Mississippi Re-Hire Employee Information Form

Description

How to fill out Re-Hire Employee Information Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find thousands of forms for business and individual purposes, organized by categories, states, or keywords. You can access the latest forms like the Mississippi Re-Hire Employee Information Form in just a few seconds.

If you have a monthly subscription, Log In to download the Mississippi Re-Hire Employee Information Form from the US Legal Forms catalog. The Download button will show up on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Mississippi Re-Hire Employee Information Form. Every template you save in your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents area and click on the form you desire. Access the Mississippi Re-Hire Employee Information Form through US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs.

- To utilize US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your city/area.

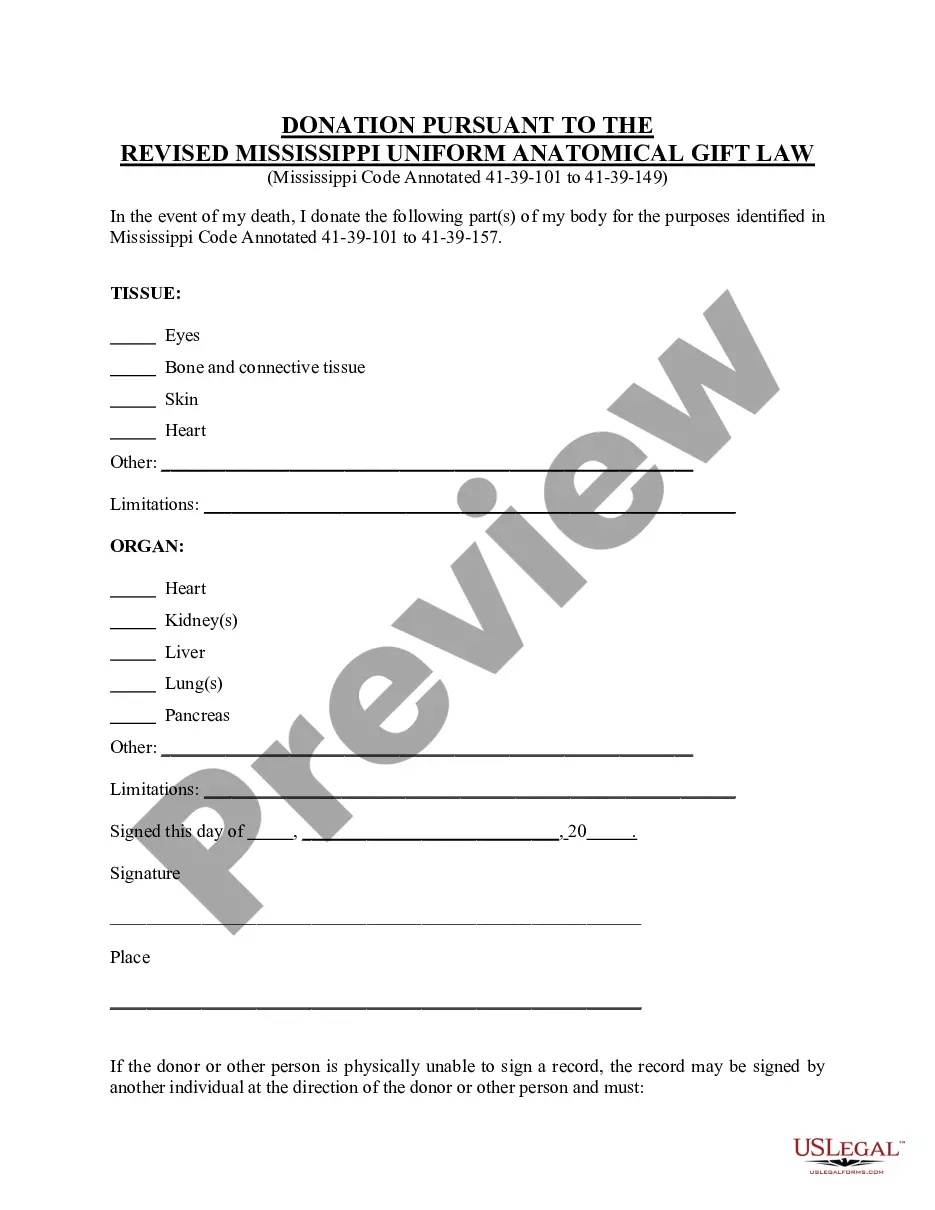

- Click on the Preview button to review the form's details.

- Examine the form information to confirm you have chosen the right document.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, select your preferred pricing plan and enter your details to create an account.

Form popularity

FAQ

A new hire letter is an official document sent to a new employee to confirm their employment and provide important information about their job. This letter typically outlines the employee's start date, job title, and salary details. Using the Mississippi Re-Hire Employee Information Form may help employers clearly communicate essential employment details.

If you have landed your first job or are starting a new job, you will need to fill out a W-4 (Employee's Withholding Certificate) form so that your employer can determine how much tax to withhold from your paycheck.

To know how much income tax to withhold from employees' wages, you should have a Form W-4, Employee's Withholding Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment.

To find out, you need to collect two new hire tax forms: federal and state W-4 forms.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

4 is a U.S. tax document that all new employees must fill out. It lists the employee's Social Security number and tax exemptions. The form allows employers to determine how much tax money to withhold from each paycheck.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4.

Required Employment Forms in TexasSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.