Mississippi Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service

Description

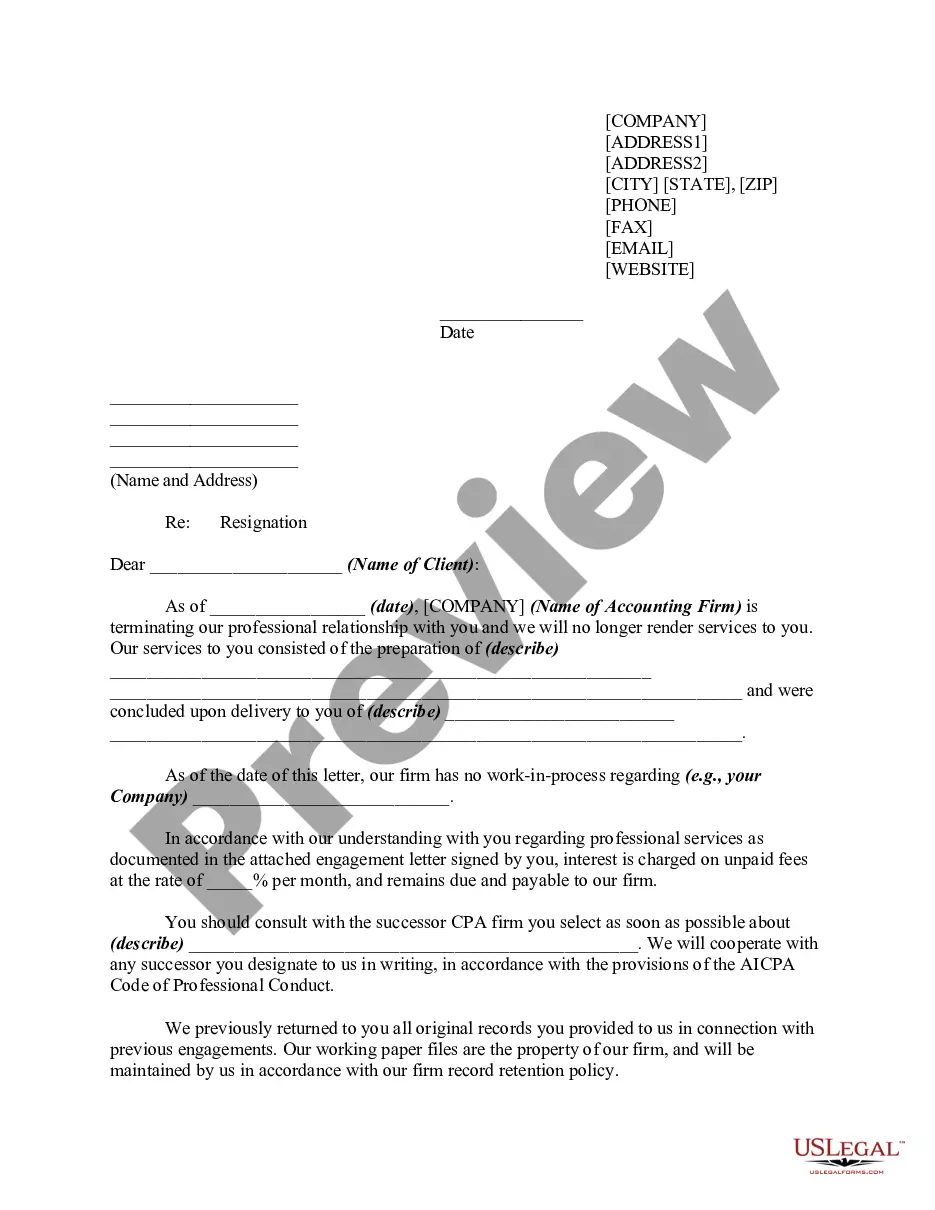

How to fill out Retirement Plan Transfer Agreement Regarding Contribution Plan Meeting Requirements Of The Internal Revenue Service?

Finding the right legal record web template could be a struggle. Naturally, there are tons of themes available on the Internet, but how will you get the legal develop you need? Use the US Legal Forms website. The assistance provides thousands of themes, such as the Mississippi Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service, that you can use for business and private needs. Every one of the varieties are checked by professionals and meet up with state and federal requirements.

Should you be presently authorized, log in to your account and then click the Obtain key to find the Mississippi Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service. Use your account to check throughout the legal varieties you may have acquired previously. Visit the My Forms tab of your account and get one more duplicate in the record you need.

Should you be a new user of US Legal Forms, allow me to share basic instructions for you to stick to:

- Initially, make certain you have chosen the appropriate develop for your city/region. It is possible to check out the shape making use of the Preview key and read the shape explanation to make certain this is basically the best for you.

- If the develop will not meet up with your preferences, take advantage of the Seach industry to obtain the proper develop.

- When you are sure that the shape is proper, go through the Acquire now key to find the develop.

- Select the prices program you would like and enter the needed information. Build your account and pay money for the transaction utilizing your PayPal account or charge card.

- Select the document formatting and acquire the legal record web template to your gadget.

- Total, change and print and indicator the obtained Mississippi Retirement Plan Transfer Agreement regarding contribution plan meeting requirements of the Internal Revenue Service.

US Legal Forms is the biggest collection of legal varieties for which you will find different record themes. Use the company to acquire appropriately-produced documents that stick to express requirements.

Form popularity

FAQ

Is retirement income taxable? Generally, retirement income, pensions and annuities are not subject to Mississippi Income tax if the recipient has met the retirement plan requirements.

Your initial retirement benefit is calculated using projected wages certified by your employer before your termination date. After your final wages are reported, PERS will audit your account and, if necessary, adjust your benefit for any underpayment or overpayment.

PERS 13th Check is the annual 3% cost of living increase given to current public sector employees and Mississippi retirees at the year's end. The 13th Check or payment is paid to the ex-employees entirely by employer contributions.

Public Employees' Retirement System of Mississippi (PERS): The employee's pre-tax contribution is 9.00% of gross wages and the University contribution is 17.40% of the employee's gross income. PERS is a defined benefits plan which entitles qualified employees to a guaranteed retirement benefit.

Your accumulated contributions earn interest monthly at an annual rate, which is set by the PERS Board of Trustees. Member contributions plus accumulated interest are refunded to members who choose to withdraw their contributions following termination of covered employment.

We process complete refund election form packages in the order of receipt. You can typically expect to receive your refund within 30 to 45 days from the date we receive all your necessary forms. However, timeframes can vary if there are holds or other restrictions on your account that require review and action.

Defined Benefit Plans PERS is a defined benefit plan, which is a plan designed based on strength in numbers, automatic participation, and pooled risk so that members may receive a benefit for life at retirement.

PERS 13th Check is the annual 3% cost of living increase given to current public sector employees and Mississippi retirees at the year's end. The 13th Check or payment is paid to the ex-employees entirely by employer contributions.