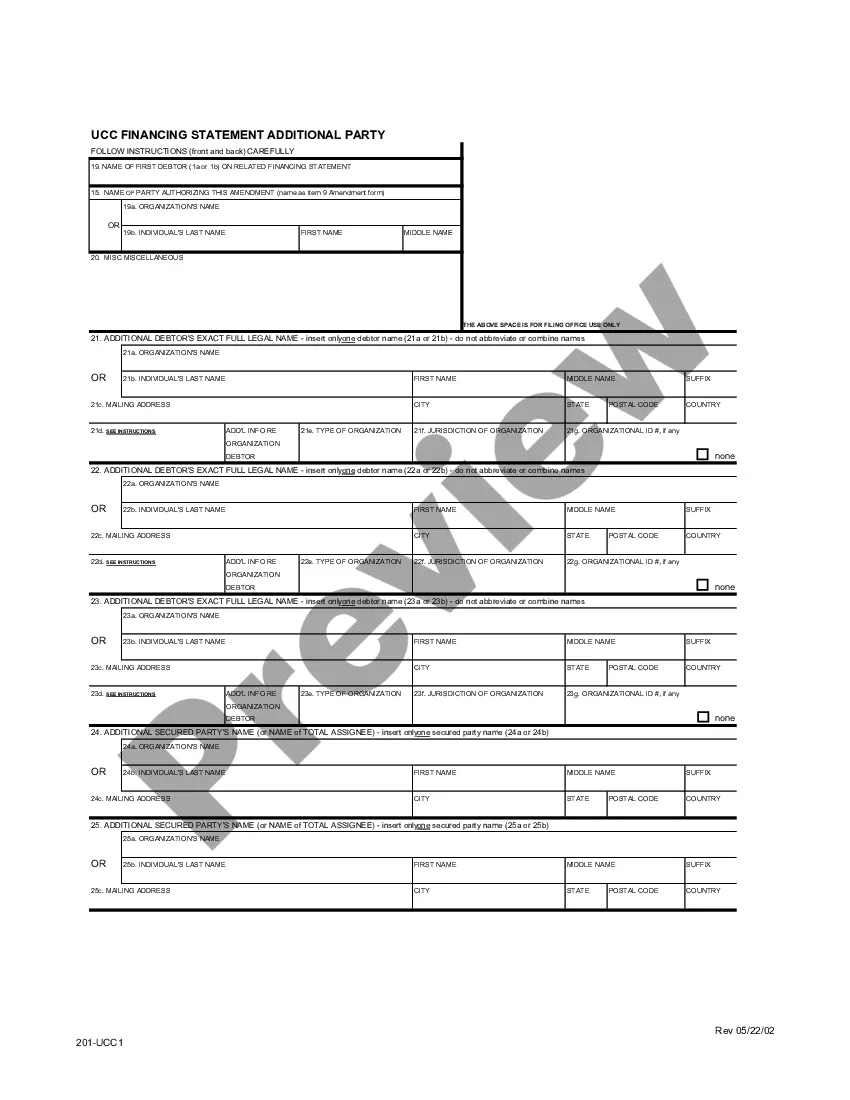

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

You might spend considerable time online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a wide array of legal forms that have been reviewed by experts.

It is easy to obtain or create the Mississippi Self-Employed Independent Contractor Construction Worker Contract through the service.

If available, use the Preview button to view the document template at the same time. To find another version of your document, use the Search section to locate the template that fits your needs and requirements. Once you have found the template you wish to use, click Acquire now to proceed. Choose the payment plan you prefer, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of your document and download it to your device. Make any necessary adjustments to the document. You can fill out, edit, sign, and print the Mississippi Self-Employed Independent Contractor Construction Worker Contract. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can fill out, edit, print, or sign the Mississippi Self-Employed Independent Contractor Construction Worker Contract.

- Every legal document template you acquire is yours to keep indefinitely.

- To retrieve another copy of any purchased document, visit the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area you choose.

- Review the document description to confirm you have selected the right template.

Form popularity

FAQ

Yes, independent contractors, including those in the Mississippi self-employed independent contractor construction worker category, file taxes as self-employed individuals. This means you will report your income on Schedule C when filing your tax return. It's important to keep track of all your income and expenses, as this can help reduce your taxable income. US Legal Forms can help you navigate the tax filing process with relevant resources tailored for independent contractors.

To provide proof of your employment as a Mississippi self-employed independent contractor construction worker, you can present a contract detailing the terms of your work. Additionally, you may include invoices for services rendered as well as bank statements showing payments received. These documents together can establish your role and income. If you need further assistance, consider using US Legal Forms to obtain a well-structured contractor agreement.

Filling out an independent contractor agreement begins with providing accurate identifying information for both parties, including names and contact details. Ensure you specify the work to be performed, payment terms, and duration of the contract. This clarity will facilitate a smoother relationship, leading to a successful Mississippi Self-Employed Independent Contractor Construction Worker Contract.

To write an independent contractor agreement, start with a title and date, then outline the parties involved. Include all relevant details such as the nature of work, compensation, timelines, and any specific clauses to safeguard both parties. A well-structured agreement serves as a strong Mississippi Self-Employed Independent Contractor Construction Worker Contract for your professional relationship.

When writing a self-employed contract, clearly outline the scope of work, payment terms, and deadlines. Include provisions for confidentiality, termination, and dispute resolution to protect both parties. This attention to detail will lead to a more effective Mississippi Self-Employed Independent Contractor Construction Worker Contract that prevents misunderstandings.

Mississippi law defines independent contractors as individuals or entities that work for others but are not considered employees. Independent contractors are responsible for their own taxes and expenses, providing them with a degree of flexibility. Understanding the legal framework ensures you create a solid Mississippi Self-Employed Independent Contractor Construction Worker Contract that protects your interests.

An independent contractor should typically fill out a Form W-9, which provides tax information to the client. Additionally, depending on your specific situation, you may need to fill out a contract form that outlines the terms of your service. This documentation is crucial for establishing a clear Mississippi Self-Employed Independent Contractor Construction Worker Contract.

To fill out an independent contractor form, start by gathering relevant information such as your name, address, and contact details. Make sure to provide details about the services you offer, the payment structure, and any deadlines involved. This information will help create a comprehensive Mississippi Self-Employed Independent Contractor Construction Worker Contract.

Yes, a construction worker can be self-employed, especially if they operate as an independent contractor. In this role, they manage their own work schedule, set their rates, and take on multiple clients. This structure often requires a Mississippi Self-Employed Independent Contractor Construction Worker Contract for clarity on obligations and rights. Understanding this categorization helps ensure compliance with tax laws and benefits.

To create a Mississippi Self-Employed Independent Contractor Construction Worker Contract, start by outlining the project's scope and details. Clearly specify the roles, responsibilities, and payment terms for both parties. Be sure to include termination conditions and any required certifications or licenses. Using a platform like uslegalforms can streamline this process by providing templates that meet state-specific requirements.