Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

If you wish to finalize, acquire, or create valid document templates, utilize US Legal Forms, the leading collection of valid forms available online.

Employ the website's simple and user-friendly search feature to locate the documents you require.

A variety of templates for commercial and personal purposes are sorted by categories and states, or keywords.

Each legal document format you purchase is your property forever. You will have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete and obtain, and print the Mississippi Bartering Contract or Exchange Agreement with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to locate the Mississippi Bartering Contract or Exchange Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to download the Mississippi Bartering Contract or Exchange Agreement.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

- Step 2. Utilize the Review option to examine the content of the form. Do not forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan that suits you and provide your details to register for an account.

- Step 5. Complete the payment process. You may use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Mississippi Bartering Contract or Exchange Agreement.

Form popularity

FAQ

Bartering does have its limitations. For instance, not all goods and services are easily exchanged, and both parties must find mutual value. Additionally, certain legal rules may apply under the Mississippi Bartering Contract or Exchange Agreement, which may restrict specific items or services from being traded. It's important to understand these boundaries to ensure successful transactions.

Starting a bartering business involves assessing your skills or products that others might need. You can create a Mississippi Bartering Contract or Exchange Agreement to formalize your trades, making them more trustworthy. Networking with like-minded individuals can help you find potential partners. Additionally, using platforms like uslegalforms can provide templates to streamline the setup process.

Yes, the IRS recognizes bartering as a legitimate form of trade. However, it requires that these transactions be reported as income, reflecting their fair market value. This means that if you engage in a Mississippi Bartering Contract or Exchange Agreement, you need to keep accurate records for tax purposes. Understanding these regulations helps you stay compliant while enjoying the benefits of bartering.

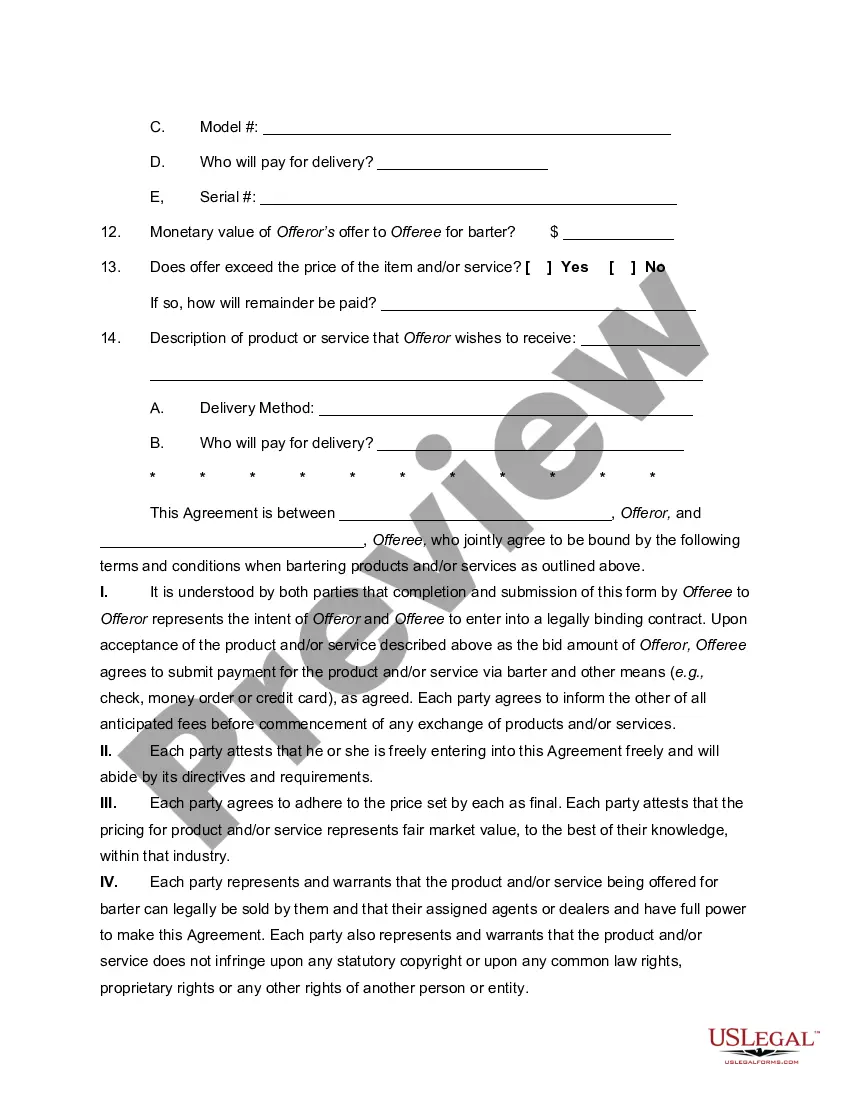

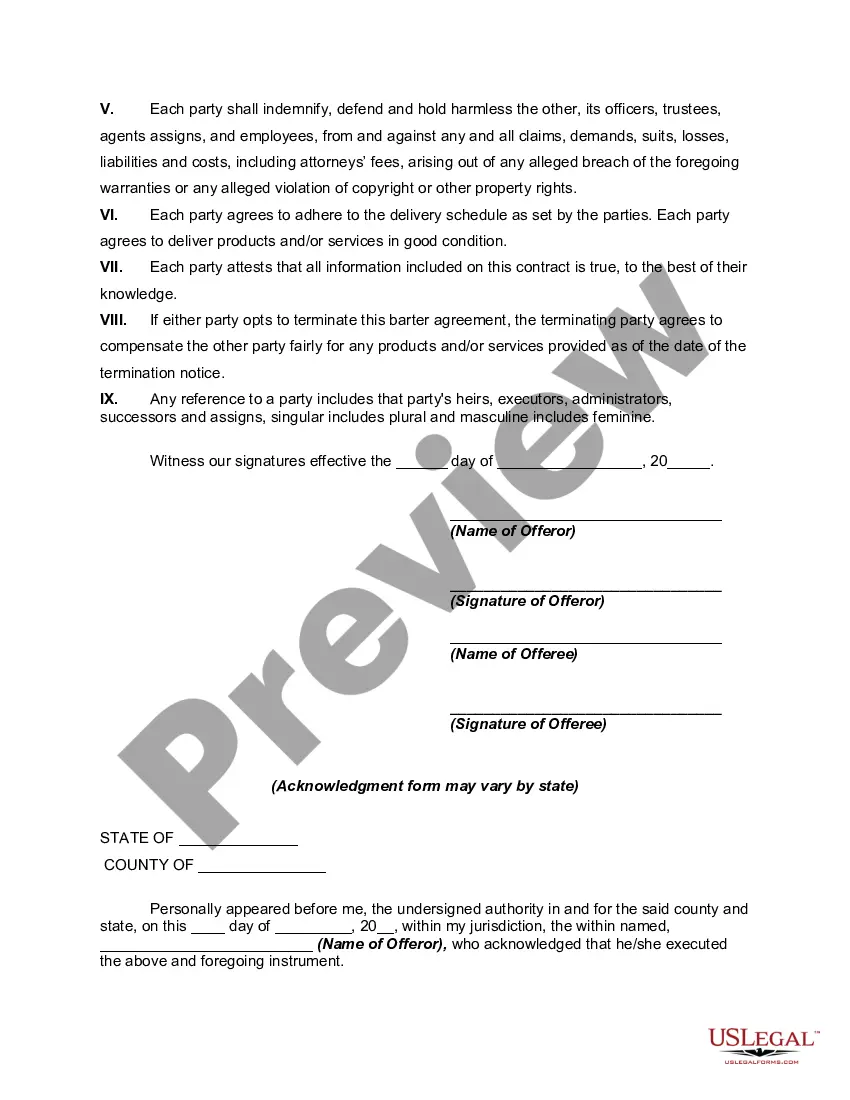

A contract of barter serves as a formal document that details the specific terms of a trade between parties. It includes information about the items being exchanged, their values, and any conditions surrounding the transaction. Utilizing a Mississippi Bartering Contract or Exchange Agreement ensures that each party understands their commitments, reducing misunderstandings.

Rules for bartering vary by jurisdiction but generally involve ensuring that both parties receive equal value. Each party should maintain clear communication regarding the expectations outlined in the Mississippi Bartering Contract or Exchange Agreement. It's important to formalize the agreement to avoid disputes and ensure transparency.

Writing a barter agreement begins with clearly identifying the parties involved and the items being exchanged. Be specific about the terms, conditions, and value of the exchanged goods or services in your Mississippi Bartering Contract or Exchange Agreement. Using a template can help streamline the process and ensure all legal aspects are covered.

The IRS requires you to report bartering as income on your tax return. You must include the fair market value of the goods or services received in your Mississippi Bartering Contract or Exchange Agreement. This reporting ensures you meet your tax obligations while benefiting from the barter arrangement. Consider seeking advice from tax professionals for clarity.

Bartering is not illegal in the US. Individuals and businesses can engage in bartering, as long as they comply with applicable laws and regulations. In the context of a Mississippi Bartering Contract or Exchange Agreement, it's essential to ensure that all parties involved understand their rights and obligations. Always consult legal professionals to ensure compliance.

Yes, bartering typically counts as income according to IRS guidelines. When you engage in trade through a Mississippi Bartering Contract or Exchange Agreement, both parties must report the fair market value of the goods or services received. This income may trigger tax liabilities, so it is vital to maintain accurate records of all bartering transactions.

Barter exchanges, while beneficial, come with certain inconveniences. For instance, finding a matching trade partner who has what you desire can be challenging. Additionally, determining the fair value of goods or services can lead to conflicts. When navigating a Mississippi Bartering Contract or Exchange Agreement, these issues can create complexities that need to be managed carefully.