US Legal Forms - one of several greatest libraries of legitimate forms in the States - gives a wide array of legitimate papers layouts it is possible to down load or printing. Utilizing the internet site, you may get 1000s of forms for business and personal reasons, categorized by types, states, or keywords and phrases.You will find the most recent models of forms such as the Mississippi Plan of Liquidation and Dissolution of a Corporation within minutes.

If you have a membership, log in and down load Mississippi Plan of Liquidation and Dissolution of a Corporation from your US Legal Forms collection. The Acquire switch can look on each kind you see. You have access to all earlier delivered electronically forms in the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, allow me to share basic directions to obtain started out:

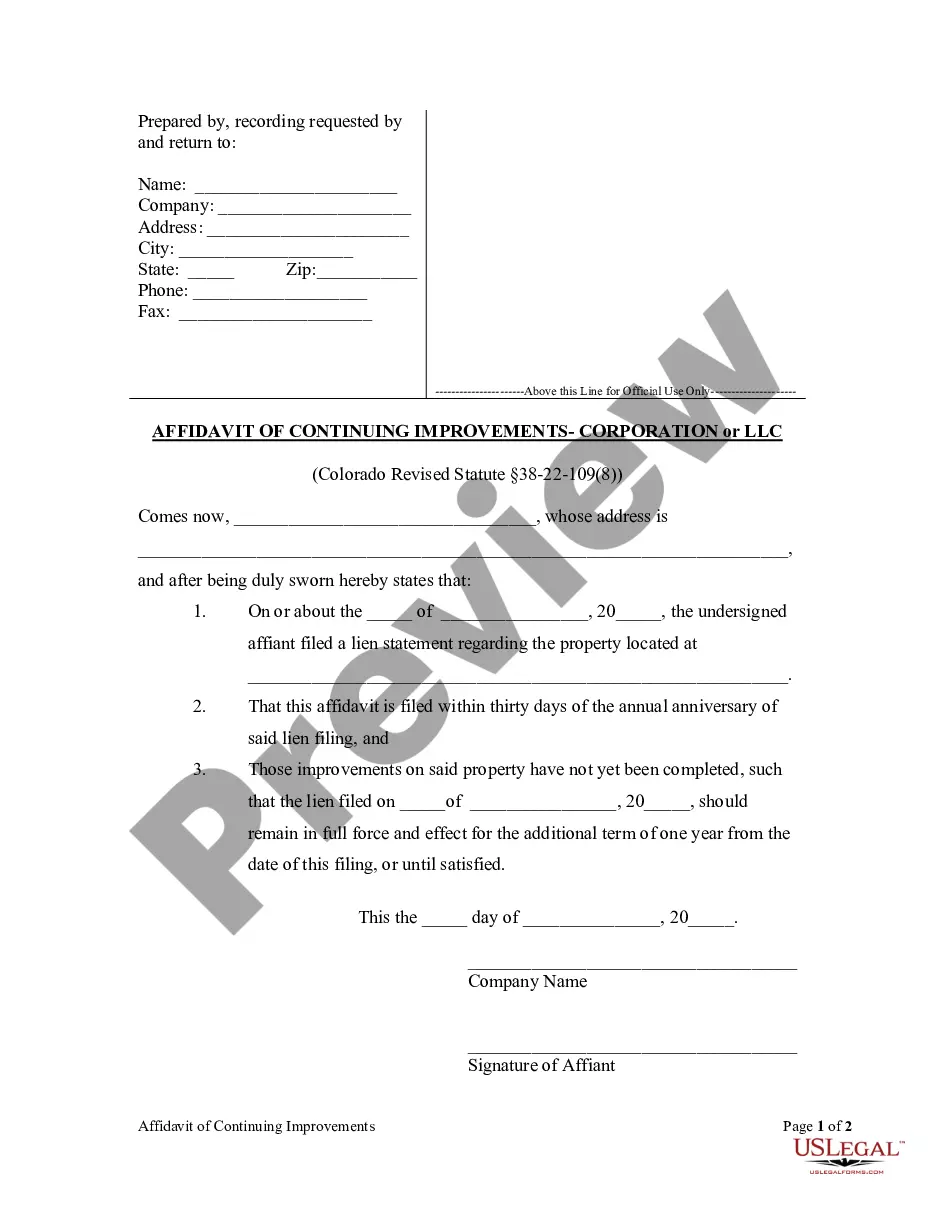

- Make sure you have picked out the best kind for the metropolis/state. Click the Preview switch to examine the form`s content material. See the kind description to actually have chosen the appropriate kind.

- In the event the kind doesn`t match your requirements, utilize the Lookup area towards the top of the screen to obtain the one that does.

- In case you are satisfied with the shape, verify your option by clicking the Acquire now switch. Then, pick the pricing program you favor and offer your qualifications to register to have an bank account.

- Approach the purchase. Make use of your credit card or PayPal bank account to accomplish the purchase.

- Find the format and down load the shape on the device.

- Make adjustments. Complete, change and printing and sign the delivered electronically Mississippi Plan of Liquidation and Dissolution of a Corporation.

Each format you included in your bank account does not have an expiration time and is the one you have forever. So, if you want to down load or printing an additional version, just proceed to the My Forms section and then click in the kind you will need.

Gain access to the Mississippi Plan of Liquidation and Dissolution of a Corporation with US Legal Forms, by far the most substantial collection of legitimate papers layouts. Use 1000s of expert and state-particular layouts that meet up with your business or personal needs and requirements.