Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation

Description

Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

How to fill out Agreement Between Physician As Self-Employed Independent Contractor And Professional Corporation?

Have you ever found yourself in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of templates, such as the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, designed to comply with both state and federal regulations.

You can download another copy of the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation at any time, if needed. Just select the desired form to download or print the template.

Use US Legal Forms, the most extensive collection of legal forms, to save time and minimize mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is appropriate for your city/state.

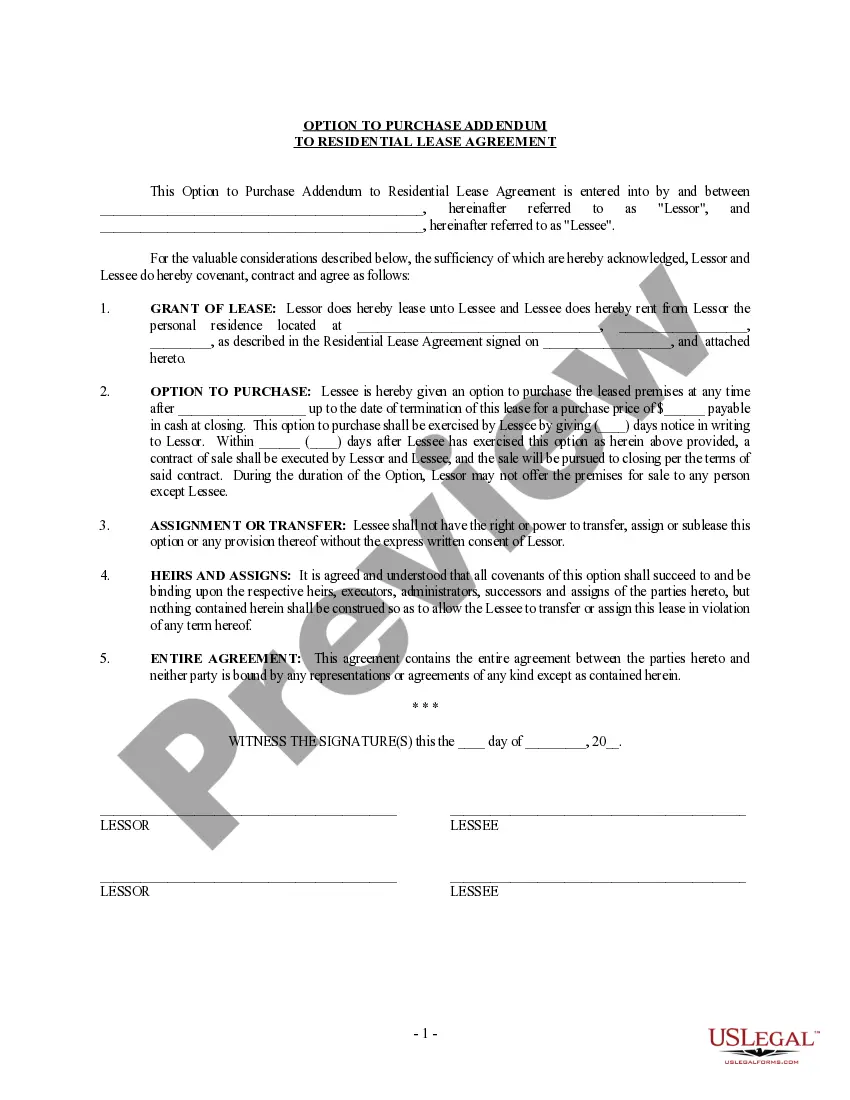

- Utilize the Review button to check the form.

- Read the description to confirm that you have selected the correct document.

- If the form does not meet your expectations, use the Search field to find the form that suits your needs.

- Once you acquire the correct form, click on Get now.

- Choose the payment plan you prefer, complete the required information to create your account, and process the payment using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

Form popularity

FAQ

The best contract for contractors clearly defines the project's scope, payment methods, and expectations. It should include clauses that protect both parties, such as confidentiality and termination rights. To ensure comprehensive coverage in your specific context, the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation can serve as a valuable starting point.

An independent contractor could be a freelance web developer or a consultant who provides specialized services to various clients. They operate under their brand and set their schedule, unlike traditional employees. The Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation serves as an excellent reference if you're considering this role in the medical field.

Writing a contract for a contractor involves specifying the project details, timeline, deliverables, and payment terms. Clearly outline the contractor's obligations and rights to avoid disputes. It is beneficial to use established templates like the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation to ensure all essential clauses are included.

A Physician Assistant (PA) can be either an employee or an independent contractor, based on their work arrangement. When working for a healthcare facility, a PA is typically an employee, but they may operate independently and establish their agreements. In such cases, utilizing the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation helps delineate their rights and responsibilities.

In the healthcare industry, most doctors are classified as employees, but many also work as independent contractors. This classification typically depends on their work agreements and level of control over their practices. Understanding the difference is essential, particularly when considering the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, which outlines the terms for those opting for independent contractor roles.

Writing an independent contractor agreement involves defining the scope of work, payment terms, and duration of the contract. You should also include clauses about confidentiality, intellectual property rights, and termination conditions. To ensure clarity and legal coverage, refer to the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation for additional guidance on necessary elements.

To write a simple contract agreement, start by clearly stating the parties involved and their roles. Detail the agreement's purpose, outlining specific terms, such as services to be provided and payment terms. It's crucial to include a section for signatures to indicate acceptance from both parties. If applicable, consider using the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation as a template.

The five essential elements of a construction contract include offer, acceptance, consideration, capacity, and legality. Each element plays a critical role in ensuring the contract is binding and enforceable. By utilizing the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation, you can ensure these elements are appropriately addressed in your contractor agreements.

The Independent Contractor Agreement (ICA) is a document that defines the working relationship between a company and an independent contractor. This agreement addresses important aspects like payment terms, deliverables, and intellectual property rights. You might find the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation useful as a specific example of an ICA tailored to your needs.

To make a contract with a contractor, clearly outline the project scope, payment details, and deadlines in a written format. Both parties should review and agree on the terms before signing to ensure mutual understanding. Consider using the Mississippi Agreement Between Physician as Self-Employed Independent Contractor and Professional Corporation for an effective template that meets legal requirements.