Mississippi Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out Sample Letter To Beneficiaries Regarding Trust Money?

You may invest several hours on the web searching for the lawful record format that suits the federal and state requirements you require. US Legal Forms gives thousands of lawful types that happen to be reviewed by professionals. It is possible to acquire or printing the Mississippi Sample Letter to Beneficiaries regarding Trust Money from our support.

If you have a US Legal Forms profile, you can log in and click on the Obtain button. Following that, you can comprehensive, revise, printing, or indication the Mississippi Sample Letter to Beneficiaries regarding Trust Money. Each and every lawful record format you purchase is your own permanently. To get yet another copy associated with a purchased kind, check out the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms internet site the first time, adhere to the simple recommendations beneath:

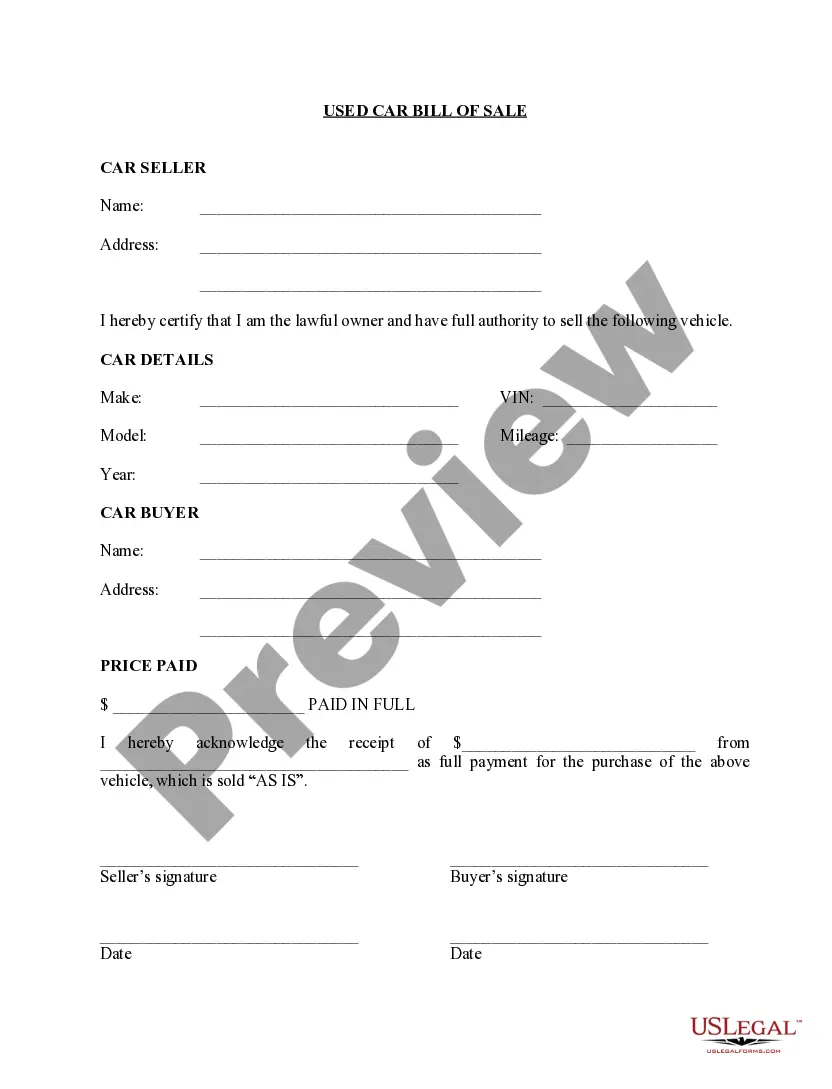

- Initially, ensure that you have selected the right record format for your area/metropolis of your liking. Read the kind outline to ensure you have picked the appropriate kind. If accessible, utilize the Review button to search with the record format at the same time.

- In order to discover yet another edition of your kind, utilize the Lookup area to obtain the format that fits your needs and requirements.

- When you have located the format you need, click Buy now to proceed.

- Pick the pricing plan you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your Visa or Mastercard or PayPal profile to fund the lawful kind.

- Pick the format of your record and acquire it to the gadget.

- Make modifications to the record if needed. You may comprehensive, revise and indication and printing Mississippi Sample Letter to Beneficiaries regarding Trust Money.

Obtain and printing thousands of record templates making use of the US Legal Forms Internet site, that offers the biggest selection of lawful types. Use skilled and state-particular templates to deal with your business or specific requires.

Form popularity

FAQ

The letter of instruction should include the following information: A summary of all assets and debts. The location of valuable physical assets (e.g., jewelry, art, collectibles, real estate) Details about your retirement and investment accounts.

Beneficiary Offer Letter means the legally binding contract between You and the Beneficiary setting out the terms and conditions of the Beneficiary Grant or Beneficiary Loan to be made available by You under the Scheme to the Beneficiary; Sample 1.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

A good first step for the beneficiary is to meet with the trustee who is tasked with executing the terms of the trust. It may be an individual, such as a CPA or lawyer, family member, or potentially a corporate trustee such as Wells Fargo Bank.

How to write a beneficiary letter List important contact information. ... Give specific and clear instructions. ... Address your beneficiary personally. ... Keep multiple copies. ... Check the letter annually and update as needed.

When writing your letter of instruction, include as much information about your estate and your assets as possible, and provide detailed instruction for how you want any assets not mentioned in your formal will to be dispersed among your heirs. Your letter of intent doesn't supersede the terms of your will.

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.