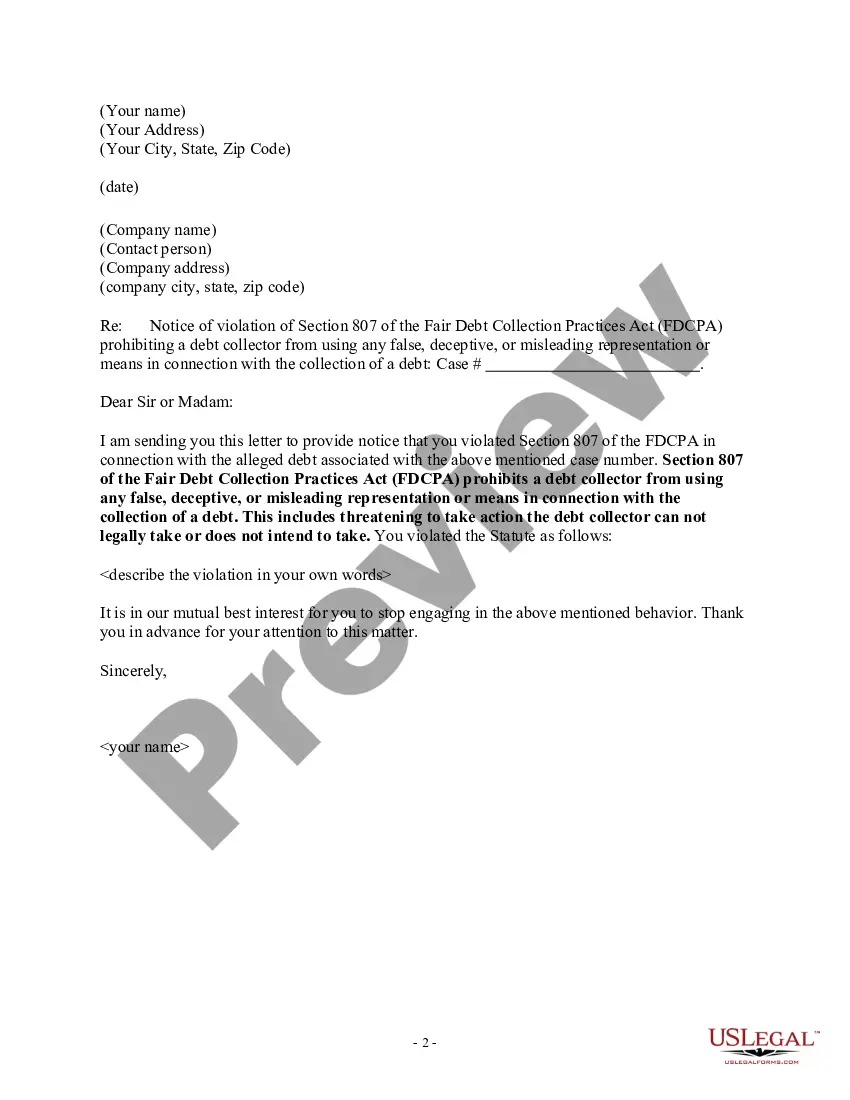

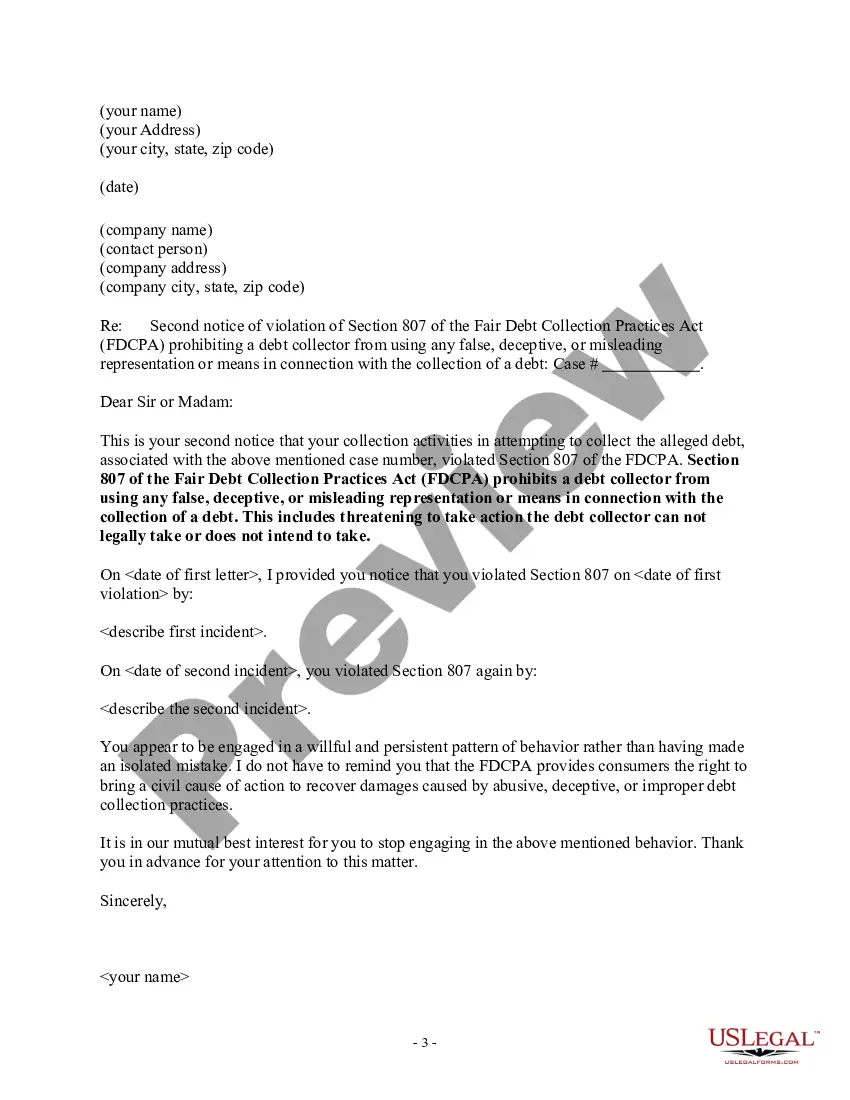

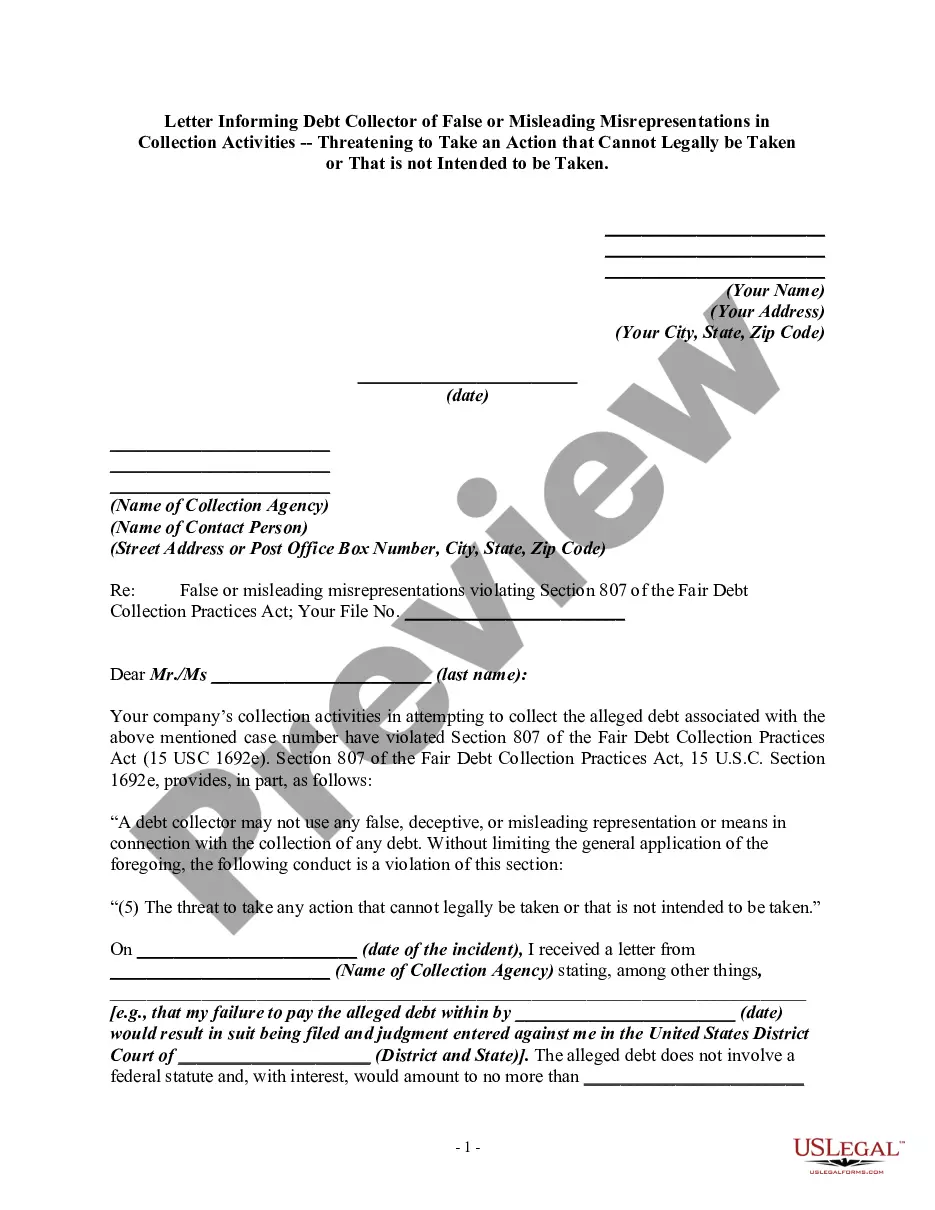

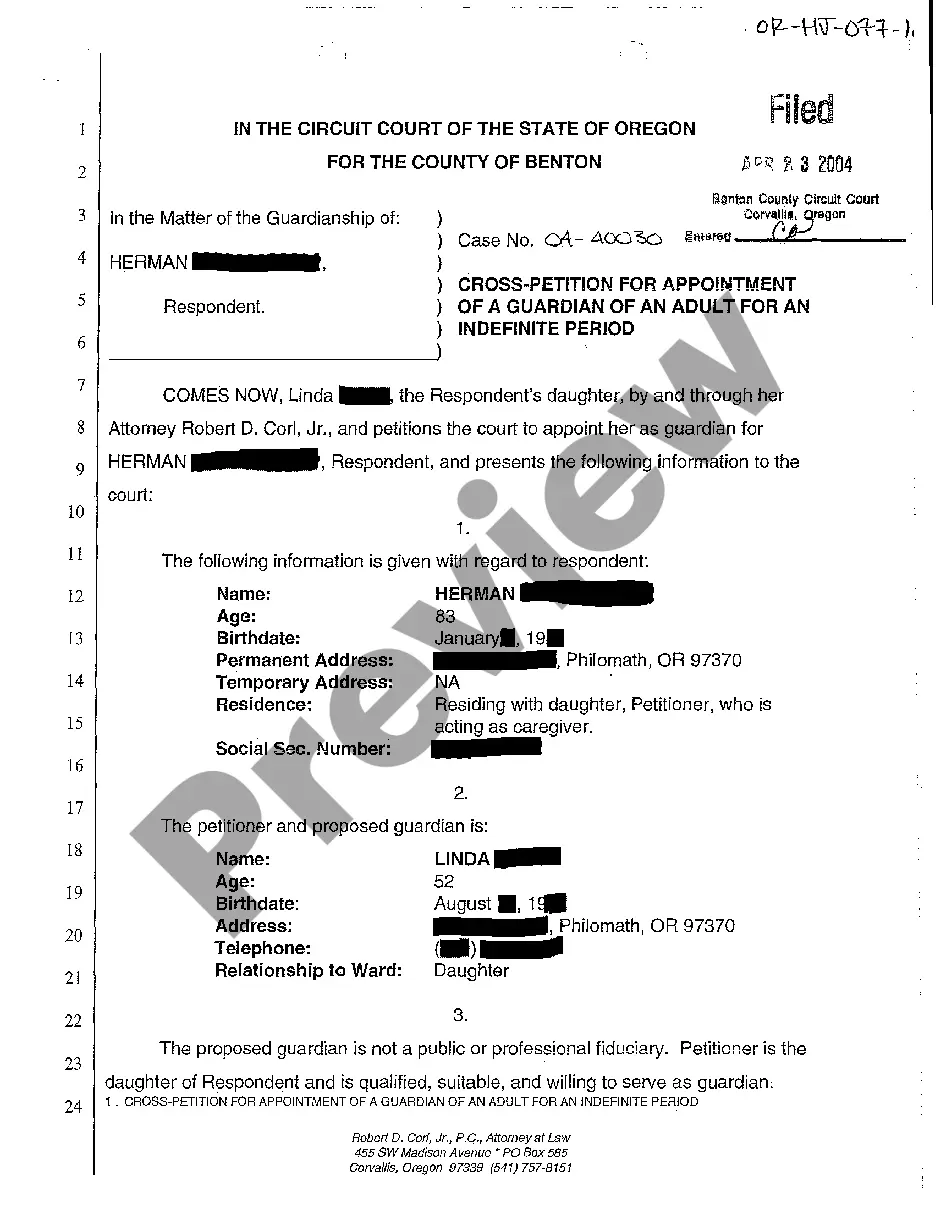

Notice to Debt Collector - Use of False Threats

Need your Credit Report! Get it on-line in minutes!

FAIR DEBT COLLECTION PRACTICES ACT (FDCPA)

Note: This summary is not intended

to be all inclusive

What is it?

The Fair Debt Collection Practice Act (FDCPA) helps you avoid being taken advantage of by predatory debt collectors in your time of trouble. It prohibits a debt collector from using harassment or abuse, false or misleading representations, or unfair practices for the purpose of collecting a debt. It also provides you with rights you can assert such as: requiring a debt collector to only contact your attorney, designating when and where a debt collector may and may not contact you, requiring a debt collector to entirely cease communications with you regarding a debt, requiring a debt collector to verify the existence and amount of a debt, and to dispute a debt.

HOW IS THE FDCPA APPLIED?

The FDCPA applies to DEBT COLLECTORS engaged in collecting DEBTS owed by CONSUMERS.

Who Is a Debt Collector?

According to the FDCPA, a debt collector is any person, other than the creditor, who

regularly collects debts owed to others. It normally does not include the original creditor or a credit card issuer collecting on its cardholder�s account. The FDCPA was amended in 1986 to include attorneys who collect debt on a regular basis. However, this amendment does not apply to attorneys who only handle debt collection matters a few times a year.

Who is a Consumer?

A Consumer is any natural person obligated to pay a debt. Therefore, business entities such as corporations, partnerships, or limited liability companies are not considered consumers under the FDCPA.

What Debts Are Covered?

Personal, family, and household debts are covered under the Act. This includes money owed for medical care, charge accounts, student loans, and car purchases. Alimony, tort claims, and non-pecuniary obligations are not covered.

How May a Debt Collector Contact You?

A debt collector may not contact you at inconvenient or unusual times or

places, such as before 8 a.m. or after 9 p.m., unless you agree. A debt

collector may not contact you at work if the debt collector has reason

to know that your employer disapproves.

Can You Stop a Debt Collector From Contacting You?

You may stop a debt collector from contacting you by writing a letter to

the collection agency telling them to stop. Once the agency receives

your letter, they may not contact you again except to notify you that some

specific action will be taken, which could include the instigation of legal

proceedings.

May a Debt Collector Contact Any Other Person Concerning Your

Debt?

A collector can only contact you, your spouse if you�re married, and your attorney. Generally, the collector is not allowed to tell anyone other than you and your attorney that you owe money. If you do not have an attorney, the debt collector may contact other people, but only to find out where you live or work. Furthermore, the collector is usually prohibited from contacting any person, other than you or your attorney, more than once.

What Is the Debt Collector Required To Tell You About the Debt?

Within five days after you are first contacted, the debt collector must send you a written notice telling you the amount of money you owe, the name of the creditor to whom you owe the money, and what to do if you believe you do not owe the money.

If You Believe You Do Not Owe the Money, May a Debt Collector Continue To Contact You?

The debt collector may not contact you if, within 30 days after you are first contacted, you send the collector a letter saying you do not owe the money. However, a debt collector can begin collection activities again if you are sent proof of the debt, such

as a copy of the bill.

What Types Of Debt Collection Practices Are Prohibited?

Harassment:

Debt collectors may not harass, oppress, or abuse any person. Debt collectors may not: (a) Use threats of violence or harm to the person, property, or reputation. (b) Advertise your debt or publish a list of consumers who refuse to pay their debts (except to a credit bureau). (c) Use obscene or profane language. (d) Repeatedly use the telephone to annoy someone. (e) Telephone people without identifying themselves.

False statements:

Debt collectors may not use any false statements when collecting a debt. Debt collectors may not: (a) Falsely imply that they are an attorney or government representative. (b) Falsely imply that you have committed a crime. (c) Falsely represent that they operate or work for a credit bureau. (d) Misrepresent the amount of the debt. (e) Indicate that papers being sent are legal forms when they are not. (f) Indicate that papers being sent are not legal forms when they are.

Debt collectors may not say that:

(a) You will be arrested if you do not pay your debt. (b) They will seize, garnish, attach, or sell your property or wages, unless the collection agency or the creditor intends to do so, and it is legal. (c) Actions will be taken against you which legally may not be taken.

Debt collectors may not:

(a) Give false credit information about you to anyone. (b) Send you anything that looks like an official document from a court or government agency when it is not. (c) Use a false name.

Unfair Practices:

Debt collectors may not engage in unfair practices in attempting to collect a debt. Debt collectors may not: (a) Collect any amount greater than your debt, unless allowed by law. (b) Deposit a post-dated check before the date on the check. (c) Make you accept collect calls or pay for telegrams. (d) Take or threaten to take your property unless this can be done legally. (e) Contact you by postcard.

What Control Do You Have Over Payment Of Debts?

If you owe several debts, any payment you make must be applied to the debt

you choose. A debt collector may not apply a payment to any debt you believe you do not owe.

What Can You Do If You Believe a Debt Collector Broke the Law?

You have the right to sue a debt collector in a state or federal court within one year from the date you believe the law was violated. If you win, you may recover money for the damage you suffered, plus court costs and attorney's fees. A group of people may sue a debt collector and recover money for damages up to $500,000 or one percent of the collector's net worth, whichever is less.

Reference: Consumer Credit Protection Act and Fair Debt Collection Practices Act See 15 U.S.C. 1601 et seq.

Need your Credit Report! Get it on-line in minutes!