Mississippi Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company

Description

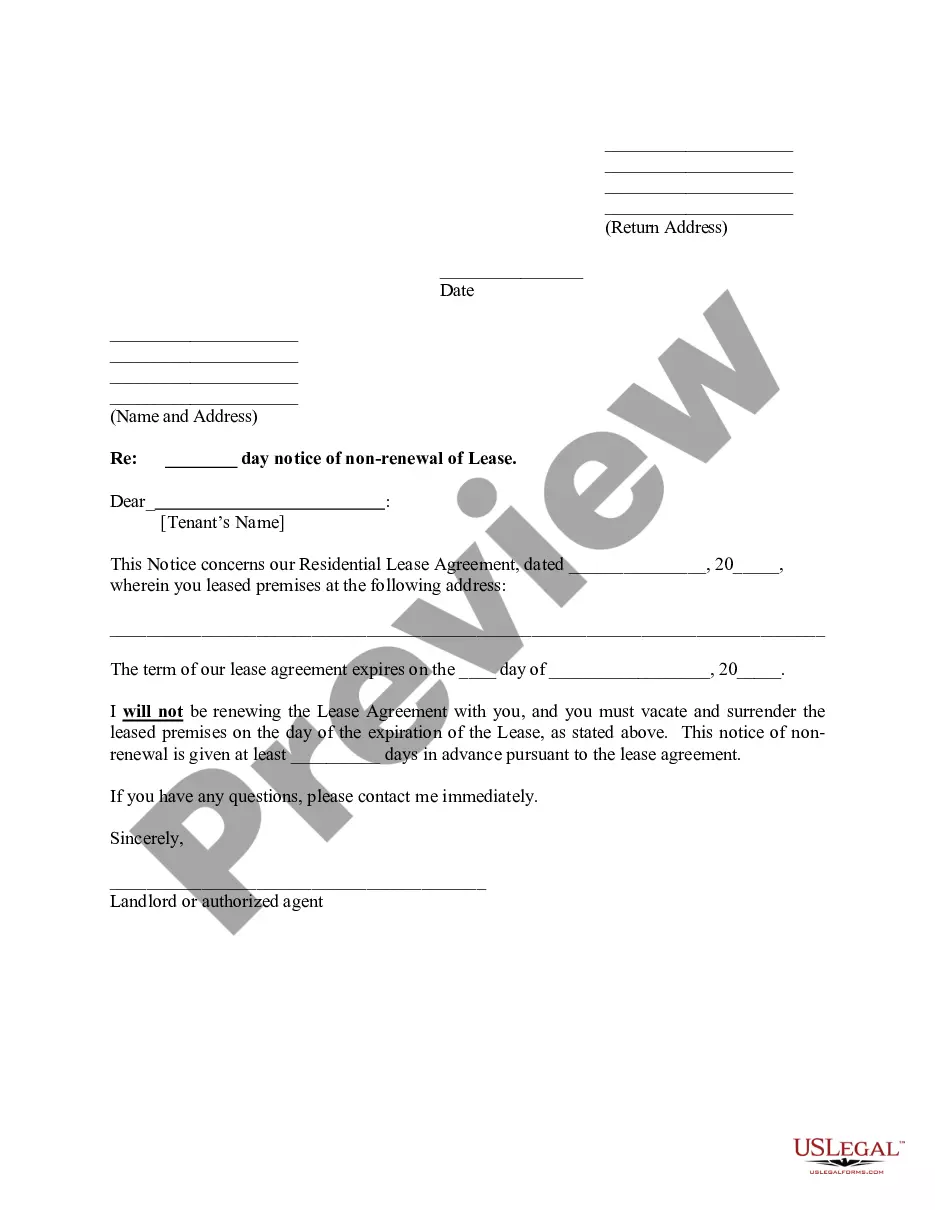

How to fill out Distribution Agreement Between First American Insurance Portfolios, Inc. And SEI Financial Services Company?

If you want to full, down load, or print out authorized papers web templates, use US Legal Forms, the greatest collection of authorized types, which can be found on-line. Use the site`s simple and handy lookup to obtain the papers you want. A variety of web templates for company and individual uses are categorized by classes and states, or keywords. Use US Legal Forms to obtain the Mississippi Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company within a couple of mouse clicks.

Should you be previously a US Legal Forms customer, log in to your profile and then click the Download button to get the Mississippi Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company. You may also access types you previously acquired from the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the right city/land.

- Step 2. Make use of the Review choice to check out the form`s information. Don`t neglect to see the information.

- Step 3. Should you be unhappy with all the form, utilize the Lookup industry on top of the screen to find other versions in the authorized form format.

- Step 4. Once you have identified the shape you want, click the Acquire now button. Opt for the rates plan you prefer and add your qualifications to register for the profile.

- Step 5. Approach the transaction. You can use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Pick the file format in the authorized form and down load it on the gadget.

- Step 7. Comprehensive, modify and print out or indication the Mississippi Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company.

Each and every authorized papers format you acquire is yours forever. You may have acces to every form you acquired within your acccount. Click on the My Forms area and pick a form to print out or down load once more.

Be competitive and down load, and print out the Mississippi Distribution Agreement between First American Insurance Portfolios, Inc. and SEI Financial Services Company with US Legal Forms. There are thousands of specialist and state-specific types you can use for your company or individual requirements.