This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

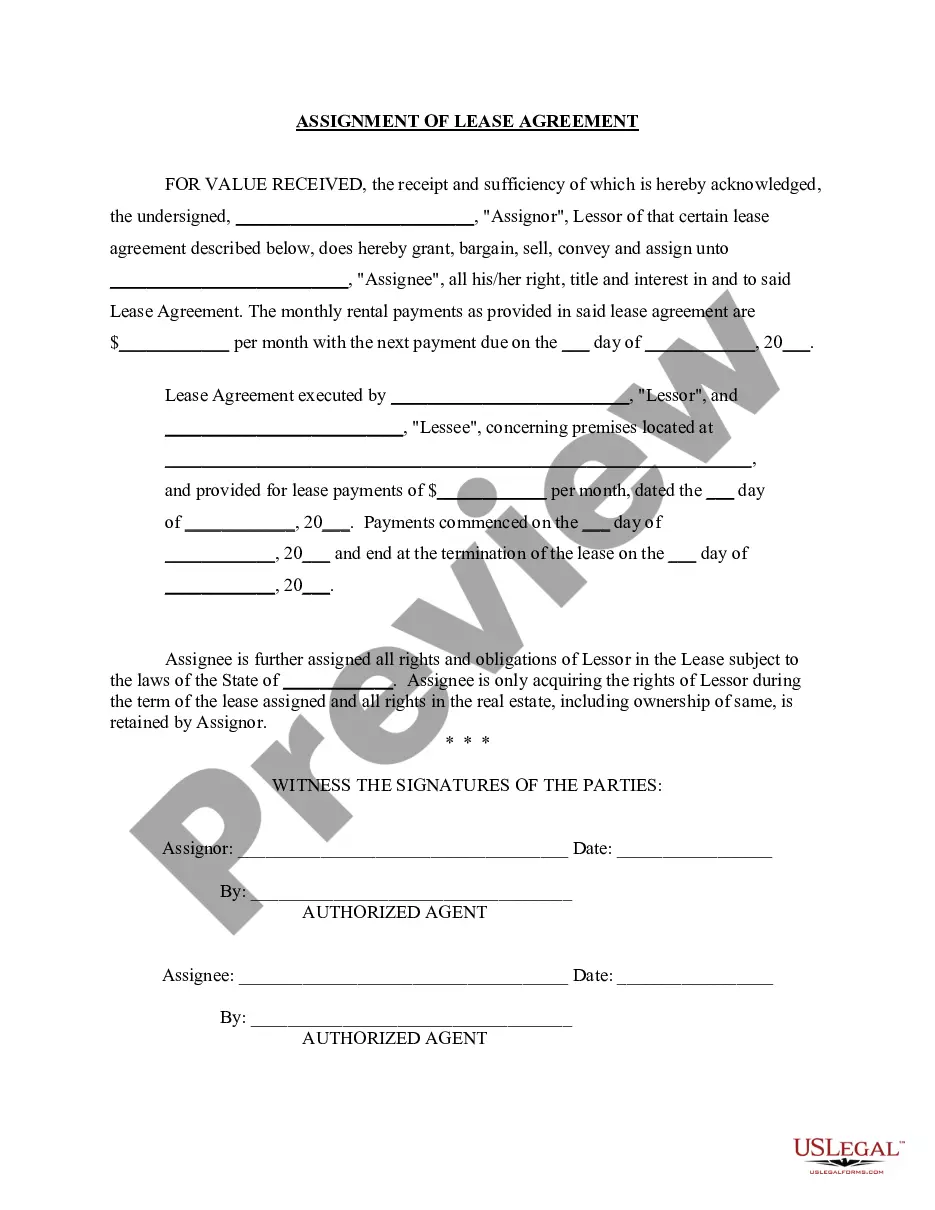

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

Finding the right legitimate record web template might be a have difficulties. Of course, there are tons of web templates accessible on the Internet, but how would you get the legitimate kind you want? Take advantage of the US Legal Forms internet site. The services gives 1000s of web templates, including the Mississippi Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement, which can be used for organization and private demands. All the kinds are examined by experts and meet up with state and federal demands.

If you are already registered, log in for your bank account and click on the Download button to get the Mississippi Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement. Utilize your bank account to appear through the legitimate kinds you have bought earlier. Go to the My Forms tab of your respective bank account and acquire one more copy of your record you want.

If you are a new user of US Legal Forms, allow me to share simple directions for you to stick to:

- Initial, ensure you have selected the appropriate kind for your personal metropolis/county. It is possible to look over the form using the Review button and read the form information to make sure this is basically the best for you.

- In the event the kind will not meet up with your needs, make use of the Seach industry to get the appropriate kind.

- Once you are certain the form is suitable, select the Acquire now button to get the kind.

- Choose the prices strategy you need and enter the essential details. Design your bank account and pay money for an order utilizing your PayPal bank account or credit card.

- Opt for the data file structure and obtain the legitimate record web template for your gadget.

- Comprehensive, revise and print out and indication the acquired Mississippi Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement.

US Legal Forms is the most significant local library of legitimate kinds for which you can find various record web templates. Take advantage of the service to obtain skillfully-produced documents that stick to state demands.

Form popularity

FAQ

Here are three main ways to structure a seller-financed deal: Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar. ... Draft a Contract for Deed. ... Create a Lease-purchase Agreement.

The seller's financing typically runs only for a fairly short term, such as five years. At the end of that period, a balloon payment is due. The expectation is usually that the initial seller-financed purchase will improve the buyer's creditworthiness and allow them to accumulate equity in the home.

For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year. In this scenario, a $100,000 loan at 8% would look like $666.67 in a monthly interest-only payment.

The key documents in a seller financing transaction include: (1) Purchase Agreement; (2) Promissory Note; and (3) Deed of Trust. Depending on the particulars of the financing arrangement, other documents may also be needed.

A seller note is a form of financing wherein the seller formally agrees to receive a portion of the purchase price ? i.e. the acquisition proceeds ? in a series of future payments. It is important to remember that seller notes are a type of debt financing, thus are interest-bearing securities.