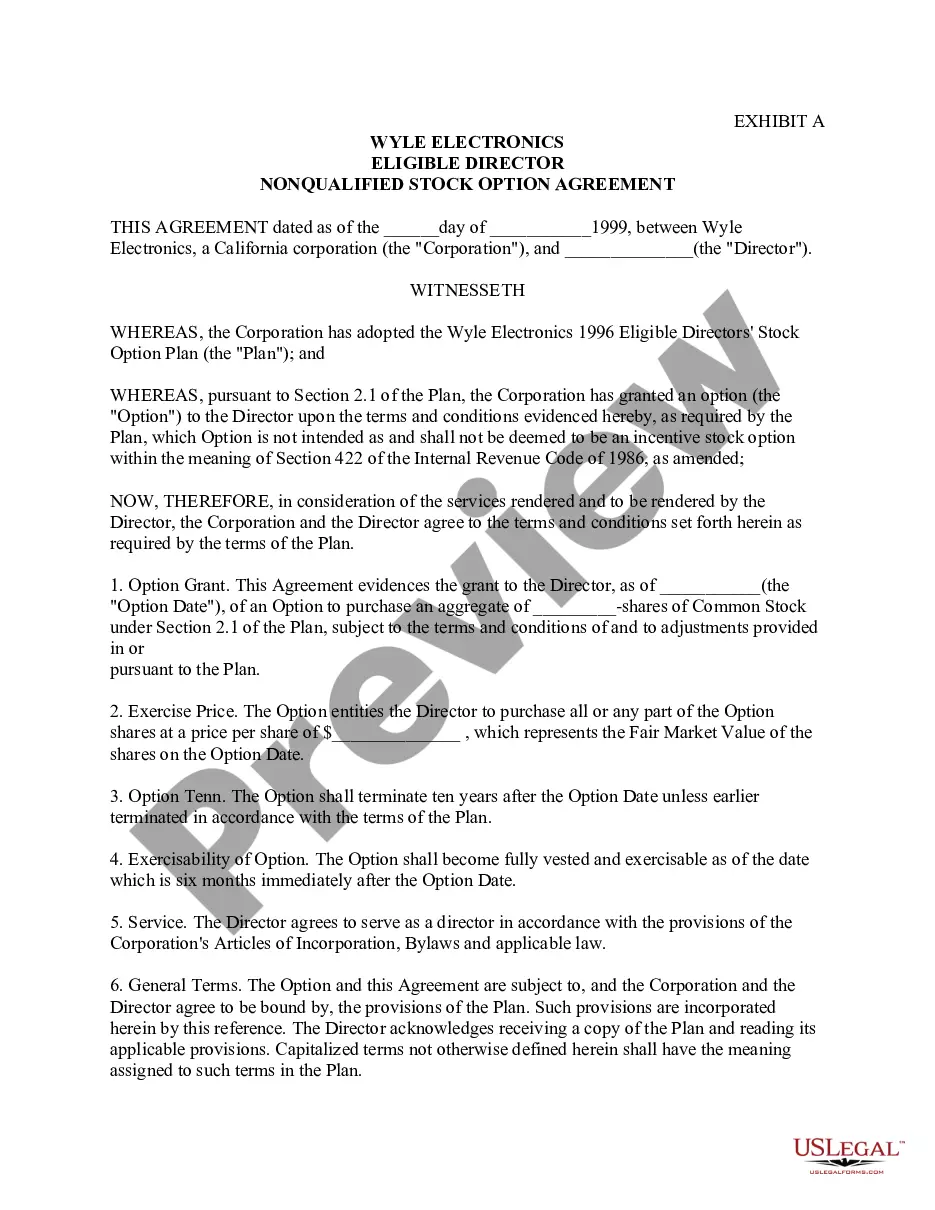

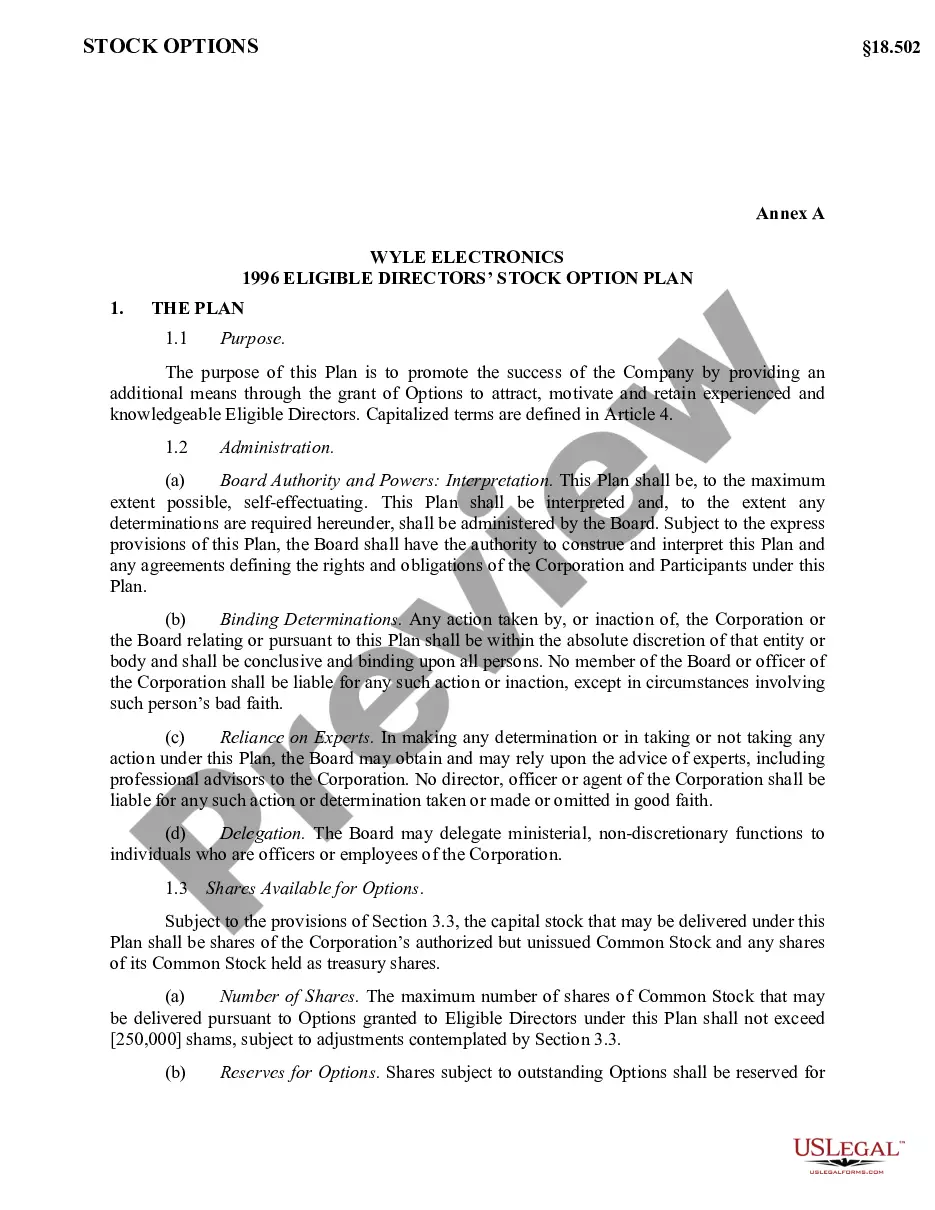

Mississippi Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics

Description

How to fill out Eligible Director Nonqualified Stock Option Agreement Of Wyle Electronics?

Choosing the right authorized file web template might be a struggle. Of course, there are a lot of layouts available on the Internet, but how can you discover the authorized form you will need? Use the US Legal Forms website. The service gives 1000s of layouts, like the Mississippi Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics, that you can use for enterprise and private requirements. All of the varieties are inspected by professionals and meet federal and state specifications.

When you are presently signed up, log in for your accounts and click the Obtain key to have the Mississippi Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics. Make use of accounts to search throughout the authorized varieties you have purchased in the past. Check out the My Forms tab of your accounts and acquire another backup in the file you will need.

When you are a new end user of US Legal Forms, allow me to share simple recommendations that you should comply with:

- Very first, make certain you have selected the proper form for your personal area/region. You are able to look over the shape using the Preview key and look at the shape explanation to make certain this is basically the right one for you.

- In the event the form does not meet your requirements, use the Seach field to discover the proper form.

- When you are certain that the shape is proper, select the Get now key to have the form.

- Opt for the prices prepare you desire and type in the required info. Make your accounts and pay for the order utilizing your PayPal accounts or bank card.

- Select the data file structure and down load the authorized file web template for your gadget.

- Comprehensive, change and print out and signal the obtained Mississippi Eligible Director Nonqualified Stock Option Agreement of Wyle Electronics.

US Legal Forms may be the largest catalogue of authorized varieties where you can discover a variety of file layouts. Use the company to down load skillfully-made files that comply with condition specifications.

Form popularity

FAQ

Non-qualified stock options (NSOs) provide employees and other stakeholders with the right (but not the obligation) to purchase shares of company stock at a predetermined price. NSOs can be profitable if a company's stock price rises more than the exercise price.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

For example, RSU and NQSO have different rules about when they are taxed (RSUs at vesting, no choice) (NQSOs at exercise, choice of timing). It's also reasonable to assume that when offered the choice, you may get ?more? NQSOs than you would RSUs. And finally, RSUs do not cost anything to purchase, whereas NQSOs do.

Non-qualified stock options often reduce the cash compensation employees earn from employment. The price of these stock options is typically the same as the market value of the shares when the company makes such options available, also known as the grant date.

Time-based stock vesting is when you earn options or shares over a specified period of time. Most time-based vesting schedules have a vesting cliff. Cliff vesting is when the first portion of your option grant vests on a specific date and the remaining options gradually vest each month or quarter afterward.

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.