Mississippi Self-Employed Independent Contractor Agreement

Description

How to fill out Self-Employed Independent Contractor Agreement?

Locating the appropriate legal document template can be rather challenging. Of course, there is a multitude of templates accessible online, but how can you acquire the legal form you require? Utilize the US Legal Forms website.

This service provides a vast array of templates, including the Mississippi Self-Employed Independent Contractor Agreement, suitable for business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Acquire button to obtain the Mississippi Self-Employed Independent Contractor Agreement. Use your account to access the legal forms you have previously ordered. Navigate to the My documents tab in your account to retrieve another copy of the document you need.

US Legal Forms is the premier repository of legal documents where you can find a variety of document templates. Leverage this service to download professionally crafted documents that adhere to state requirements.

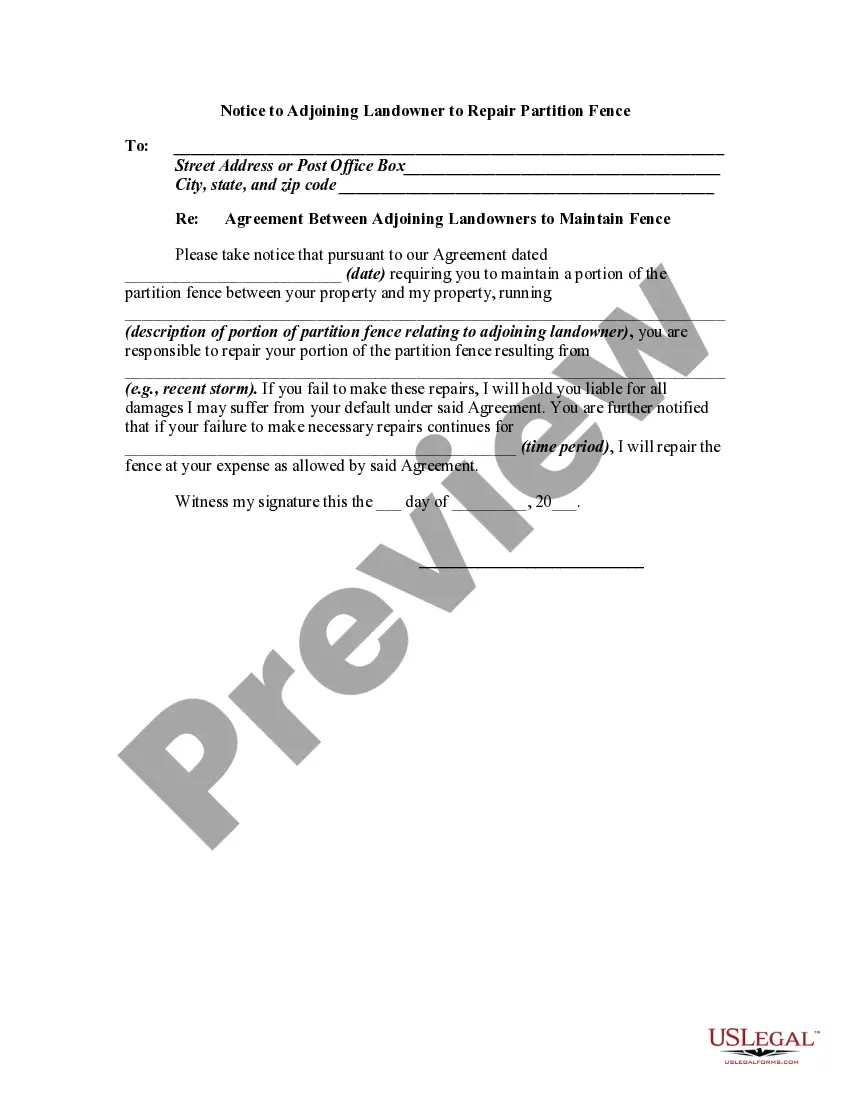

- First, ensure that you have selected the correct form for your city/county. You can preview the form using the Review button and examine the form details to confirm it is right for you.

- If the form does not satisfy your needs, use the Search field to find the appropriate form.

- Once you are sure that the form is correct, choose the Purchase now button to acquire the form.

- Select the pricing plan you prefer and enter the necessary details. Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Fill out, modify, print, and sign the completed Mississippi Self-Employed Independent Contractor Agreement.

Form popularity

FAQ

Like other small business owners, sole proprietors do have the ability to hire employees. As per the IRS, any time a sole proprietor hires an employee other than an independent contractor, the sole proprietorship will need to obtain an Employer Identification Number (EIN).

1. Not Having a Written Contract.The taxing, labor and employment, and insurance authorities expect a written contract that states that the worker is an independent contractor and will be paid as such with no tax withholding, no benefits, etc.

A sole proprietorship can use independent contractors for the term of the contract without any further obligation. If the sole proprietor no longer needs the independent contractor, the sole proprietor is under no obligation to extend the contract. This also allows a sole proprietor to try out potential employees.

Sole proprietors are commonly called self-employed. Instead, you're classified as an independent contractor, which is an individual that performs services for clients and customers without being considered an employee. All sole proprietors are independent contractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else. An independent contractor is someone who provides a service on a contractual basis.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Do I need an EIN to hire an independent contractor? Yes, you will need to get the EIN (Employer Identification Number) for your contractor's business. If they provide individual services, a social security number will suffice.

You can hire 1099 workers for specific projects, but you can't control when or how they complete their jobs. You're not responsible for covering their Medicare and Social Security taxes, and you won't provide them with the same benefits as you would for a W2 worker.

Protect your social security number. Have a clearly defined scope of work and contract in place with clients. Get general/professional liability insurance. Consider incorporating or creating a limited liability company (LLC).