Mississippi LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

Are you in a predicament where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable versions isn't easy.

US Legal Forms provides thousands of form templates, such as the Mississippi LLC Operating Agreement for Spouses, which are designed to comply with state and federal regulations.

Once you find the appropriate form, click on Buy now.

Choose the payment plan you wish, complete the required information to set up your payment, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi LLC Operating Agreement for Spouses template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and verify that it is for your specific town/county.

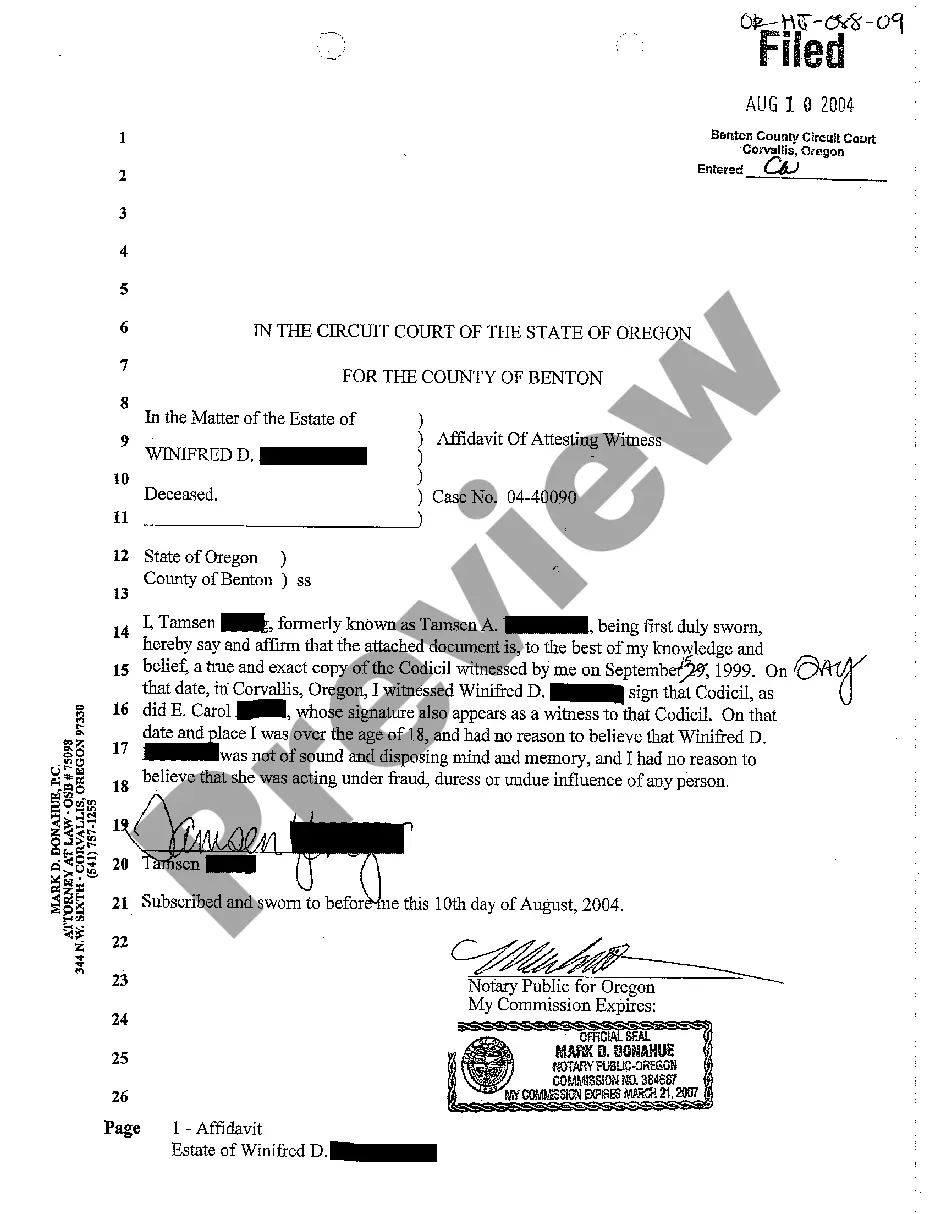

- Utilize the Review button to examine the form.

- Check the description to ensure that you have chosen the correct form.

- If the form isn't what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Prepare an Operating AgreementAn LLC operating agreement is not required in Mississippi, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

Like other states, Mississippi requires LLCs and PLLCs to designate a registered agent when filing a Certificate of Formation. ZenBusiness's registered agent services can help new firms find a suitable agent in their area. The agent's purpose is to receive documents on behalf of the PLLC, such as summons and subpoenas.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Prepare an Operating AgreementAn LLC operating agreement is not required in Mississippi, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

A Mississippi LLC operating agreement is a binding legal document that controls the affairs of an LLC. The company's owners and managers are bound by the agreement.