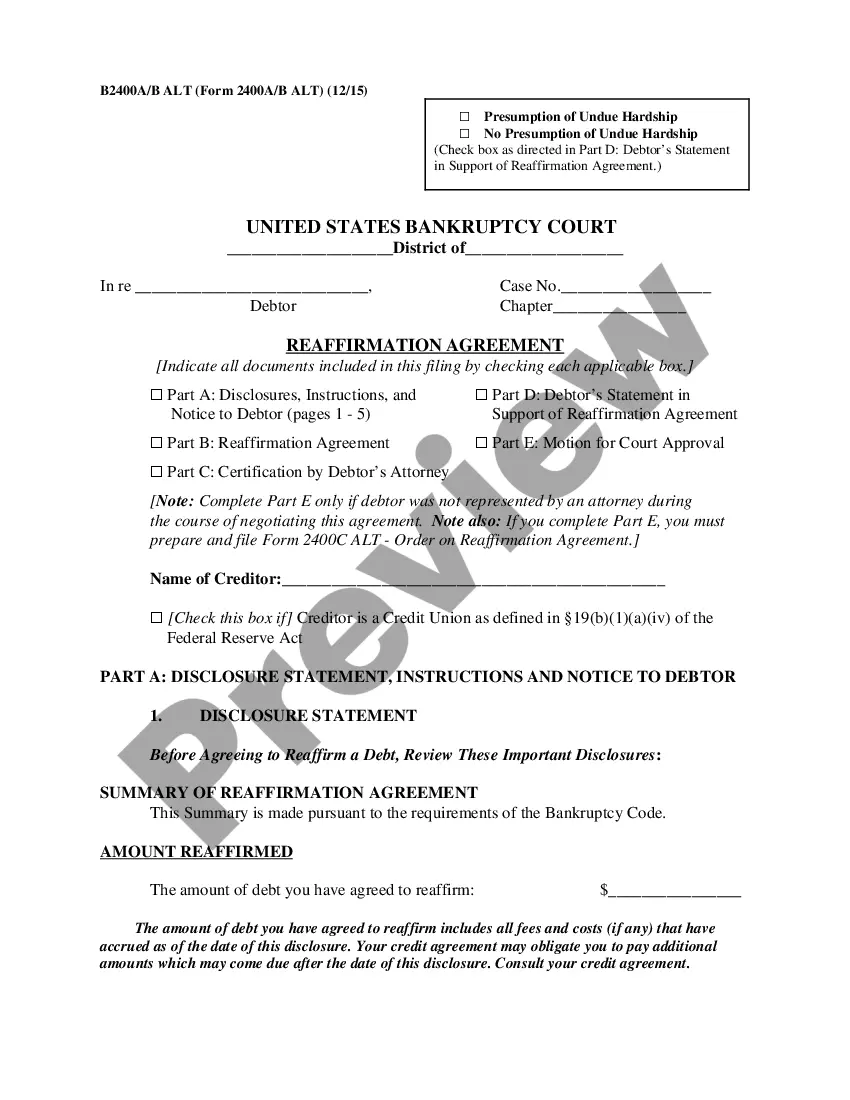

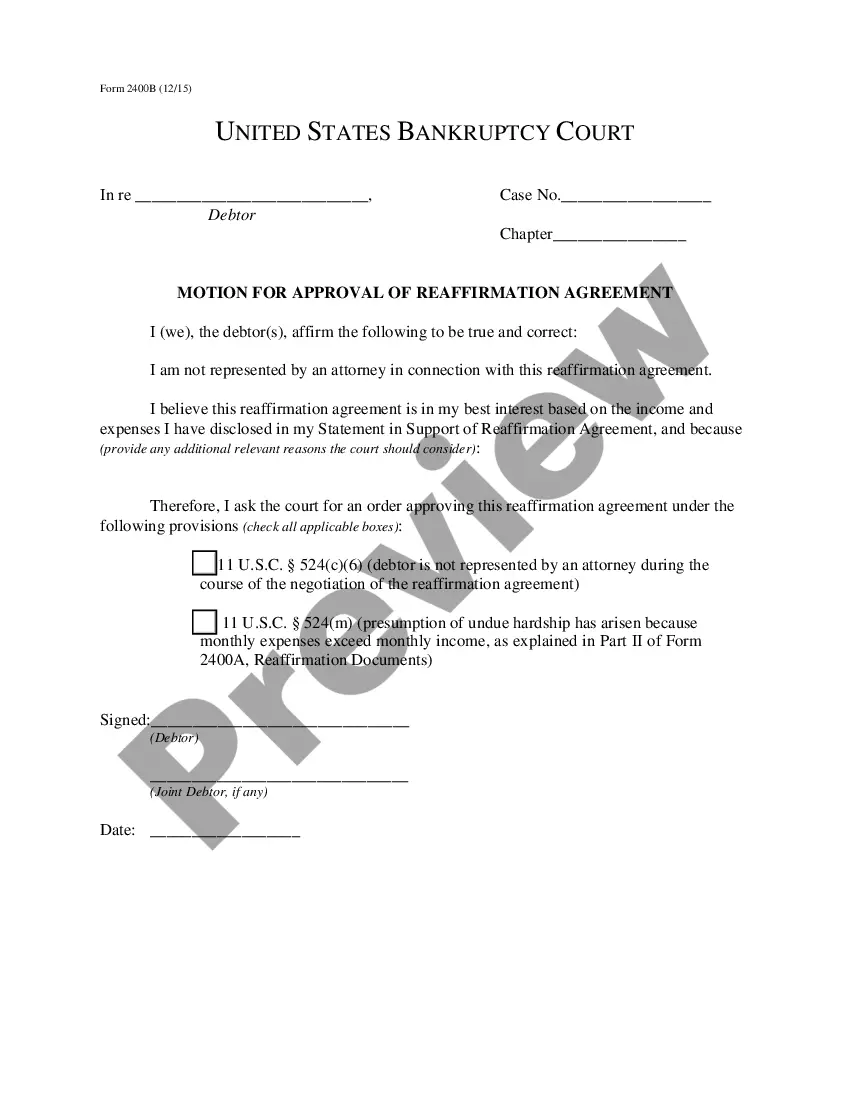

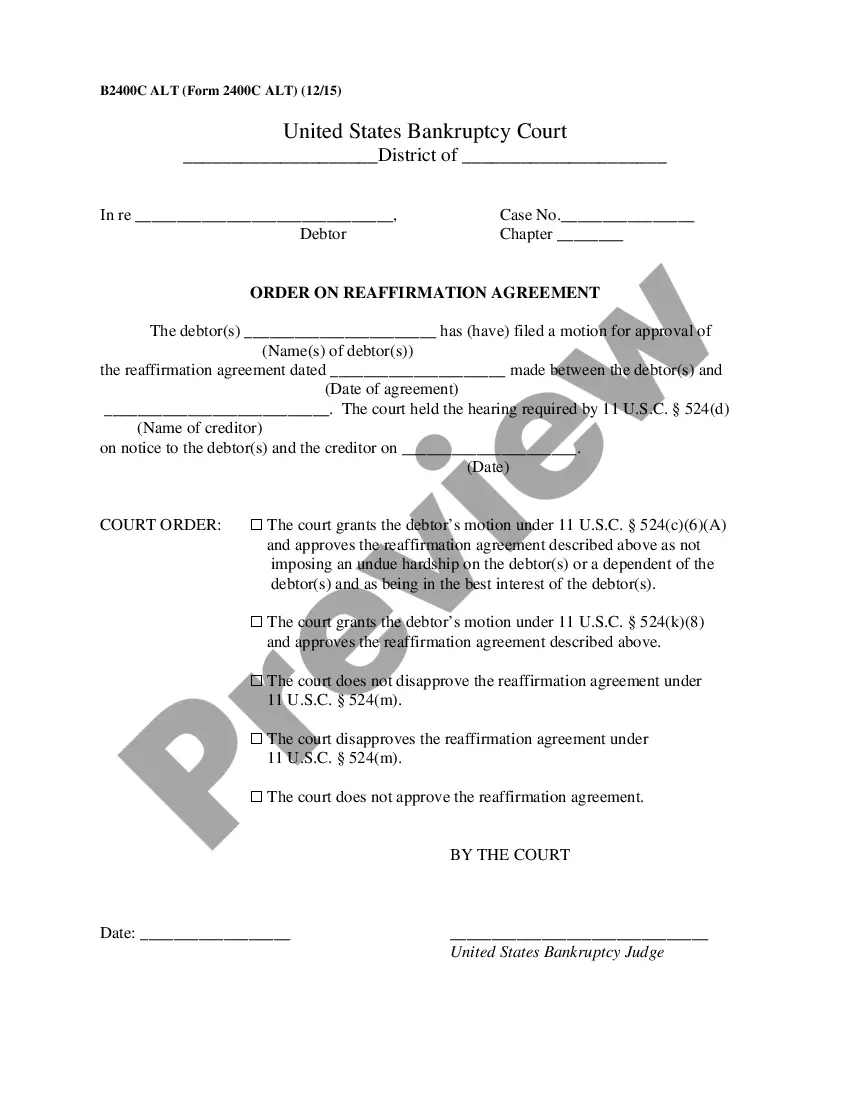

Mississippi Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

US Legal Forms - among the most significant libraries of authorized kinds in the States - gives a wide array of authorized document themes it is possible to acquire or printing. Using the web site, you can get a large number of kinds for company and personal reasons, categorized by types, claims, or search phrases.You will find the latest versions of kinds such as the Mississippi Reaffirmation Agreement, Motion and Order in seconds.

If you already have a registration, log in and acquire Mississippi Reaffirmation Agreement, Motion and Order from your US Legal Forms catalogue. The Acquire key will appear on each type you perspective. You gain access to all in the past downloaded kinds within the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are basic guidelines to obtain started out:

- Make sure you have selected the proper type for the area/state. Select the Preview key to analyze the form`s content material. See the type description to actually have chosen the proper type.

- If the type does not suit your needs, utilize the Lookup field near the top of the display to discover the one which does.

- When you are happy with the shape, validate your decision by clicking on the Purchase now key. Then, opt for the prices strategy you like and give your references to sign up to have an bank account.

- Approach the transaction. Utilize your charge card or PayPal bank account to perform the transaction.

- Select the file format and acquire the shape in your gadget.

- Make adjustments. Load, revise and printing and signal the downloaded Mississippi Reaffirmation Agreement, Motion and Order.

Each format you included with your account does not have an expiration time and it is your own eternally. So, if you want to acquire or printing one more backup, just check out the My Forms section and click on in the type you need.

Obtain access to the Mississippi Reaffirmation Agreement, Motion and Order with US Legal Forms, one of the most considerable catalogue of authorized document themes. Use a large number of professional and condition-specific themes that satisfy your organization or personal demands and needs.

Form popularity

FAQ

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.

Example of Reaffirmation He has depleted his savings and is unable to make his mortgage payments. John arranges with his mortgage company a reaffirmation that is approved in court. He reaffirms the debt he owes on the home mortgage, with a chance to renegotiate payments with the lender.

If I deny the motion to reaffirm the debt, you are under no legal responsibility to pay the creditor, but the creditor can seek to repossess the collateral (if there is any). However the creditor cannot obtain a judgment against you for the amount you owe on this debt.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

In bankruptcy, a reaffirmation is an agreement that a debtor and a creditor enter into after a debtor has filed for bankruptcy, in which the debtor agrees to repay all or part of an existing debt after the bankruptcy proceedings are over and the property subject to the reaffirmation is not subject to partition in the ...

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

Making a reaffirmation agreement can be helpful if you want to stay in your home or you need to keep driving your car during a bankruptcy settlement. However, this type of agreement means you are still responsible for some sort of payment on the loan.

A reaffirmation agreement is where you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. When you reaffirm a debt, you continue to be legally responsible for paying it back. This gives the creditor some legal rights.