Mississippi Hourly Employee Evaluation

Description

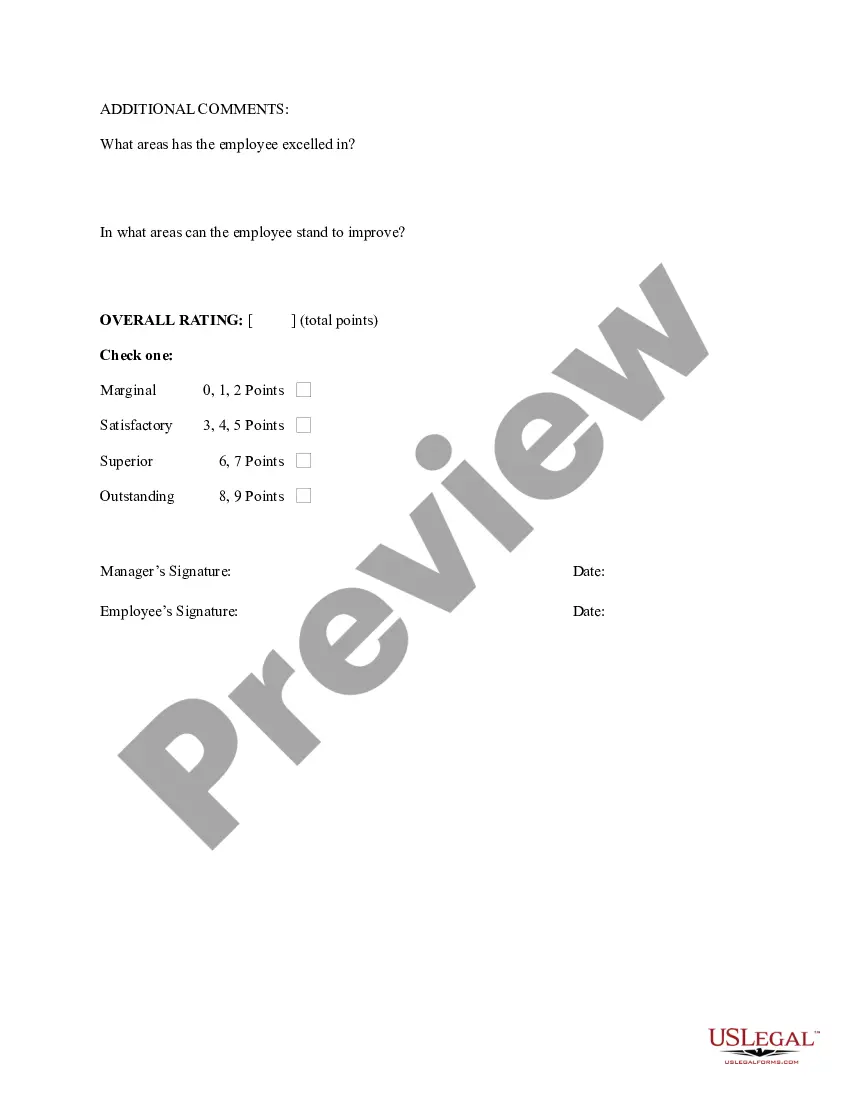

How to fill out Hourly Employee Evaluation?

US Legal Forms - one of the most prominent collections of legal templates in the USA - offers a vast selection of legal document formats that you can download or print.

While utilizing the website, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of forms like the Mississippi Hourly Employee Evaluation within moments.

If you have an account, Log In and download the Mississippi Hourly Employee Evaluation from the US Legal Forms collection. The Download button will be visible on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Mississippi Hourly Employee Evaluation. Every template you save to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Mississippi Hourly Employee Evaluation with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/region.

- Click the Preview button to examine the form's details.

- Review the form description to confirm you have selected the appropriate form.

- If the form doesn’t suit your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select your preferred pricing plan and enter your credentials to register for an account.

Form popularity

FAQ

Eight Factors That Can Affect Your PayYears of experience. Typically, more experience results in higher pay up to a point.Education.Performance reviews.Boss.Number of reports.Professional associations and certifications.Shift differentials.Hazardous working conditions.

Mississippi has no minimum wage law. That means eligible employees in Mississippi are entitled to either federal minimum wage (currently $7.25 per hour) or any local (city or county) minimum wage law that is on the books, whichever wage rate is higher.

Mississippi labor laws do not require employers to provide employees with severance pay. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

You also have the right not to engage in conversations or communications about your wages. When you and another employee have a conversation or communication about your pay, it is unlawful for your employer to punish or retaliate against you in any way for having that conversation.

Tip Credits The federal minimum wage is $7.25 per hour and the minimum wage in Mississippi is the same. Mississippi does allow employers to take a tip credit and, therefore, must pay tipped employees at least $2.13 per hour. The tip credit an employer may take is a maximum of $5.12 per hour.

Mississippi Law Doesn't Require Meal or Rest Breaks In other words, although breaks are not required, employers must pay employees for time they spend working and for shorter breaks during the day.

Most workers in Mississippi are entitled to overtime pay when they work more than 40 hours per week. In certain circumstances, however, there are exceptions.

While many states have labor regulations specifying the timing and duration of meal breaks that must be provided to employees, the Mississippi government has no such laws.

Use these six steps to determine a pay rate for new employees.Write a job description. A job title isn't enough.Consider experience and training. Determine the minimum experience and education necessary for the position.Check out industry rates.Factor in benefits and perks.Set a salary range.Be flexible.

5 essential factors for determining compensationYears of experience and education level. It probably goes without saying, but the more experience and education a candidate has, the higher their expected compensation.Industry.Location.In-demand skill sets.Supply and demand.