Mississippi Accounts Receivable Write-Off Approval Form

Description

How to fill out Accounts Receivable Write-Off Approval Form?

If you require extensive, obtain, or print authentic document templates, utilize US Legal Forms, the largest assortment of legitimate forms accessible online.

Employ the site`s straightforward and user-friendly search option to find the documents you need.

A variety of templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have located the form you desire, select the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Use US Legal Forms to acquire the Mississippi Accounts Receivable Write-Off Approval Form in just a few clicks.

- If you are already a US Legal Forms client, sign in to your account and click on the Get button to obtain the Mississippi Accounts Receivable Write-Off Approval Form.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for your correct city/state.

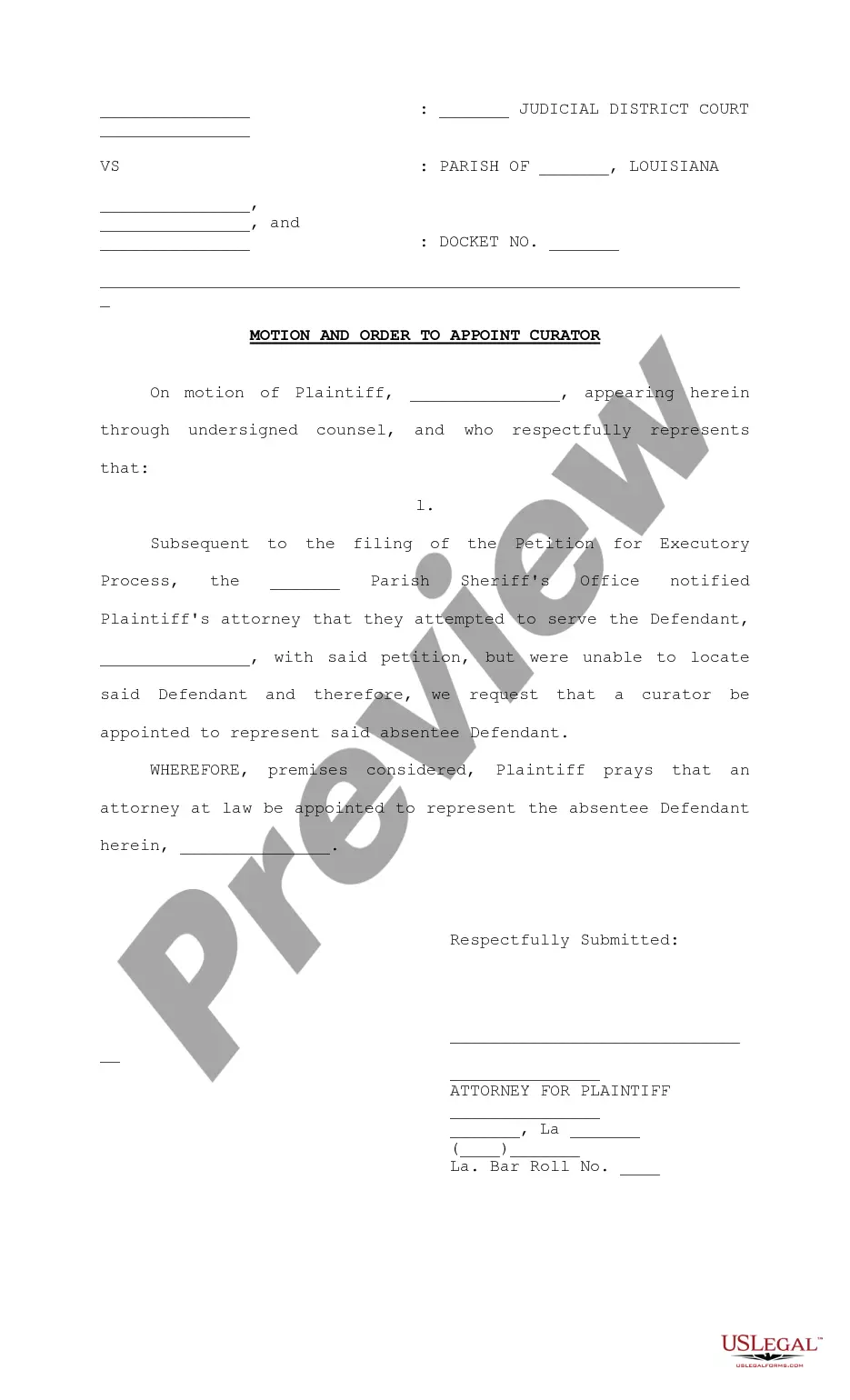

- Step 2. Use the Preview option to review the content of the form. Be sure to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

When you write off an account receivable, you acknowledge that the amount owed is no longer collectible. This action reduces your accounts receivable balance and impacts your net income. It also allows your business to present a clearer financial picture. Utilizing the Mississippi Accounts Receivable Write-Off Approval Form can help you manage this important process efficiently.

Yes, you can write-off a note receivable if it becomes uncollectible. The procedure is similar to that for accounts receivable, where you adjust your financial records to remove the expected payments. This action can protect your financial statements from overstating your assets. Using the Mississippi Accounts Receivable Write-Off Approval Form can simplify this process for your organization.

Recording the write-off of accounts receivable involves adjusting your financial records to reflect that you no longer expect to collect the amount owed. You typically debit the allowance for doubtful accounts and credit the accounts receivable. This process ensures that your financial statements provide an accurate picture of your assets. Using the Mississippi Accounts Receivable Write-Off Approval Form can help streamline this process.

The journal entry for allowance method accounts receivable involves creating an allowance through a debit to bad debt expense and a credit to the allowance for doubtful accounts. This entry reflects the estimated uncollectible amount in your financial reports. Utilizing a Mississippi Accounts Receivable Write-Off Approval Form can simplify tracking these entries for improved record-keeping.

When using the allowance method, the entry to write off accounts receivable includes debiting the allowance for doubtful accounts and crediting accounts receivable. This demonstrates that you acknowledged the estimated losses and adjusted your records accordingly. The Mississippi Accounts Receivable Write-Off Approval Form assists in making this process straightforward and organized.

The journal entry for writing off accounts receivable typically involves debiting the allowance for doubtful accounts and crediting accounts receivable. This effectively removes the uncollectible account from the financial records while maintaining the overall balance. To streamline this process, consider utilizing a Mississippi Accounts Receivable Write-Off Approval Form.

An example of a write-off in accounting occurs when a business determines that a specific receivable is uncollectible. For instance, if a customer goes bankrupt, the company may decide to write off the outstanding invoice. Implementing a Mississippi Accounts Receivable Write-Off Approval Form helps businesses document these decisions and maintain organized records.

Accounts receivable can be offset with allowances for doubtful accounts. This reflects the amount you do not expect to collect from customers. By properly managing your accounts through a Mississippi Accounts Receivable Write-Off Approval Form, you can ensure better accuracy in your financial statements and reduce the impact of bad debts.

To treat allowance for receivables, you first estimate the amount of uncollectible accounts. This involves analyzing past collection history and current economic conditions. You then create an allowance by adjusting entries based on this estimate, which helps maintain accurate financial records. Using a Mississippi Accounts Receivable Write-Off Approval Form aids in streamlining this process.

An uncollectible account receivable is written off when you determine it is unlikely that the debt will be collected. This typically occurs after a significant period of non-payment. Utilizing the Mississippi Accounts Receivable Write-Off Approval Form ensures that you have the necessary documentation to support your decision.