Mississippi Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

Locating the appropriate sanctioned document template can be a struggle.

Certainly, numerous templates exist online, but how can you acquire the approved form you need.

Utilize the US Legal Forms platform. The service provides thousands of templates, including the Mississippi Assignment and Bill of Sale to Corporation, which can be utilized for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All the documents are reviewed by experts and meet federal and state regulations.

- If you are already a member, sign in to your account and click the Acquire button to download the Mississippi Assignment and Bill of Sale to Corporation.

- Use your account to search for the legal documents you have previously purchased.

- Visit the My documents section of the account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

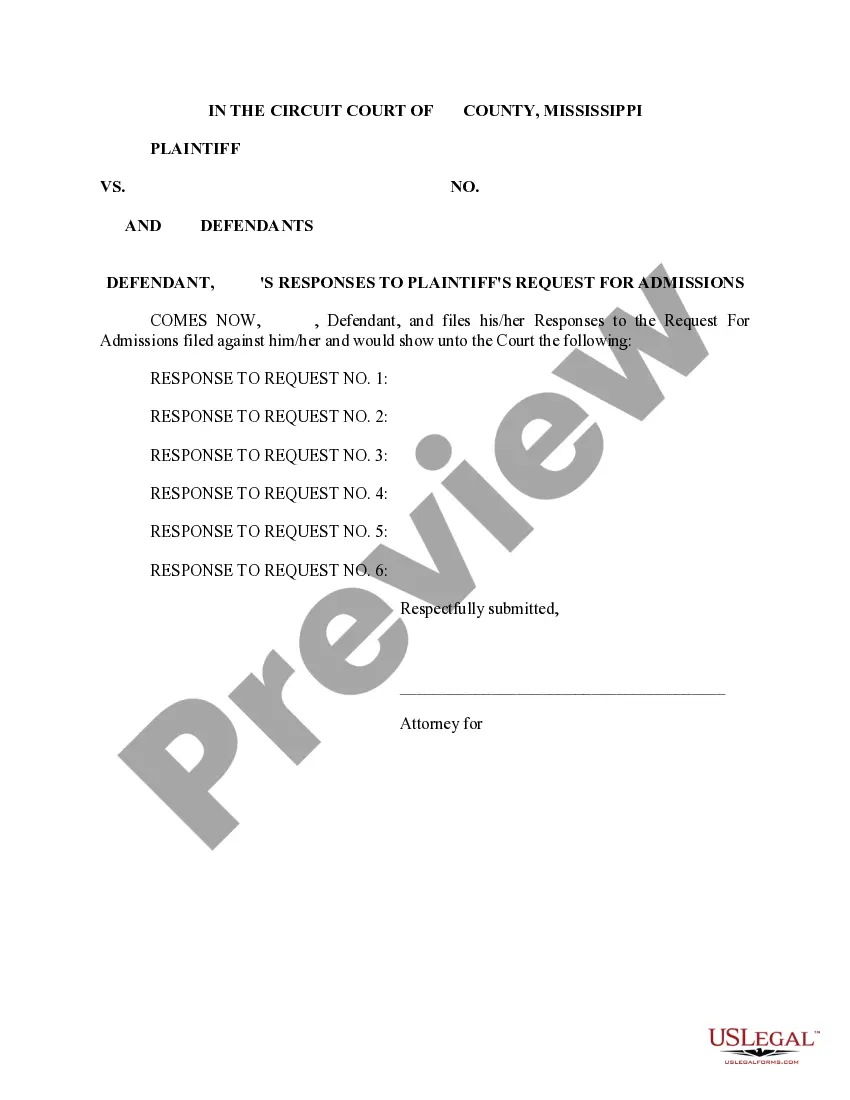

- First, make sure you have selected the correct form for your location/state. You can preview the form using the Preview button and review the form description to ensure it is suitable for you.

Form popularity

FAQ

Yes, Mississippi requires a bill of sale during the vehicle transfer process. The Mississippi Assignment and Bill of Sale to Corporation is often used to document the transaction. This document serves as proof of sale and helps protect both the buyer and seller by detailing the terms of the agreement. It is highly recommended to have this completed to ensure proper documentation.

To transfer a car title in Mississippi, you will need the signed title from the seller, a completed Mississippi Assignment and Bill of Sale to Corporation, and a photo ID. Gather all documents and present them at your local Department of Revenue. Ensure that both parties have filled out their sections correctly to avoid any delays.

In Mississippi, a notary is not required to sell a car. However, having your Mississippi Assignment and Bill of Sale to Corporation notarized can add an extra layer of security for both parties. It helps verify identities, ensuring that the transaction is legitimate. While it may not be necessary, it is often a good practice to have important documents notarized.

No, a bill of sale does not count as a title in Mississippi. However, the Mississippi Assignment and Bill of Sale to Corporation acts as a crucial document that assists in vehicle transfer. It proves ownership and provides essential details about the sale to both parties. Remember, a title is still necessary for official transfer and documentation.

To transfer a title in Mississippi, you typically need the current title, a completed Mississippi Assignment and Bill of Sale to Corporation, and forms of identification. If you’re the seller, you must also sign the title over to the buyer. Make sure all information is accurate and includes the signatures, as inaccuracies can delay the process.

To gift a car in Mississippi, you need to complete a Mississippi Assignment and Bill of Sale to Corporation. This document should include information about the vehicle and both the giver and receiver's details. Once filled out, both parties should sign it. After that, the recipient must take this document to the local Department of Revenue to transfer the title.

Not all states require notarized bills of sale, but some do for specific transactions, such as vehicle registrations. States like Florida and California often urge notarization for clarity and security in sales. When preparing a Mississippi Assignment and Bill of Sale to Corporation, always check local regulations to confirm requirements.

A notarized bill of sale is generally more reliable in court, as it proves that both parties acknowledged the transaction. While it is not an absolute guarantee, having the document notarized strengthens your position. It's important to include clear terms in your Mississippi Assignment and Bill of Sale to Corporation to ensure enforceability.

Yes, you can create a bill of sale without a notary in Mississippi. While notarization adds a layer of security and legitimacy, it is not a legal requirement for the document to be valid. Just ensure that the bill includes necessary details for the Mississippi Assignment and Bill of Sale to Corporation, so it holds value in a transaction.

The PTE rate in Mississippi refers to the pass-through entity tax rate, which is set at 3% for qualified businesses. This tax benefits certain corporations and partnerships by allowing them to reduce their income tax burden. When creating a Mississippi Assignment and Bill of Sale to Corporation, being aware of tax implications becomes essential for financial planning.