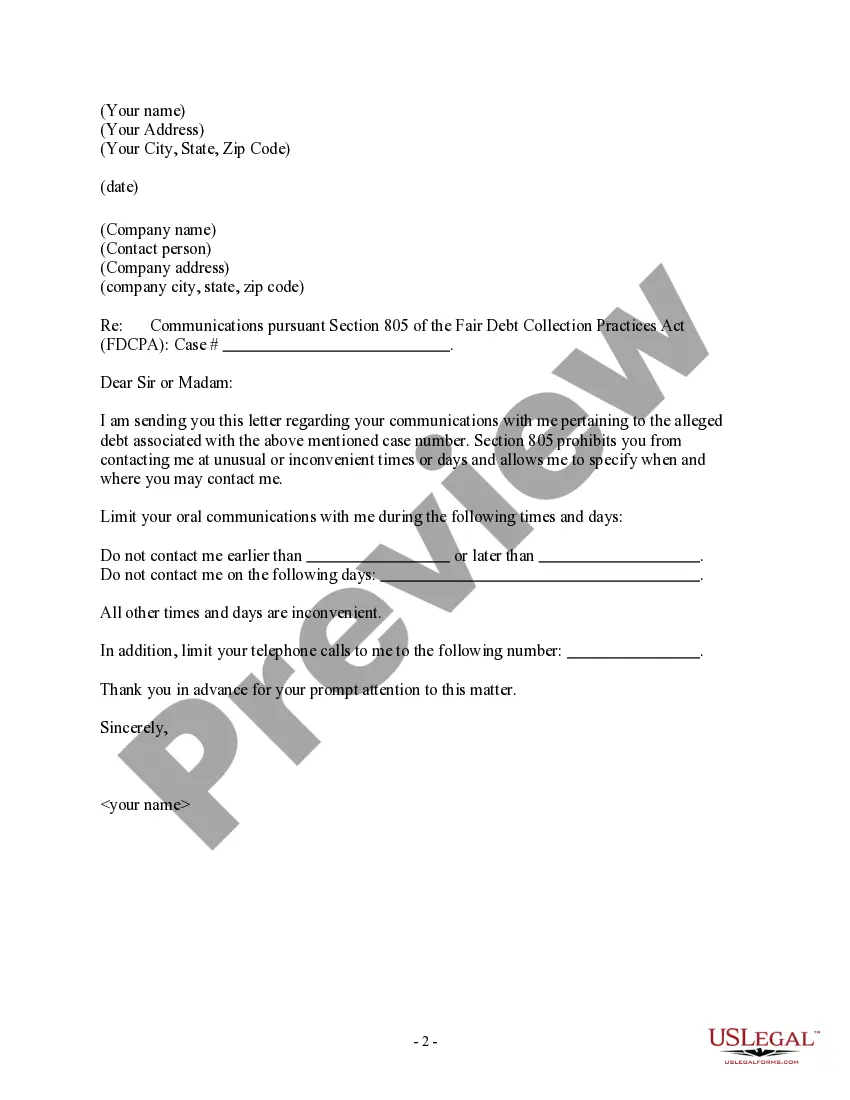

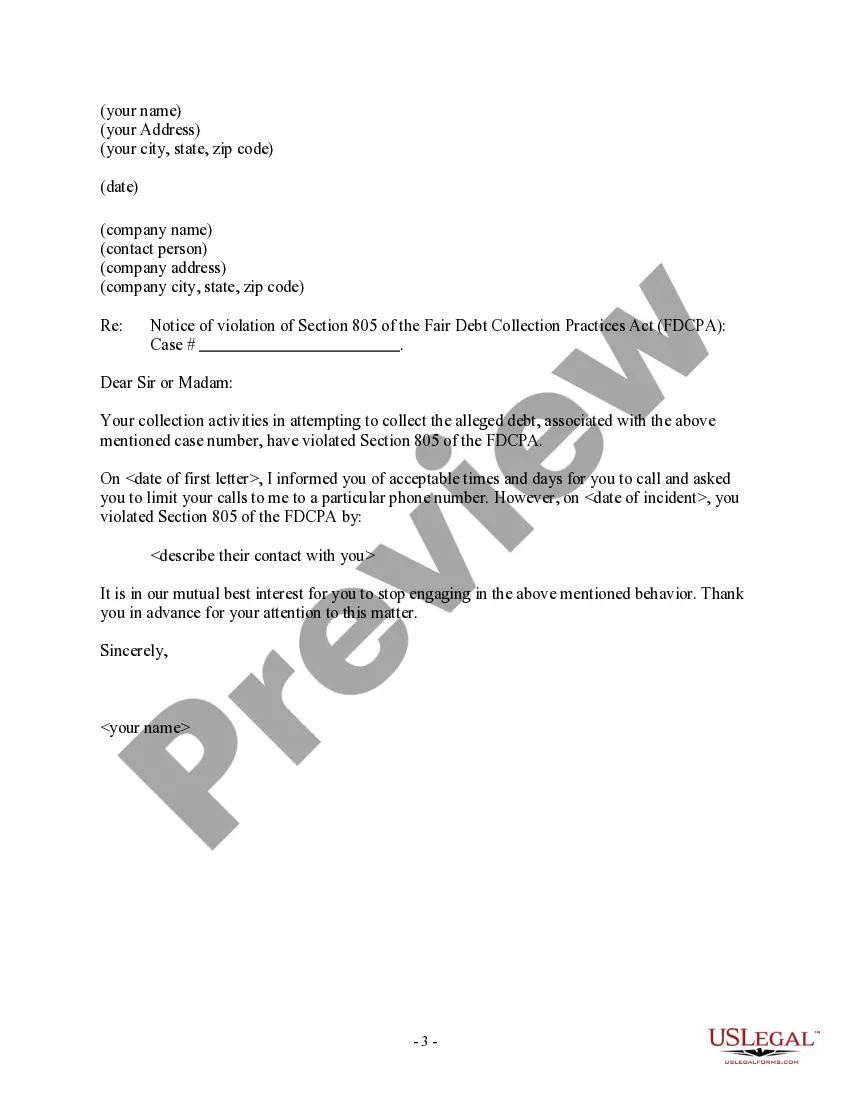

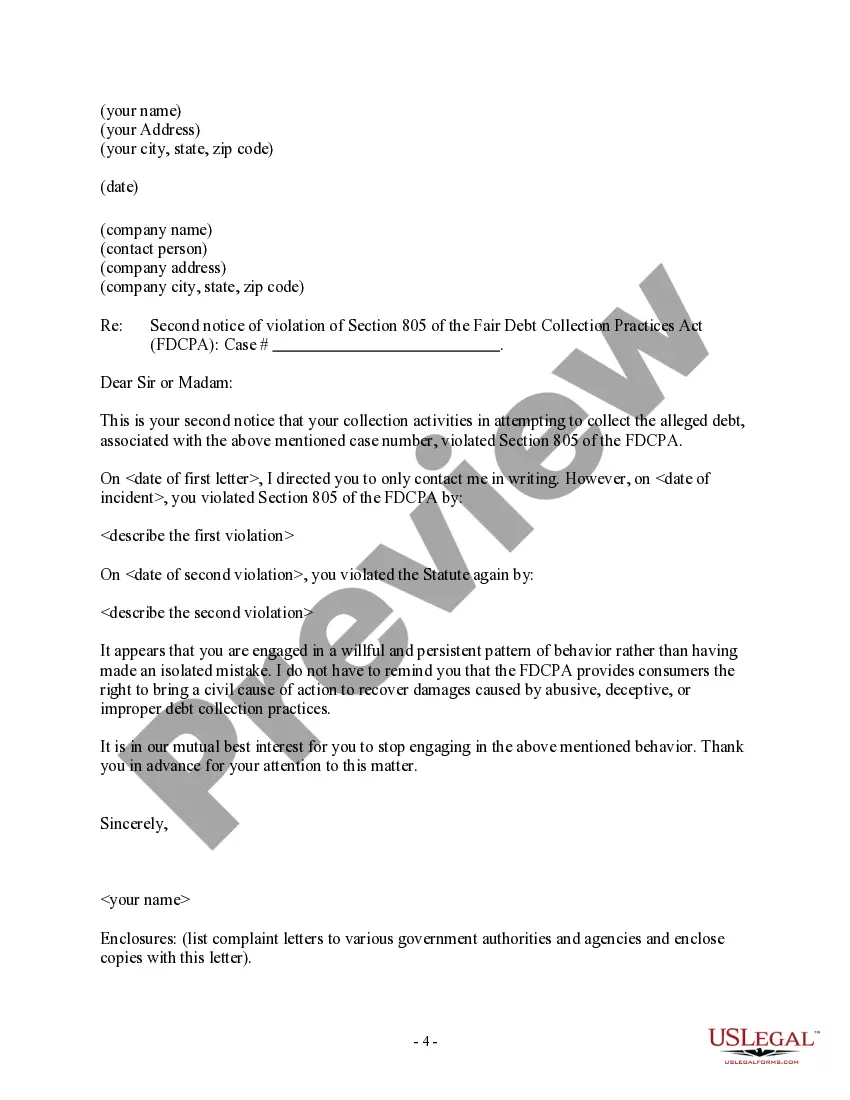

Mississippi Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Locating the appropriate genuine document format can be a challenge.

Indeed, there are numerous templates accessible online, but how will you find the specific legal type you seek.

Utilize the US Legal Forms website. The platform offers a wide array of templates, including the Mississippi Letter to Debt Collector - Only call me on the specified days and times, which can be utilized for business and personal purposes.

Firstly, make sure you have selected the correct form for your city/state. You can examine the document using the Preview button and review the form details to ensure it's right for you. If the form does not meet your needs, use the Search feature to find the correct document. Once you are confident the form is appropriate, select the Order now button to purchase the form. Choose the pricing plan you wish and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal paper format to your device. Finally, complete, modify, print, and sign the acquired Mississippi Letter to Debt Collector - Only call me on the specified days and times. US Legal Forms is the largest repository of legal documents where you can find a multitude of paper templates. Take advantage of the service to download professionally crafted files that comply with state requirements.

- All documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Mississippi Letter to Debt Collector - Only call me on the specified days and times.

- Use your account to access the legal documents you have previously purchased.

- Navigate to the My documents tab in your account to download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

Form popularity

FAQ

The statute of limitations for debt collection under Mississippi law is typically 3 years but there are exceptions. If the statute of limitations has passed, you can no longer be sued for the debt and you can ignore the debt collector.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The statute of limitations for debt collection under Mississippi law is typically 3 years but there are exceptions. If the statute of limitations has passed, you can no longer be sued for the debt and you can ignore the debt collector.

The state's civil statute of limitations ranges from one to seven years, but most civil actions have a time limit of two years to file from the date of the (alleged) incident.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.