Mississippi Charitable Remainder Inter Vivos Unitrust Agreement

Description

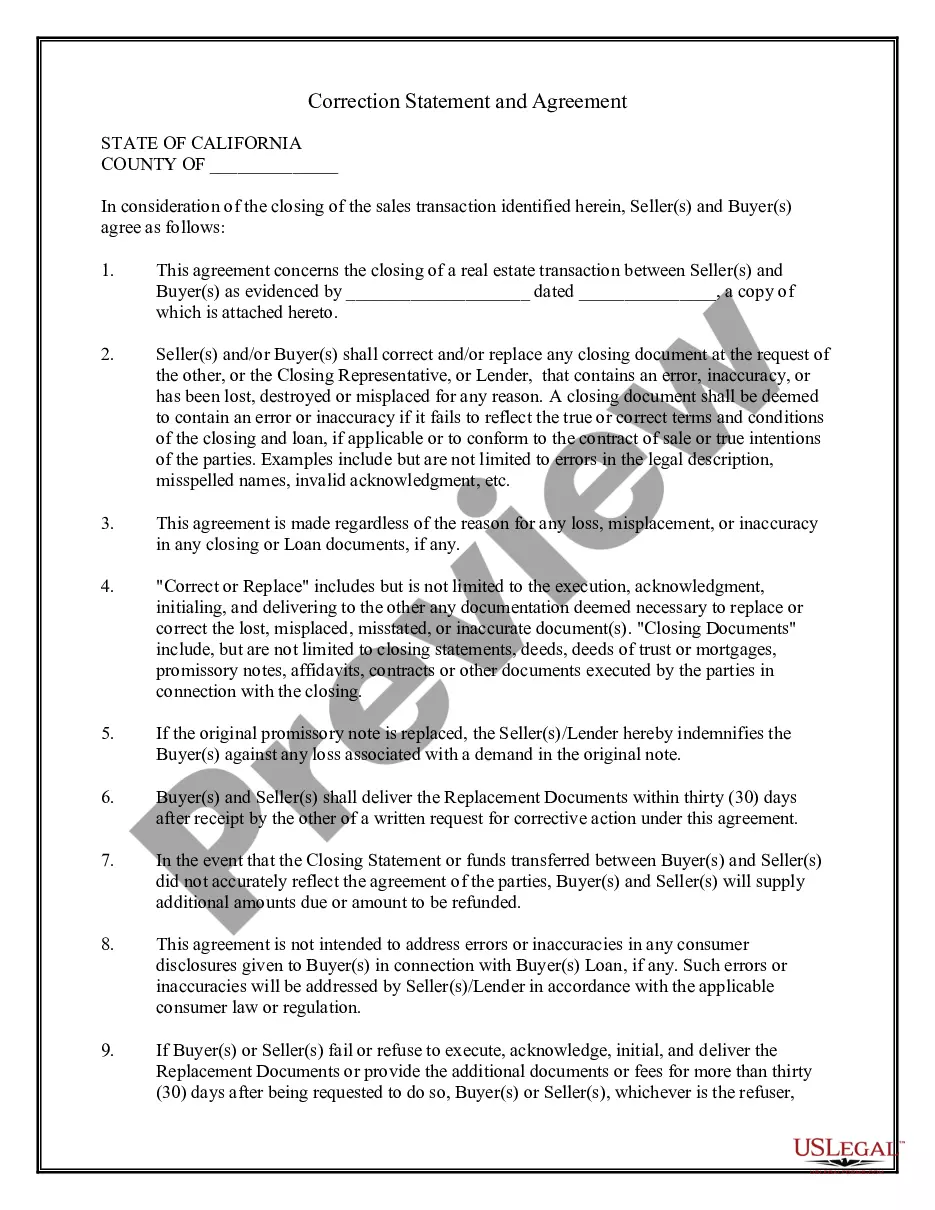

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

If you need extensive, acquire, or reproduce legal document templates, utilize US Legal Forms, the largest assortment of legal forms, accessible online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have located the form you need, select the Purchase now button. Choose the pricing plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use a credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement.

- You can also find forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct state or country.

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

The difference between a charitable remainder trust (CRT) and a charitable lead trust (CLT) lies in the flow of income. A CRT provides income to the donor or beneficiaries first, and then the remaining assets go to the charity. In contrast, a CLT pays income to the charity for a set term before the remaining assets pass to the beneficiaries. This distinction is important when considering options like the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement for achieving your philanthropic and financial objectives.

An inter vivos charitable remainder trust is created during your lifetime, allowing you to donate assets to charity while still receiving income. With the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, you can enjoy tax benefits and give to causes you care about without waiting until death. This arrangement enables you to witness the impact of your contribution while still maintaining financial security. It's a thoughtful way to balance generosity and practicality.

Generally, the maximum duration for a charitable remainder unitrust is 20 years, or until the income beneficiary passes away, whichever occurs first. This is relevant when considering the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement as an option for your charitable giving. The timing can significantly affect your financial strategy, so careful planning is critical. Make sure to consider your long-term financial outlook when establishing this agreement.

The main difference lies in how the income is calculated. A charitable remainder trust offers a fixed dollar amount to the donor, while a charitable remainder unitrust, including the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, calculates payments based on a percentage of the trust's value, which can fluctuate. This means you could potentially receive varying income over the years in a unitrust setup. Choosing the right structure is essential for your financial and charitable goals.

The charitable remainder unitrust deduction allows you to receive a tax benefit when you donate to a charity while retaining income from the asset for a certain period. This deduction applies to the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, which helps you structure your charitable giving efficiently. By using this type of trust, you can contribute to your favorite charities while enjoying financial benefits. Consult with a tax advisor to explore how this can work for you.

Yes, Mississippi generally accepts federal extensions for trust income tax filing requirements. If you have created a trust, including a Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, understanding your tax obligations is vital. Consulting with a tax professional can help you navigate these requirements and ensure timely compliance with both state and federal regulations.

A Charitable Remainder Unitrust (CRUT) typically takes the form of a legal document that outlines the terms of the trust, including the distribution percentages and beneficiary details. For the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, this document must comply with both state and federal regulations. Working with a legal expert can ensure that your CRUT file is properly structured and filed.

Establishing a charitable remainder trust begins with deciding whose needs are to be met and identifying the charitable beneficiaries involved. You will draft the necessary legal documents and fund the trust by transferring assets into it. Utilizing platforms like uslegalforms can simplify this process by providing templates and guidance specific to the Mississippi Charitable Remainder Inter Vivos Unitrust Agreement, ensuring compliance and clarity in your setup.

Advised Fund (DAF) allows donors to recommend grants to charities over time, while a Charitable Remainder Trust (CRT) provides a fixed income to beneficiaries before the remainder goes to charity. The Mississippi Charitable Remainder Inter Vivos Unitrust Agreement allows for a steady income stream during the trust's term, making it a unique tool for philanthropy and financial planning. Understanding these differences can help you choose the right option based on your financial goals.

To set up a charitable remainder trust, you typically begin by drafting the trust document, outlining the key terms. You will need to identify the charitable organization you wish to benefit, as well as the beneficiaries who will receive income from the trust. It is often advisable to consult with a legal or financial professional experienced in Mississippi Charitable Remainder Inter Vivos Unitrust Agreements to ensure compliance with state laws and regulations.