An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

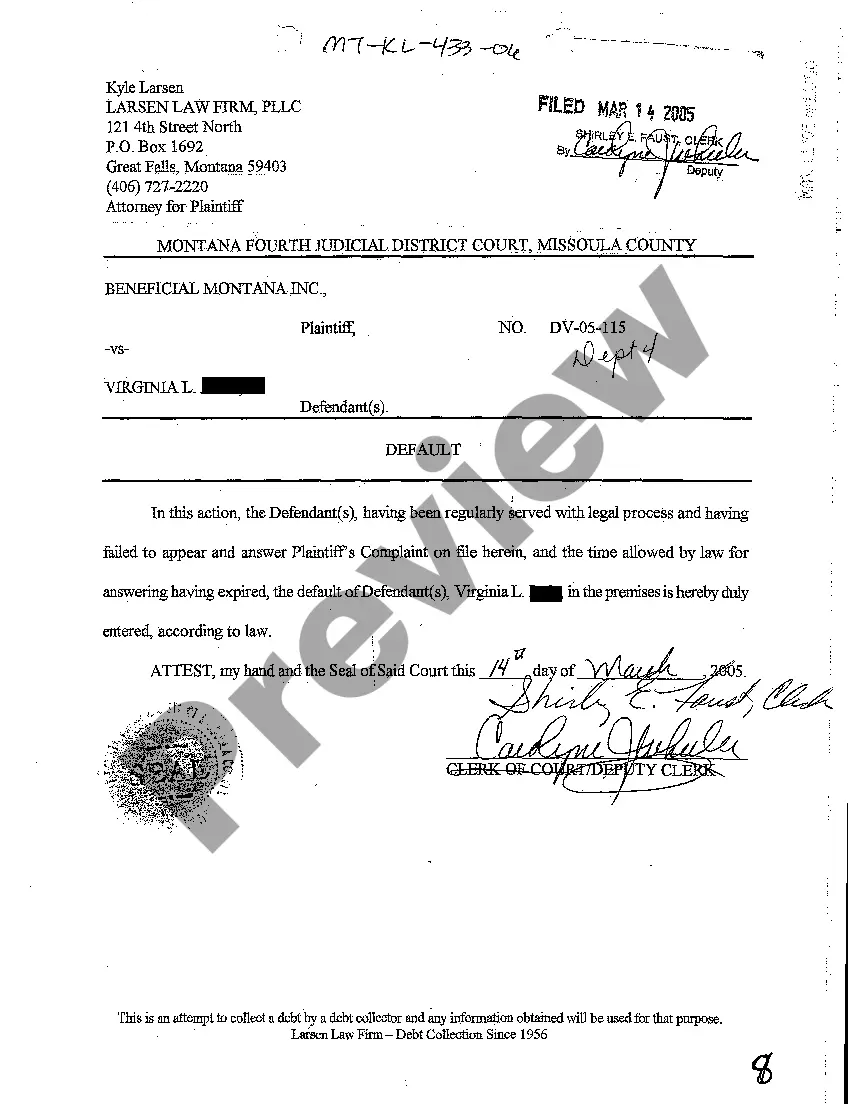

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Locating the appropriate legal document format can be challenging.

Clearly, there is a range of designs accessible online, but how can you acquire the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Mississippi Assignment by Beneficiary of an Interest in the Trust Established for the Advantage of Beneficiary, which can be utilized for both professional and personal purposes.

Initially, confirm that you have selected the correct form for your locality. You can review the document using the Review button and read the form description to ascertain it is suitable for you.

- All of the templates are reviewed by specialists and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Mississippi Assignment by Beneficiary of an Interest in the Trust Established for the Advantage of Beneficiary.

- Use your account to access the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new customer of US Legal Forms, follow these simple steps.

Form popularity

FAQ

The decanting statute in Mississippi allows a trustee to distribute assets from one trust to another, benefiting the beneficiaries while adhering to the original intent of the trust. With the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, this process becomes more straightforward and effective. Trustees can modify trust provisions, adjusting for changes in circumstances or tax laws, all while ensuring that beneficiaries remain protected. Utilizing resources like uslegalforms can provide valuable guidance in navigating these legal intricacies.

Mississippi does accept federal extensions for trusts, allowing additional time to file tax documents. It's important to ensure that the trust complies with both state and federal rules. This focus will help in navigating the nuances of the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary while ensuring timely filings.

A trust in Mississippi operates by having a trustee manage the trust's assets on behalf of the beneficiaries. The terms of the trust dictate how the assets are distributed and managed. Understanding the intricacies of the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can facilitate a smoother trust management process.

Yes, Mississippi accepts federal extensions for tax filings, including those related to trusts. However, additional state-specific requirements may apply. Make sure to review the regulations concerning the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure compliance.

Yes, a beneficiary can also serve as a trustee of the same trust in Mississippi. However, this dual role can complicate issues like conflicts of interest. It is vital to understand the responsibilities of both positions in relation to the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

A trust is a legal arrangement where one party holds property for the benefit of another. The beneficiary is the individual or entity that receives benefits from the trust. Clarifying these roles is crucial when completing the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

The PTE, or Pass-Through Entity, rate in Mississippi is 3% for the first $5,000 of income and 4% for income over that threshold. Understanding how the PTE rate applies can help beneficiaries and trustees in planning their financial strategies effectively. Always consider the implications of the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary when discussing tax liabilities.

To put a house in a trust in Mississippi, you need to create a trust document that outlines the terms and conditions of the trust. After drafting the document, you will transfer ownership of the property to the trust by executing a deed. This process is essential for the proper administration of the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

The extension deadline for trusts in Mississippi is typically the same as for individual tax returns, which falls on April 15 each year. If you need more time, you can file for an extension using IRS Form 7004. Be sure to consider the implications of the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary when managing deadlines.

Yes, a beneficiary can assign their interest in a trust, but this is often subject to the terms of the trust agreement. Assigning interest means transferring the beneficiary's rights to another individual or party. Using the Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary allows for proper legal documentation of this transfer, protecting all parties involved. It is essential to follow the legal guidelines to ensure validity.