Mississippi Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

Choosing the best lawful record web template could be a have difficulties. Obviously, there are a lot of layouts accessible on the Internet, but how can you discover the lawful develop you want? Take advantage of the US Legal Forms web site. The service offers a huge number of layouts, including the Mississippi Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings, that can be used for enterprise and private needs. All the forms are checked out by professionals and meet up with state and federal requirements.

If you are presently registered, log in for your account and click the Down load button to get the Mississippi Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings. Make use of account to appear throughout the lawful forms you possess acquired previously. Proceed to the My Forms tab of your respective account and obtain one more copy of your record you want.

If you are a brand new end user of US Legal Forms, listed here are basic guidelines for you to adhere to:

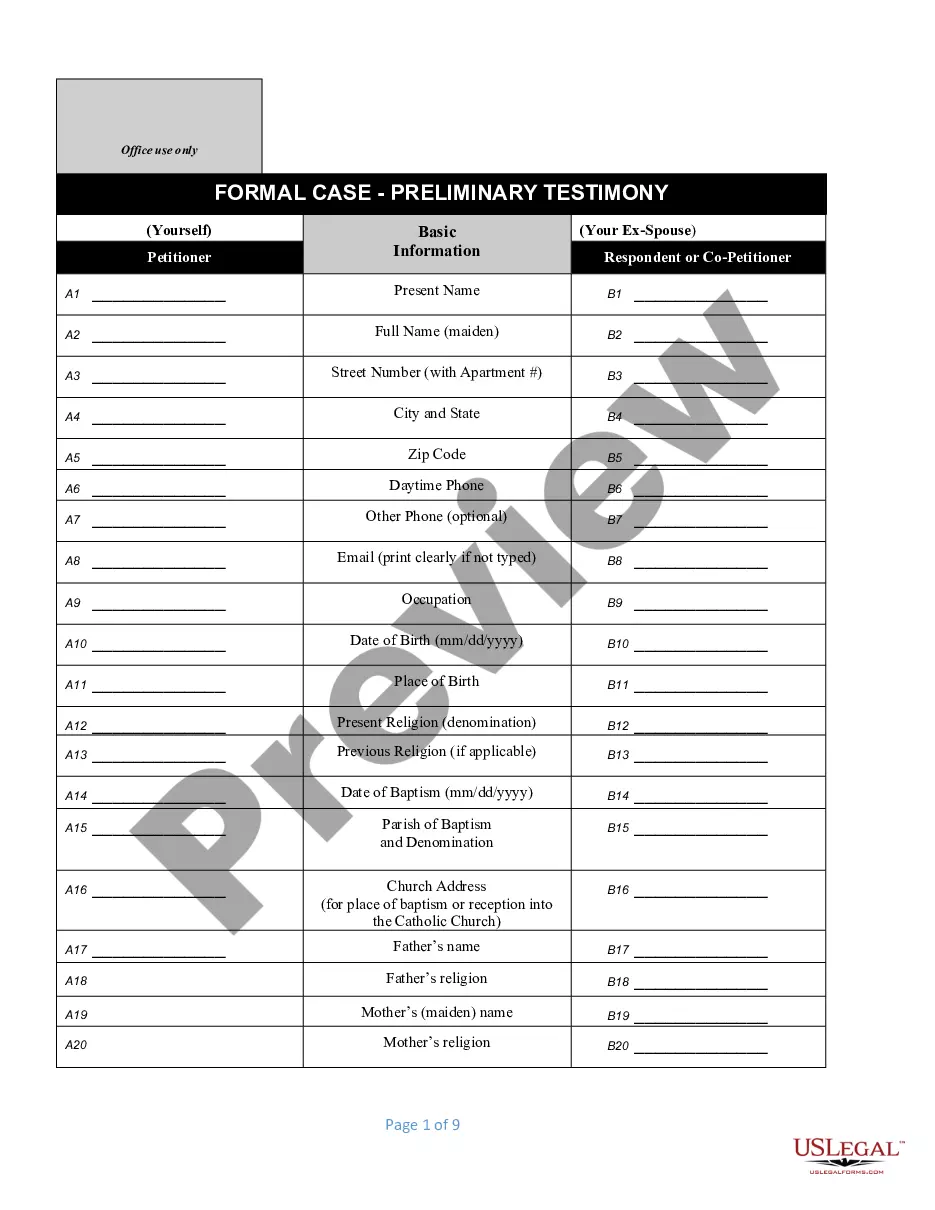

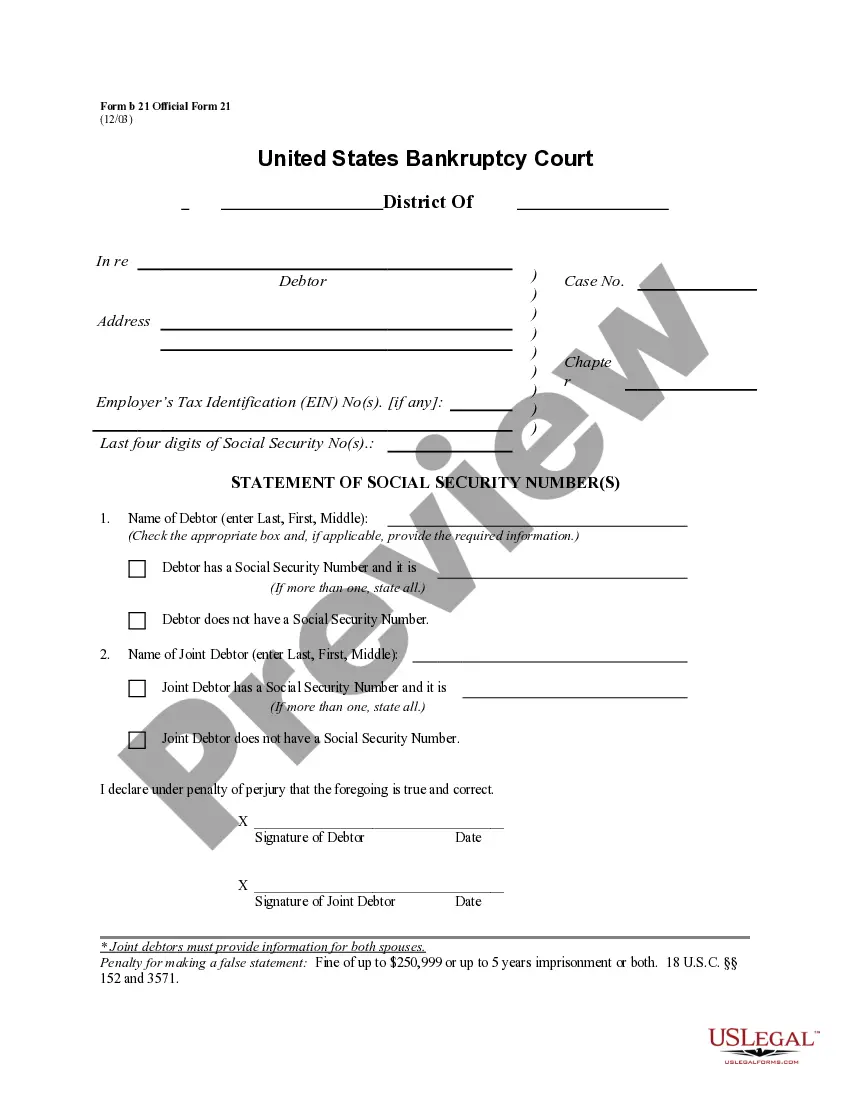

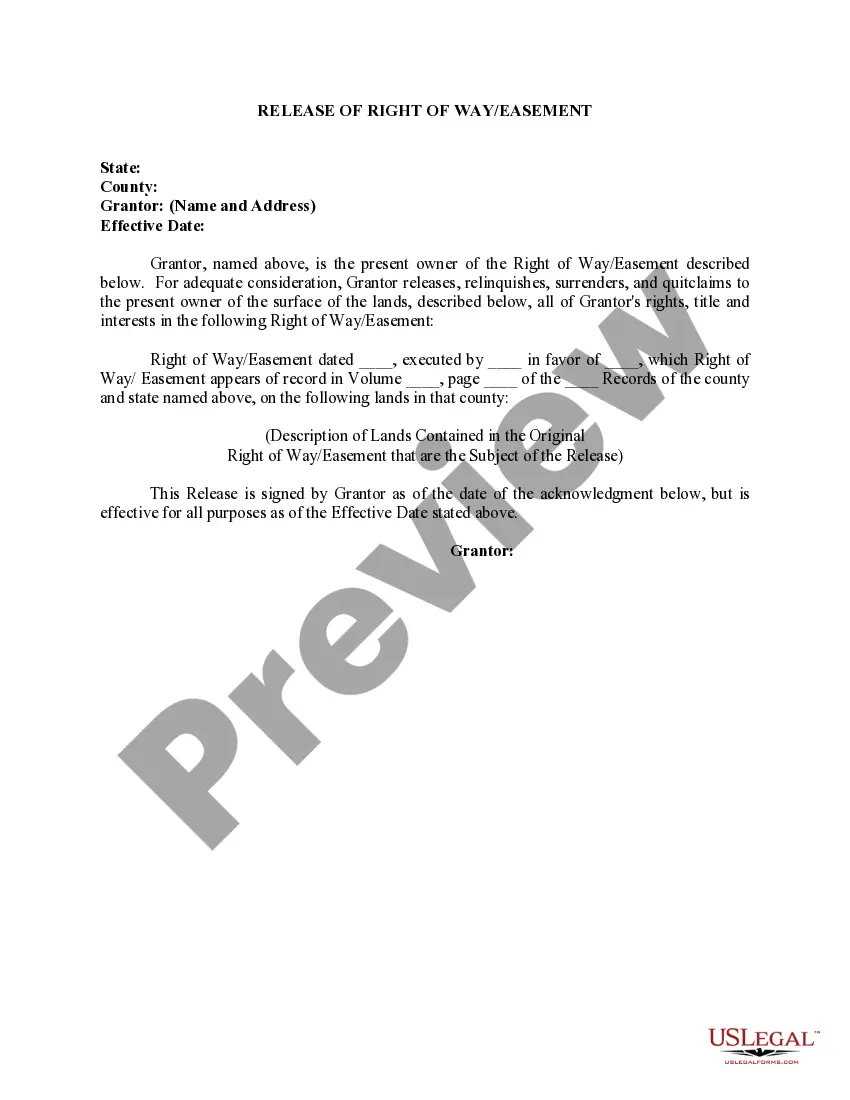

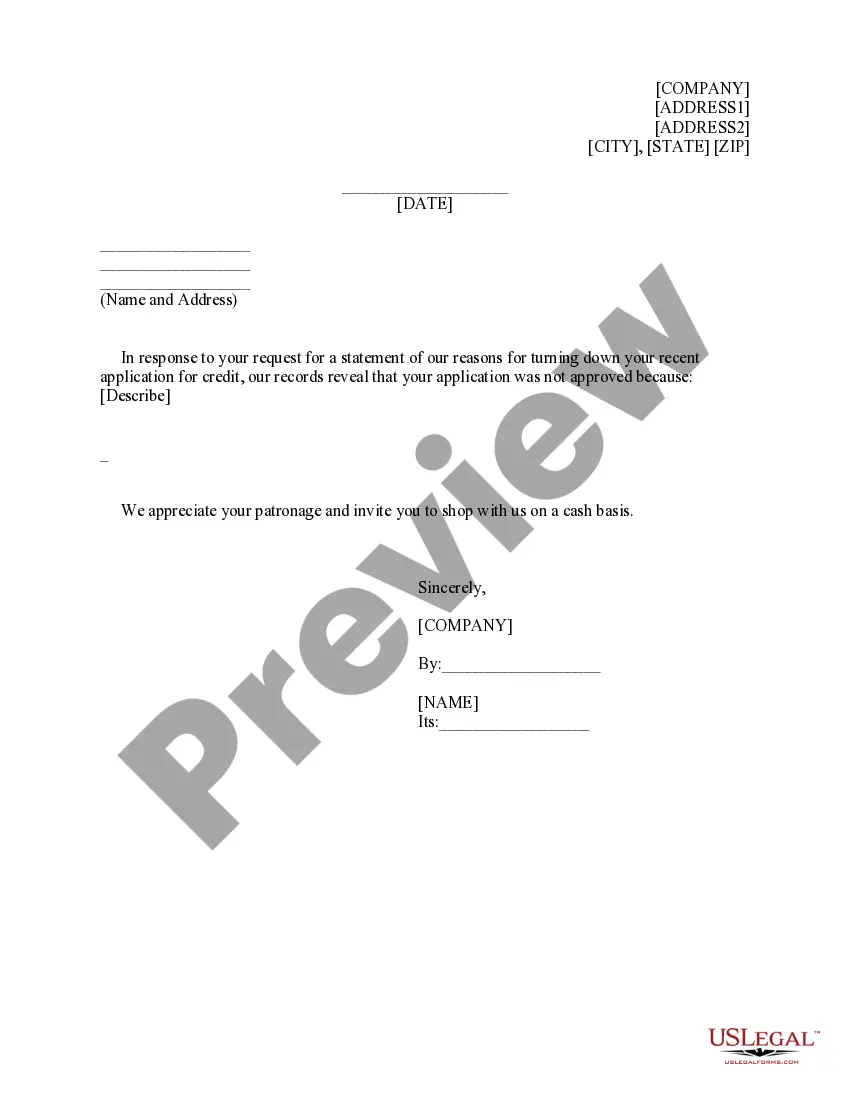

- Very first, make certain you have chosen the appropriate develop for the town/state. You can look through the form using the Review button and look at the form information to make sure this is the best for you.

- If the develop does not meet up with your expectations, take advantage of the Seach discipline to get the right develop.

- When you are sure that the form is acceptable, click the Get now button to get the develop.

- Opt for the pricing program you desire and enter in the required information and facts. Build your account and pay for the transaction utilizing your PayPal account or credit card.

- Choose the submit file format and obtain the lawful record web template for your gadget.

- Complete, modify and printing and signal the obtained Mississippi Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

US Legal Forms is the most significant catalogue of lawful forms in which you will find different record layouts. Take advantage of the service to obtain appropriately-made papers that adhere to express requirements.

Form popularity

FAQ

The company cannot use general solicitation or advertising to market the securities. The company may sell its securities to an unlimited number of "accredited investors" and up to 35 other purchasers.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Other types of accredited investors The following can also qualify as accredited investors: Financial institutions. A corporation or LLC, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5M. Knowledgeable employees of private funds.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.