Mississippi How to Request a Home Affordable Modification Guide

Description

How to fill out How To Request A Home Affordable Modification Guide?

Have you ever been in a situation where you constantly need documents for business or personal purposes? There are numerous legal document templates accessible online, but sourcing ones you can trust is challenging.

US Legal Forms offers a wide array of template documents, such as the Mississippi How to Request a Home Affordable Modification Guide, that are designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Mississippi How to Request a Home Affordable Modification Guide template.

- Obtain the document you wish and ensure it corresponds to your specific city/county.

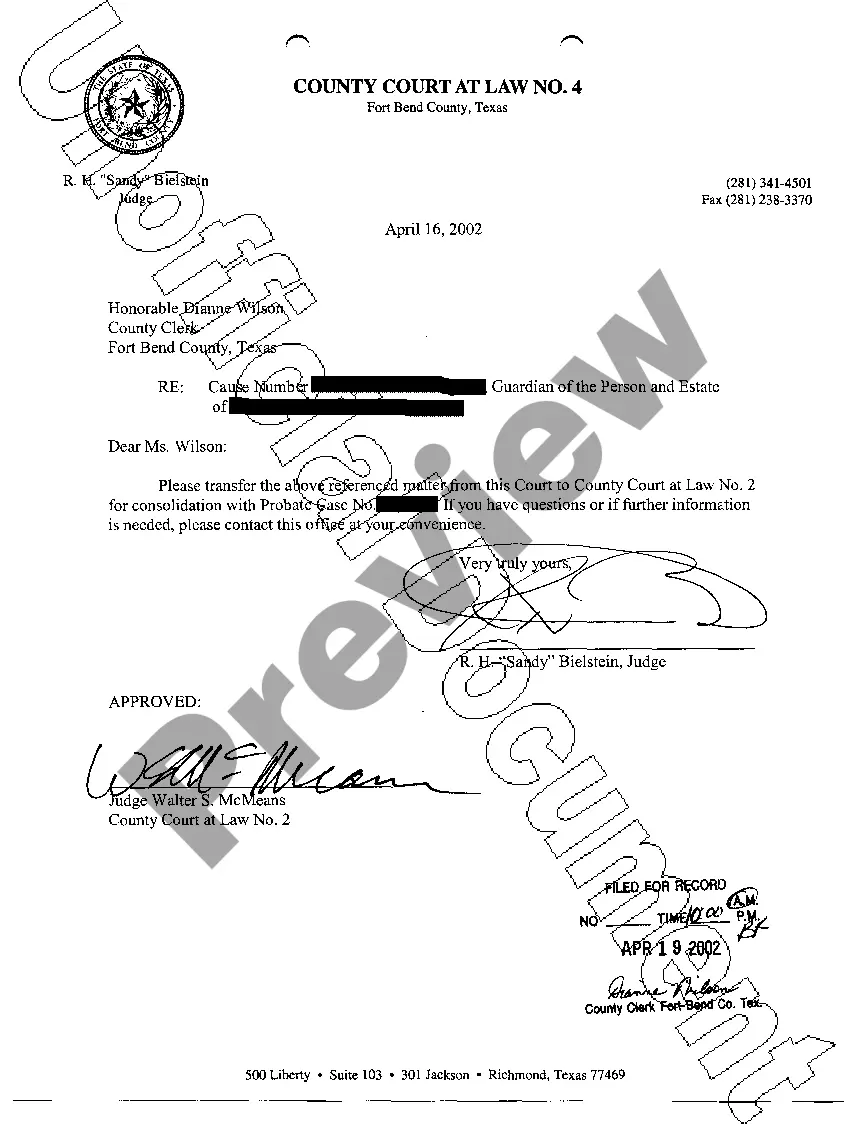

- Utilize the Preview button to review the form.

- Check the description to ensure you have selected the correct document.

- If the document isn't what you seek, use the Search field to locate a form that fits your needs and requirements.

- Once you've found the correct document, click Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and process the payment using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

The mortgage assistance program in Mississippi offers support to homeowners who are struggling to make their mortgage payments. This program provides financial aid and resources to help you avoid foreclosure and stay in your home. If you're looking for guidance on your options, our Mississippi How to Request a Home Affordable Modification Guide can simplify the process. By understanding the program, you can effectively navigate your way toward home stability.

Although this question specifically mentions Virginia, many mortgage relief programs have similar qualifications. Generally, eligibility might depend on factors like the borrower's income, payment history, and the type of mortgage held. To ensure you understand the requirements, consulting the Mississippi How to Request a Home Affordable Modification Guide can provide key insights into various programs, including those in Virginia.

HAMP, or the Home Affordable Modification Program, aims to provide relief for homeowners experiencing financial hardship. It allows qualifying homeowners to modify their loans, making payments more manageable and sustainable. If you want to dive deeper into this program, check the Mississippi How to Request a Home Affordable Modification Guide for actionable steps.

HAMP stands for the Home Affordable Modification Program. It was established as a government initiative to provide financial relief to homeowners facing difficulties with their mortgage payments. By understanding what HAMP entails, you can better navigate the options available to you, which is crucial when using the Mississippi How to Request a Home Affordable Modification Guide.

The Home Affordable Modification Program (HAMP) offers assistance to homeowners who are struggling to make their mortgage payments. Under this program, eligible participants may receive a modification to their mortgage terms, helping to reduce monthly payments and avoid foreclosure. For a detailed understanding, refer to the Mississippi How to Request a Home Affordable Modification Guide.

Qualifying for a mortgage modification typically depends on your financial situation and whether you can demonstrate a hardship. Lenders often seek evidence of income, expenses, and other debts. For detailed criteria, refer to the Mississippi How to Request a Home Affordable Modification Guide, which outlines eligibility requirements clearly. Meeting these qualifications can lead you towards a more manageable mortgage payment.

To apply for a mortgage modification, start by gathering necessary documents, such as your income statements and monthly expenses. Then, reach out to your lender to express your interest in modifying your mortgage. Using the information in the Mississippi How to Request a Home Affordable Modification Guide can help you understand the specific requirements. By preparing your application carefully, you enhance your chances of approval.

Getting a mortgage modification can feel challenging, but you can simplify the process by being organized and proactive. Typically, lenders require you to provide documentation about your financial situation. If you follow the steps in the Mississippi How to Request a Home Affordable Modification Guide, you can improve your chances of success. Remember, persistence pays off, and many homeowners find relief through this option.