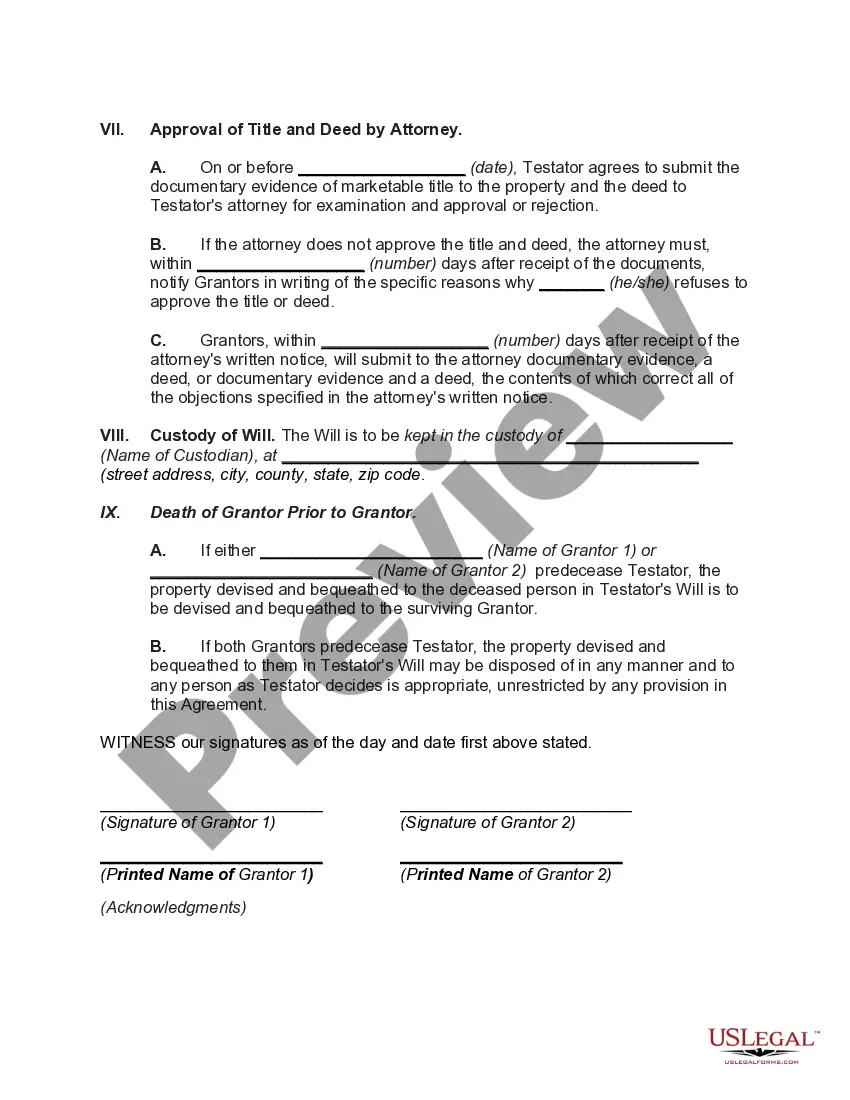

Mississippi Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the site's simple and convenient search feature to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours permanently. You have access to all forms you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, then print the Mississippi Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to access the Mississippi Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Mississippi Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- You can also find forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have chosen the form designated for your specific area/state.

- Step 2. Utilize the Review function to examine the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative forms within the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing option you prefer and provide your details to create an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Mississippi Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

Form popularity

FAQ

Heirs who inherit property are typically children, descendants, or other close relatives of the decedent. Spouses typically are not legally considered to be heirs, as they are instead entitled to properties via marital or community property laws.

A gift given by means of the will of a decedent of an interest in real property.

An executor of an estate is an individual appointed to administer the last will and testament of a deceased person. The executor's main duty is to carry out the instructions to manage the affairs and wishes of the deceased.

BENEFICIARY - A person named to receive property or other benefits.

There are 3 effective ways to revoke this deed:File and record a Revocation of Revocable Transfer on Death Deed form.Record a new transfer on death deed naming a different beneficiary.Sell or transfer the real property to someone else prior to the real property owner's death.

In case I don't have a will or a trust, what will be the possible consequence? If you do not have a Will or a Trust, and have not used other probate-avoiding techniques, upon your death, your assets will pass according to the laws of the state to those whom you might not desire to share your wealth.

In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death. Before setting-up a transfer on death account, you should review the tax implications of these accounts.

The law of succession defines the rules of devolution of property in case a person dies without making a Will. These rules provide for a category of persons and percentage of property that will devolve on each of such persons. A Will is a legal declaration.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.