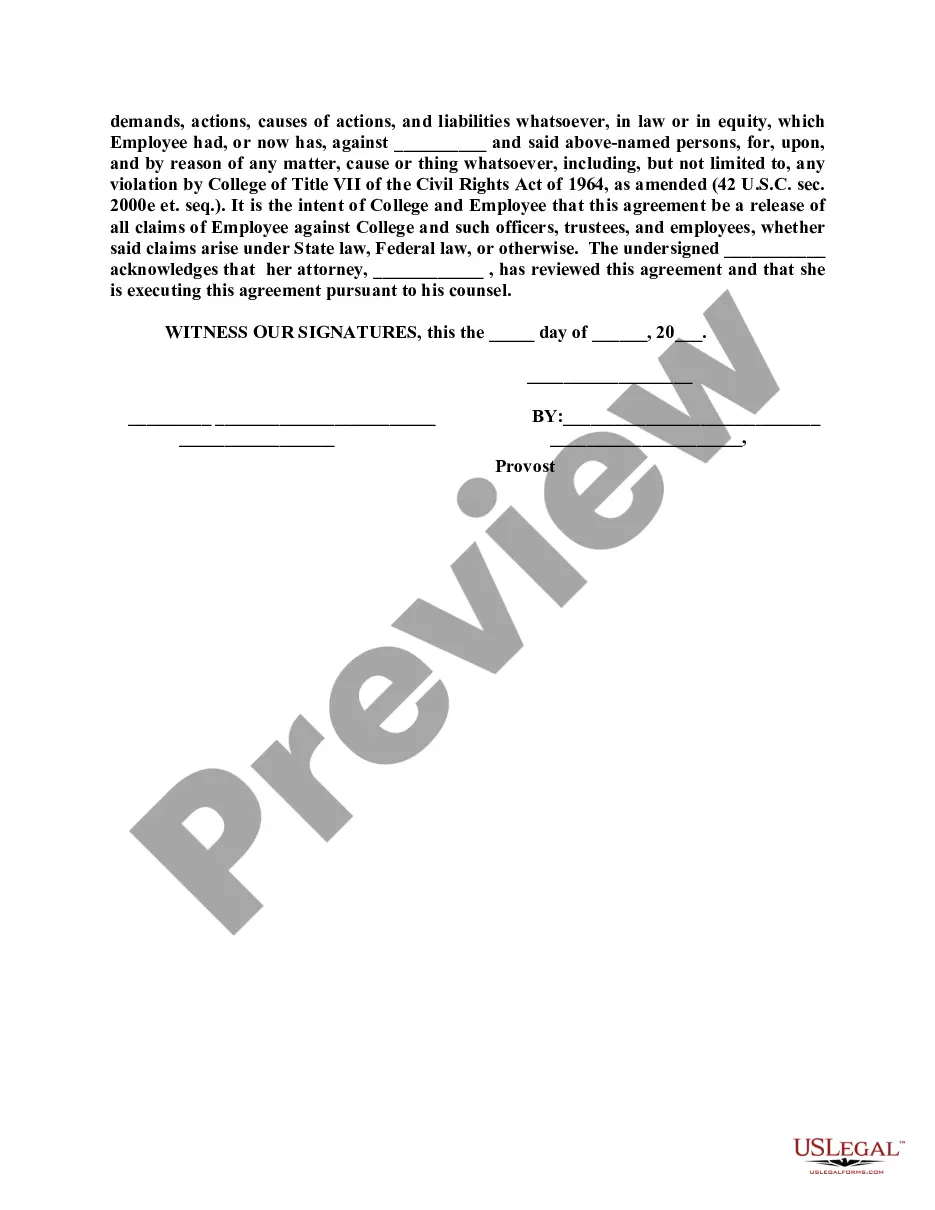

Mississippi Severance Agreement between Employee and College

Description

How to fill out Severance Agreement Between Employee And College?

It is feasible to spend hours online attempting to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal forms that can be reviewed by experts.

It is easy to obtain or print the Mississippi Severance Agreement between Employee and College from my service.

If available, use the Review button to examine the document template as well. If you wish to obtain another version of your document, utilize the Search field to find the template that suits your needs.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- After that, you may complete, edit, print, or sign the Mississippi Severance Agreement between Employee and College.

- Every legal document template you receive is yours indefinitely.

- To obtain another copy of the purchased document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Review the document outline to confirm you have selected the appropriate form.

Form popularity

FAQ

Just cause terminations: If the offense charged against the employee is proven, the employer is not required to grant separation pay. But if the employer fails to observe due process, he may be financially liable to the employee, even as the dismissal is upheld.

In cases of retrenchment due to financial losses, cessation of business or illness, separation pay is normally half month's pay for every year of service or one month's pay, whichever is higher. If the business was closed due to severe financial losses, it may be exempt from granting separation pay.

Early RetirementIf you are under age 60 and have reached 25 years of service, you are eligible for an immediate benefit with reduction.

Employees terminated by an employer have certain rights. An employee has the right to receive a final paycheck and the option of continuing health insurance coverage, and may even be eligible for severance pay and unemployment compensation benefits.

Mississippi labor laws do not require employers to provide employees with severance pay. If an employer chooses to provide severance benefits, it must comply with the terms of its established policy or employment contract.

Vesting in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

You can retire with 30 years of creditable service at any age or age 60 and vested.

Mississippi is an "at will" state, which means an employer can fire an employee for any or no reason, as long as it is not discriminatory.

Not only can you retire at age 50 with 20 years of service but you can also do that at any age with 25. Unused sick leave can't be used to meet the length of service requirement to make you eligible to retire. It can only be added to your length of service after you are eligible to retire.

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.