Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms like the Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor in moments.

If you already have an account, Log In and download the Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

Select the format and download the form onto your device.

Make modifications. Complete, edit, print, and sign the saved Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor.

- If you want to use US Legal Forms for the first time, here are simple steps to help you get started.

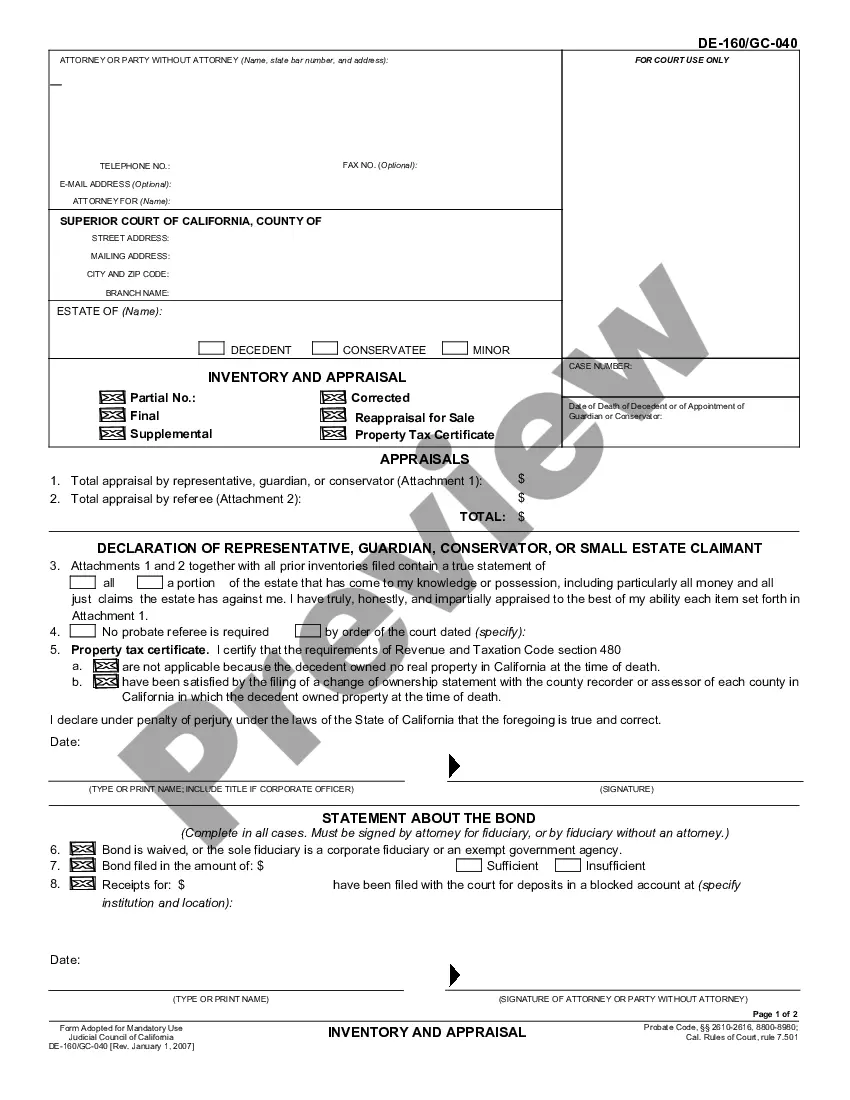

- Ensure you have chosen the correct form for the area/state. Click the Preview button to review the form's content.

- Read the form description to confirm that you have selected the suitable form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Download now button. Then, choose your preferred pricing plan and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete your transaction.

Form popularity

FAQ

As an independent contractor, you have several key rights, including the right to fair compensation and to work without discrimination. Moreover, you also have the right to control your work hours and methods, as outlined in your Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor. It’s critical to know these rights to ensure a positive working experience while protecting your interests. Always consult a legal professional for guidance specific to your situation.

Recently, Mississippi introduced new laws aimed at regulating independent contractors, focusing on classification and rights. These changes enhance protections for self-employed individuals and clarify responsibilities. Understanding these laws is vital as a contractor, particularly when you enter a Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor. Staying informed helps you maintain compliance and protects your business.

An independent contractor files taxes differently from regular employees. Contractors use IRS Form 1040, along with Schedule C for reporting income and deductible expenses. Under the Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor, it's essential to keep thorough records of your earnings and expenditures. Additionally, contractors should consider quarterly estimated tax payments to avoid underpayment penalties.

The standard independent contractor clause outlines the relationship between the contractor and the client. It clarifies that the contractor is self-employed and not an employee. Including this clause in a Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor helps protect both parties. It also defines the scope of work, payment terms, and responsibilities of each party.

In Mississippi, contractors typically need a license if they perform work worth $10,000 or more. This requirement ensures that independent contractors adhere to state regulations. As a self-employed independent contractor under a Mississippi Payroll Specialist Agreement, it's crucial to check whether your work requires a license. Be sure to consult with local authorities or legal professionals for specific advice.

Independent contractors do not need to be on payroll, as they operate under different tax rules than traditional employees. Instead, they receive payments for services rendered and report their earnings. It's important to have a Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor in place to outline this relationship clearly. This can help both parties understand their financial responsibilities and legal obligations.

To create an independent contractor agreement, first, establish the terms of the working relationship clearly. Include essential details such as scope of work, payment terms, and deadlines. Utilizing a platform like US Legal Forms can streamline this process by providing templates designed for a Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor. This ensures that all critical aspects are covered, making the agreement both professional and legally binding.

Independent contractors are not on payroll in the traditional sense, as they operate under a different classification. Instead of receiving a regular paycheck with tax withholdings, independent contractors invoice clients for their services. This distinction is crucial in the context of a Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor. Understanding this difference helps you manage your taxes and finances effectively, ensuring compliance with the law.

A service agreement for an independent contractor outlines the terms and conditions of the working relationship. In Mississippi, this document typically details project scope, compensation, deadlines, and other key aspects of the work arrangement. Having a solid Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor can help establish mutual expectations and reduce misunderstandings. Consider using platforms like uslegalforms to streamline the drafting process.

Independent contractors in Mississippi must comply with specific legal requirements to ensure proper classification. This includes obtaining any necessary licenses, maintaining self-employment tax obligations, and upholding the terms outlined in your Mississippi Payroll Specialist Agreement - Self-Employed Independent Contractor. Make sure to keep clear records of your income and expenses, as this provides protection during tax season and any audits. Understanding these requirements is crucial for your success and legal standing.