Mississippi Audiologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Audiologist Agreement - Self-Employed Independent Contractor?

You might spend hours online searching for the valid document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be reviewed by experts.

It is easy to download or print the Mississippi Audiologist Agreement - Self-Employed Independent Contractor from their service.

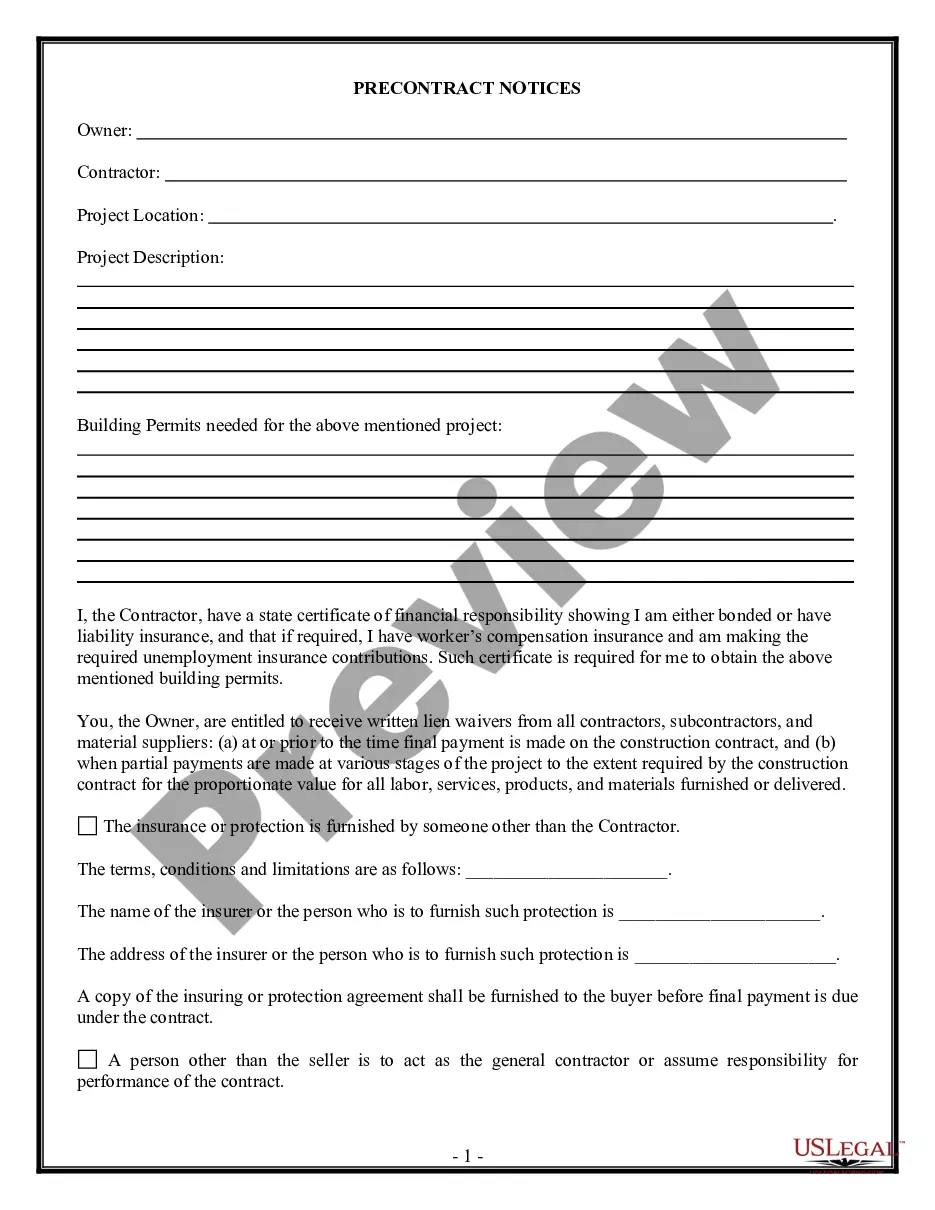

If available, use the Preview button to look through the document template as well. If you wish to obtain another version of your form, use the Search area to find the template that fits your needs and requirements. Once you have located the template you want, click Buy now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal form. Choose the format of your document and download it to your device. Make adjustments to the document if needed. You can complete, modify, sign, and print the Mississippi Audiologist Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Mississippi Audiologist Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the area/city of your choice.

- Check the form description to ensure you have selected the right form.

Form popularity

FAQ

To fill out an independent contractor agreement, provide specific details in each section, ensuring accuracy and clarity. You will include information such as work scope, payment method, and project timeline. Utilizing a resource like the Mississippi Audiologist Agreement - Self-Employed Independent Contractor helps simplify this process, making it easier to adhere to legal requirements and safeguard both parties' interests.

Typically, either party can draft the independent contractor agreement, but it is advisable for the hiring entity to prepare the document. When creating the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, using resources like uslegalforms can provide invaluable guidance. These documents often include legal language which helps in establishing clear expectations and responsibilities for both parties.

Filling out an independent contractor form involves providing essential information such as your name, contact details, and the nature of your work. For those using the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, you will also specify the project details and payment terms. Ensure all sections are completed accurately to avoid any misunderstandings or disputes later on.

To write an independent contractor agreement, start by clearly outlining the scope of work and terms of engagement. Include key details like payment structure, duration, and confidentiality provisions. It is essential to refer to a well-structured template, such as the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, which ensures all critical elements are in place. This structure protects both parties and clarifies expectations.

Creating an independent contractor agreement, such as the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, starts with defining the scope of work, including specific services and deliverables. Next, outline payment terms, such as rates and schedules, to ensure clarity. It is essential to include confidentiality clauses and dispute resolution terms. To make the process easier, you can utilize platforms like uslegalforms, which provide templates tailored for various industries and functions.

Independent contractors, including those under the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, are entitled to payment for services rendered as outlined in their agreement. They also have the right to set their own schedules, control their methods of work, and enjoy tax deductions related to their business expenses. Additionally, independent contractors can seek benefits such as liability insurance and retirement plans to enhance their financial security.

In Mississippi, the amount of work you can do without a contractor license depends on the type and scale of your services. For specific tasks like audiology services, knowing your licensing requirements is crucial. The Mississippi Audiologist Agreement - Self-Employed Independent Contractor addresses these specifications to ensure you comply with local regulations while working.

Recent updates to contractor laws in Mississippi emphasize the classification and rights of independent contractors. These changes aim to enhance fairness and clarity in contractor relationships. Keeping informed about these updates is essential for maintaining compliance when drafting your Mississippi Audiologist Agreement - Self-Employed Independent Contractor.

The independent contractor law in Mississippi outlines the conditions under which individuals may operate as independent contractors rather than employees. Clear distinctions must be made, especially regarding control and independence in performing tasks. Understanding these laws is essential for crafting your Mississippi Audiologist Agreement - Self-Employed Independent Contractor.

Yes, having a contract is vital as an independent contractor. A well-structured contract, such as the Mississippi Audiologist Agreement - Self-Employed Independent Contractor, clarifies expectations and protects your rights. It serves as a roadmap for your services, defining the scope of work and payment terms.