Mississippi Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Are you currently in the position where you will need paperwork for both organization or person uses almost every day time? There are plenty of legal file layouts available on the net, but discovering versions you can depend on isn`t simple. US Legal Forms gives thousands of develop layouts, much like the Mississippi Approval of deferred compensation investment account plan, which can be composed to fulfill state and federal needs.

When you are previously acquainted with US Legal Forms internet site and also have a free account, merely log in. Afterward, you are able to download the Mississippi Approval of deferred compensation investment account plan format.

Should you not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you need and ensure it is for your right area/region.

- Use the Review key to check the form.

- Look at the outline to ensure that you have selected the proper develop.

- When the develop isn`t what you`re searching for, take advantage of the Look for discipline to get the develop that fits your needs and needs.

- If you find the right develop, just click Get now.

- Opt for the rates plan you want, fill in the necessary information and facts to generate your money, and buy your order making use of your PayPal or credit card.

- Pick a handy paper format and download your duplicate.

Locate all the file layouts you have bought in the My Forms food list. You can aquire a additional duplicate of Mississippi Approval of deferred compensation investment account plan anytime, if needed. Just click the necessary develop to download or printing the file format.

Use US Legal Forms, one of the most substantial assortment of legal kinds, in order to save efforts and steer clear of mistakes. The service gives skillfully produced legal file layouts which you can use for an array of uses. Generate a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

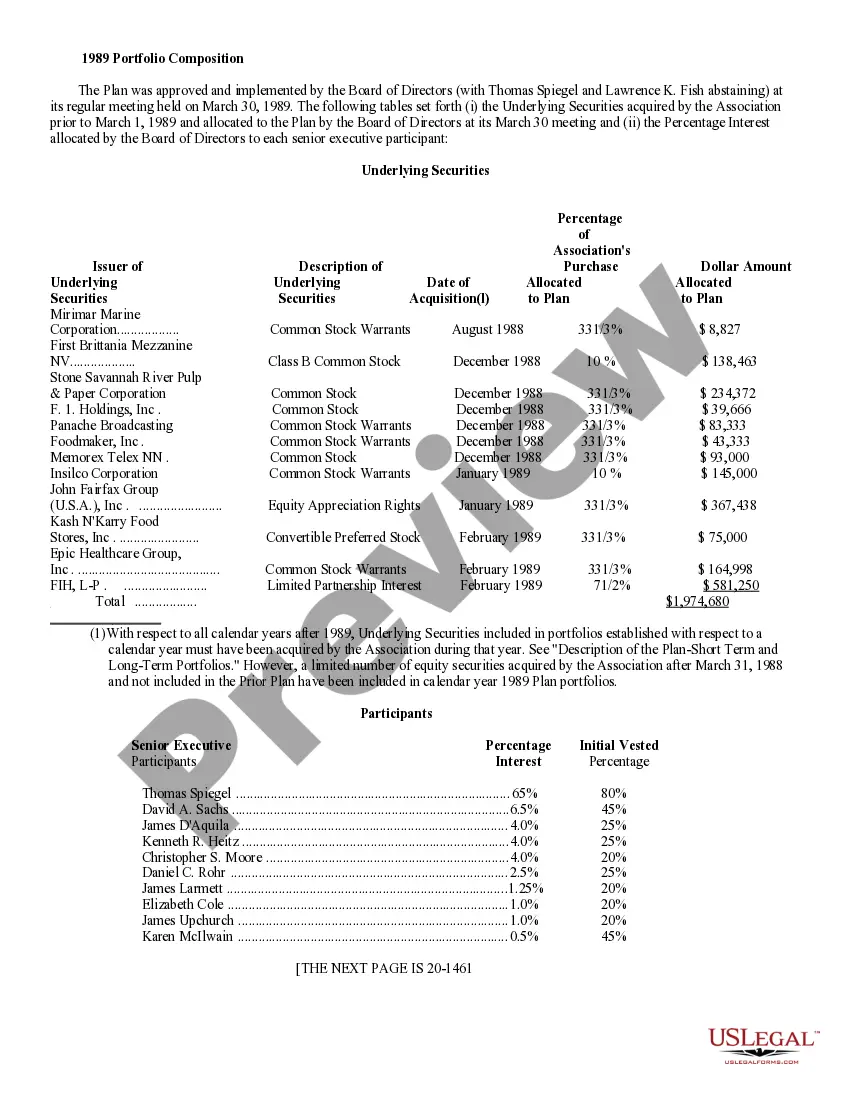

Mississippi Deferred Compensation (MDC) MDC is a voluntary supplemental tax-deferred retirement savings plan offered through PERS to all state employees, elected officials, employees of participating political subdivisions, and independent contractors of the state or participating political subdivisions.

The Mississippi Deferred Compensation Plan & Trust (MDCPT), offered through the Mississippi Public Employees' Retirement System (PERS), is a supplemental retirement savings plan authorized under Section 457 of the Internal Revenue Code and enacted by the Mississippi State Legislature.

A deferred compensation plan is another name for a 457(b) retirement plan, or ?457 plan? for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.