Idaho Promissory Note Assignment and Notice of Assignment

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent templates of documents such as the Idaho Promissory Note Assignment and Notice of Assignment within moments.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, select your preferred payment plan and provide your credentials to register for an account.

- If you already have an account, sign in to download the Idaho Promissory Note Assignment and Notice of Assignment from the US Legal Forms library.

- The Download button will appear on every form you view.

- You will have access to all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your jurisdiction/county.

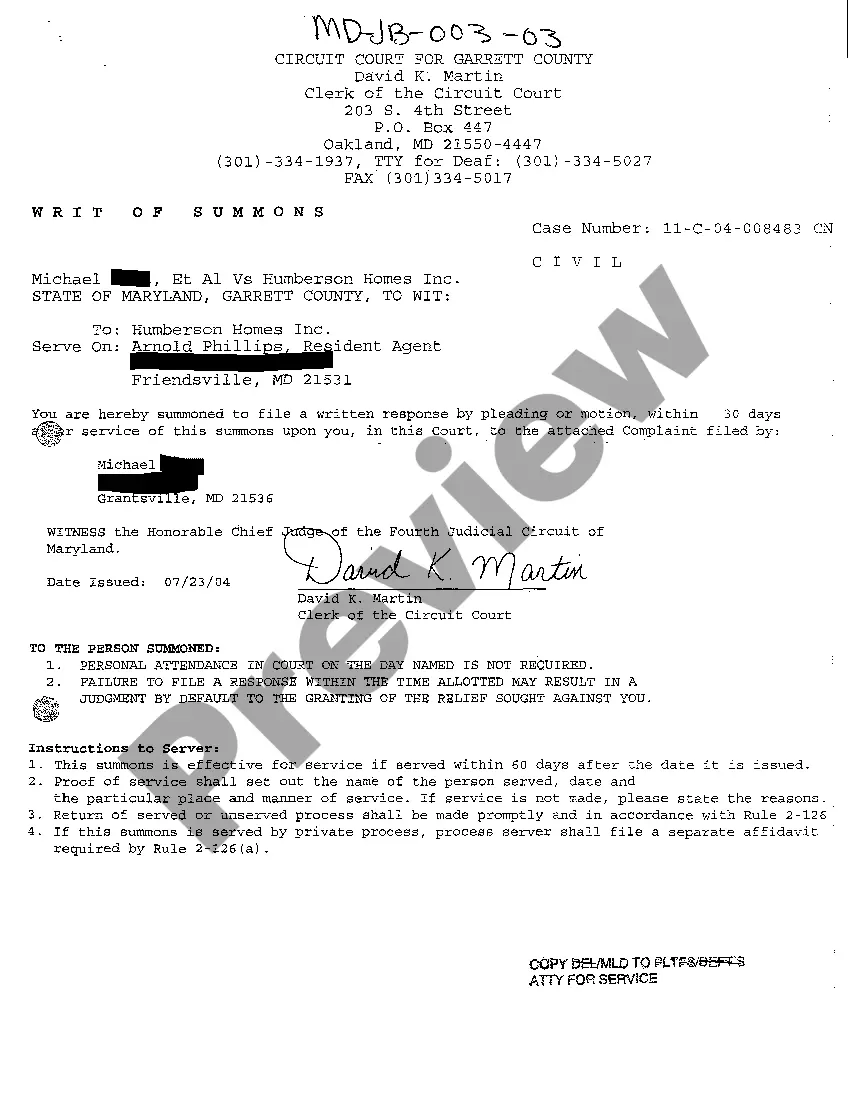

- Click the Preview button to review the contents of the form.

Form popularity

FAQ

To assign a promissory note, you need to prepare a written assignment that identifies the note, the original parties involved, and the assignee. Ensure the document clearly states that the rights and obligations under the note are being transferred. It's a good idea to keep proper records of the assignment and refer to the Idaho Promissory Note Assignment and Notice of Assignment for necessary legal phrasing.

Transferring ownership of a promissory note requires you to draft an assignment document. This document should detail the original borrower, new owner, and the note's specifics. Be sure to follow the state requirements for the Idaho Promissory Note Assignment and Notice of Assignment to ensure all legal protocols are followed. You can find templates that guide you through this process on various legal platforms.

Filling out a promissory note involves entering the essential details like the names of the parties involved, the principal amount, and the repayment timeline. It's crucial to specify whether the payment is secured or unsecured. Then, you will need to sign and date the document. For additional clarity, consider using resources from the Idaho Promissory Note Assignment and Notice of Assignment for best practices.

In Idaho, a property is generally considered abandoned after one year of non-use. This timeframe allows property owners to reclaim their property, while also serving to protect against claims of abandonment. When dealing with property assignments, including Idaho Promissory Note Assignments, understanding these timeframes is crucial. For more information about property laws and related documents, visit US Legal Forms for comprehensive resources.

Yes, forgery is classified as a felony in Idaho. Engaging in forgery undermines trust in financial transactions, such as those related to Idaho Promissory Note Assignments. This serious offense can result in significant penalties, including imprisonment and fines. Always approach any assignment or legal process carefully, and utilize platforms like US Legal Forms to ensure your documents are valid and respected.

Codes 18 3314 and 18 3315 in Idaho refer to legal statutes that address the implications of promissory notes and their assignments. Specifically, these codes outline the requirements for executing an Idaho Promissory Note Assignment and providing proper Notice of Assignment. Understanding these codes helps individuals ensure compliance when dealing with financial agreements. If you need assistance with these legal processes, consider using the US Legal Forms platform for reliable resources and templates.

To assign a note means to transfer the ownership of the note from one party to another, effectively giving the new holder the right to collect payments. This action is common in financial transactions and must be executed properly to maintain legal validity. Engaging with resources for Idaho Promissory Note Assignment and Notice of Assignment will help facilitate a seamless transfer.

An assignment of a promissory note occurs when the original lender transfers their rights to receive payment to another party. This process includes the creation of a Notice of Assignment, which formalizes the transfer. Using a platform like US Legal Forms can help streamline the Idaho Promissory Note Assignment and Notice of Assignment, ensuring all necessary documents are completed accurately.

An example of a promissory note could be a situation where you borrow $10,000 from a friend to buy a car. The note would outline your promise to repay the amount over a year with monthly installments. In this context, understanding the Idaho Promissory Note Assignment and Notice of Assignment allows both parties to protect their interests should questions about repayment arise.

Statute 18-3319 in Idaho addresses issues related to anti-fraud provisions in financial transactions. It is crucial for protecting parties engaged in promissory notes and other financial documents from deceptive practices. By adhering to this statute during Idaho Promissory Note Assignment and Notice of Assignment, you can safeguard your financial dealings and ensure compliance.