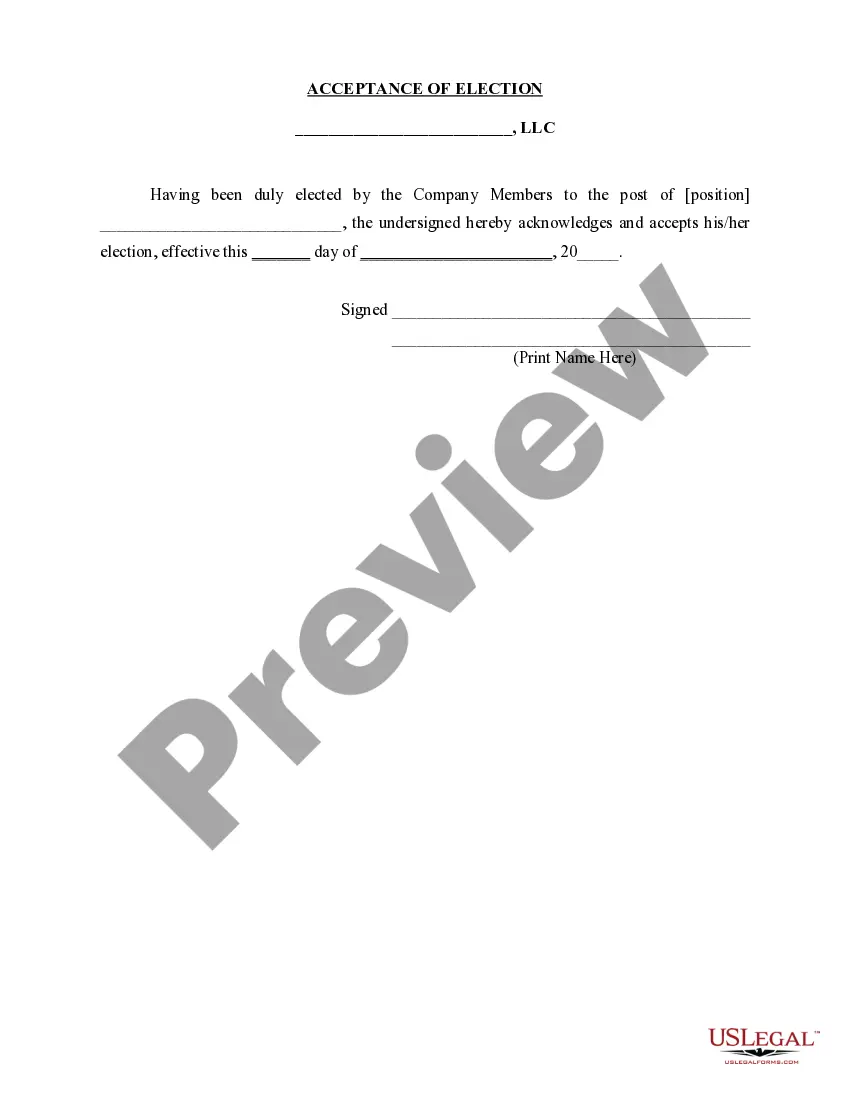

Mississippi Acceptance of Election in a Limited Liability Company LLC

Description

How to fill out Acceptance Of Election In A Limited Liability Company LLC?

You are able to devote hrs on-line searching for the authorized papers design that fits the state and federal specifications you want. US Legal Forms supplies a large number of authorized kinds which are reviewed by professionals. You can easily down load or print the Mississippi Acceptance of Election in a Limited Liability Company LLC from your services.

If you already have a US Legal Forms accounts, you can log in and then click the Download button. Afterward, you can complete, revise, print, or indicator the Mississippi Acceptance of Election in a Limited Liability Company LLC. Each and every authorized papers design you purchase is your own for a long time. To get another copy of the obtained form, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site initially, adhere to the easy recommendations under:

- Initial, be sure that you have chosen the correct papers design for your region/metropolis of your choice. Look at the form outline to make sure you have selected the correct form. If offered, make use of the Review button to search from the papers design too.

- If you want to discover another version of your form, make use of the Research field to discover the design that meets your needs and specifications.

- Once you have found the design you want, click on Buy now to continue.

- Choose the pricing strategy you want, enter your references, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your bank card or PayPal accounts to purchase the authorized form.

- Choose the file format of your papers and down load it to the product.

- Make changes to the papers if needed. You are able to complete, revise and indicator and print Mississippi Acceptance of Election in a Limited Liability Company LLC.

Download and print a large number of papers templates using the US Legal Forms site, which provides the greatest selection of authorized kinds. Use expert and condition-particular templates to deal with your company or specific demands.

Form popularity

FAQ

No, it's not legally required in Mississippi under § 79-29-123. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

If an LLC is listed as a C Corporation, the LLC must file corporate income taxes. In 2022, the federal corporate income tax rate is 21%, with many states adding their own taxes on top of that. Along with the corporate income tax, any profits or dividends distributed to members are subject to capital gains tax. LLC Tax Rates and Rules - SmartAsset smartasset.com ? taxes ? llc-tax-rates-and-rules smartasset.com ? taxes ? llc-tax-rates-and-rules

$50 Mississippi LLC Formation Filing Fee: $50 To bring your Mississippi LLC into existence, you must pay $50 (plus a $4 credit card fee) to file your LLC Certificate of Formation. You must fill out your application online, via the Mississippi Business Services portal. Cost to Start a Mississippi LLC - Northwest Registered Agent northwestregisteredagent.com ? llc ? cost northwestregisteredagent.com ? llc ? cost

Under Mississippi law, all limited liability companies operating in Mississippi are required to file an Annual Report with the Secretary of State. This report can be filed any time on or after January 1st of each calendar year and is due by April 15th of that year.

All Mississippi LLCs are taxed as a pass-through entity by default, which means all of the business' revenue is reported on the members' individual tax returns. In addition to the federal 15.3% self-employment tax, Mississippi LLC members pay the Mississippi personal income tax rate, which starts at 4%.

Pros and Cons of Forming an LLC in Mississippi. How to Get an LLC in Mississippi in Six Steps. ... Create an Account with the MS Secretary of State. ... Choose a Name for Your LLC. ... Choose a Registered Agent. ... Fill Out and File a Certificate of Formation. ... Draft an Operating Agreement. ... Request a Federal Employee Identification Number.

State Taxes for LLCs There are three types of state tax you might have to pay to your state Department of Revenue: Mississippi state income tax, and Mississippi state sales tax, and Mississippi Franchise Tax. Mississippi Business & Sales Taxes - Incfile Incfile ? mississippi-llc ? business-taxes Incfile ? mississippi-llc ? business-taxes

Mississippi Tax Rates, Collections, and Burdens Mississippi also has a 4.00 to 5.00 percent corporate income tax rate. Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent. Mississippi Tax Rates & Rankings taxfoundation.org ? location ? mississippi taxfoundation.org ? location ? mississippi