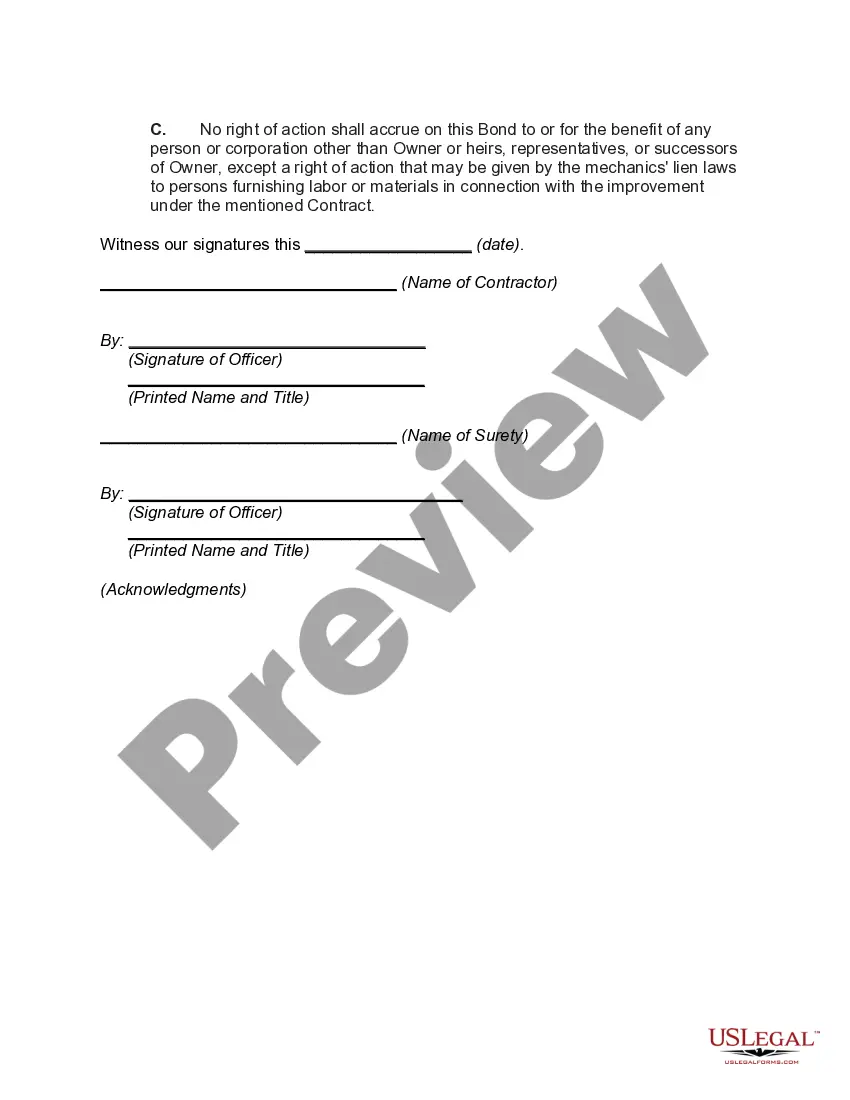

Mississippi Contractor's Performance Bond with Limitation of Right of Action

Description

How to fill out Contractor's Performance Bond With Limitation Of Right Of Action?

If you wish to complete, acquire, or produce legitimate record web templates, use US Legal Forms, the biggest variety of legitimate forms, that can be found on the Internet. Make use of the site`s easy and hassle-free research to discover the papers you need. Various web templates for business and individual uses are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Mississippi Contractor's Performance Bond with Limitation of Right of Action within a few mouse clicks.

Should you be currently a US Legal Forms customer, log in for your bank account and click on the Download switch to obtain the Mississippi Contractor's Performance Bond with Limitation of Right of Action. You may also gain access to forms you formerly delivered electronically from the My Forms tab of your bank account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for your proper area/land.

- Step 2. Use the Review solution to look over the form`s information. Do not neglect to see the outline.

- Step 3. Should you be unhappy using the develop, take advantage of the Look for field towards the top of the screen to locate other types of your legitimate develop design.

- Step 4. When you have identified the shape you need, click the Get now switch. Pick the rates strategy you like and include your references to sign up on an bank account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal bank account to accomplish the purchase.

- Step 6. Find the file format of your legitimate develop and acquire it in your gadget.

- Step 7. Full, modify and produce or sign the Mississippi Contractor's Performance Bond with Limitation of Right of Action.

Every single legitimate record design you buy is your own property eternally. You may have acces to every single develop you delivered electronically inside your acccount. Go through the My Forms segment and choose a develop to produce or acquire yet again.

Contend and acquire, and produce the Mississippi Contractor's Performance Bond with Limitation of Right of Action with US Legal Forms. There are millions of specialist and state-particular forms you may use for your business or individual requirements.

Form popularity

FAQ

If the surety does not voluntarily pay the claim, a lawsuit must be filed against the payment bond surety as follows: (a) if the public entity files a notice of completion or cessation notice, thirty (30) days six plus (6) months after the notice is filed or (b) if neither a notice of completion or cessation is filed, ...

Performance bonds, which are secured by a contractor before the beginning of a project, provide a guarantee to the project owner that contract obligations will be fulfilled. If the contractor fails to complete work ing to the contract terms, the property owner may be financially compensated.

(5) A payment bond assures payments as required by law to all persons supplying labor or material in the prosecution of the work provided for in the contract. (6) A performance bond secures performance and fulfillment of the contractor's obligations under the contract.

Performance Bonds guarantee that a product will be of a certain standard and a penalty is payable if they are not. This will usually be issued when a Tender Bond is cancelled.

A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet the obligations of the contract. A performance bond is usually issued by a bank or an insurance company.

Usually, a performance bond is required for a contractor when the construction project is funded by tax dollars, which essentially means any public construction project will require bonding. However, a private company might also require a performance bond to help mitigate risk.

Performance Bonds A performance bond guarantees satisfactory performance of all duties specified in the contract. Examples would the labor of all sub-contractors, suppliers, and payment of materials. The principal will require the performance bond once awarded the contract.

A payment bond protects the project owner from liens against the property by guaranteeing that the policyholder (typically the GC) will pay all subcontractors and suppliers for their work and materials. Payment bonds are required on most public projects, but are also frequently used on commercial jobs as well.