Mississippi Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

If you need to finalize, download, or print legal document templates, utilize US Legal Forms, the largest repository of legal documents, available online.

Utilize the site's user-friendly and accessible search feature to locate the forms you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the Mississippi Direct Deposit Form for IRS in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click the My documents section and select a form to print or download again.

Complete, download, and print the Mississippi Direct Deposit Form for IRS with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Mississippi Direct Deposit Form for IRS.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

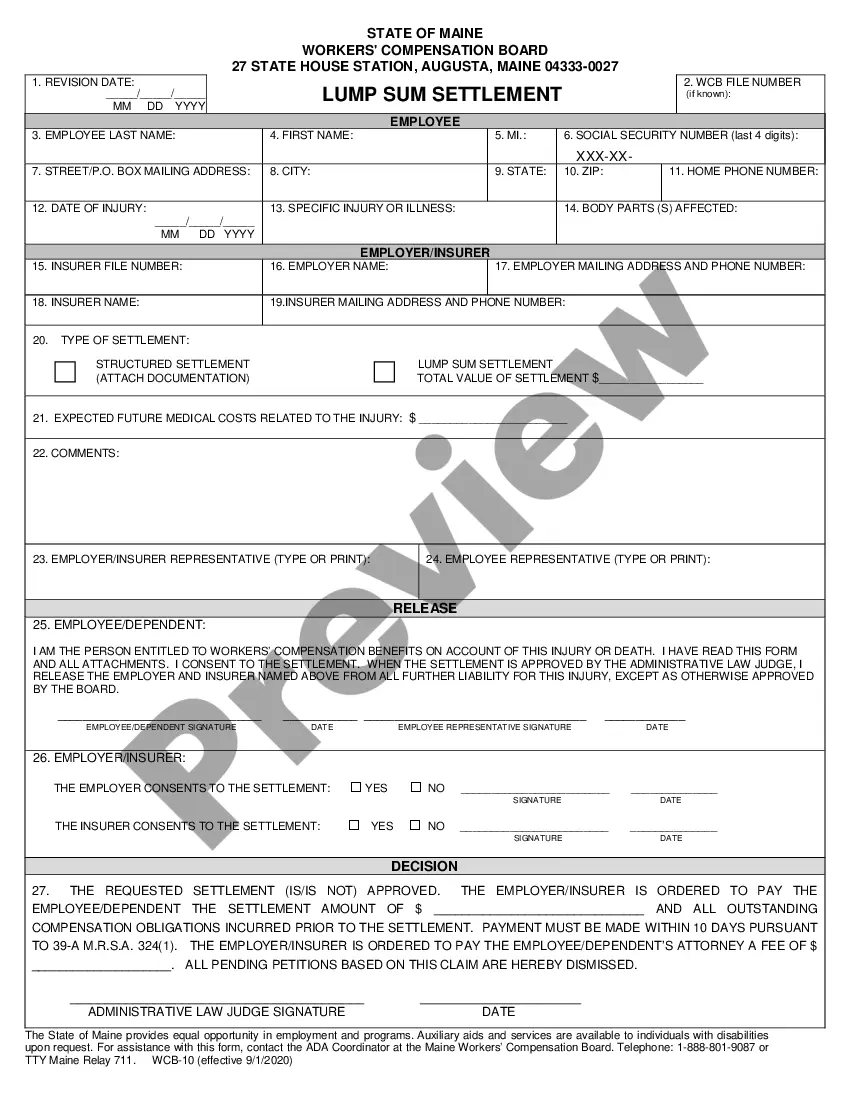

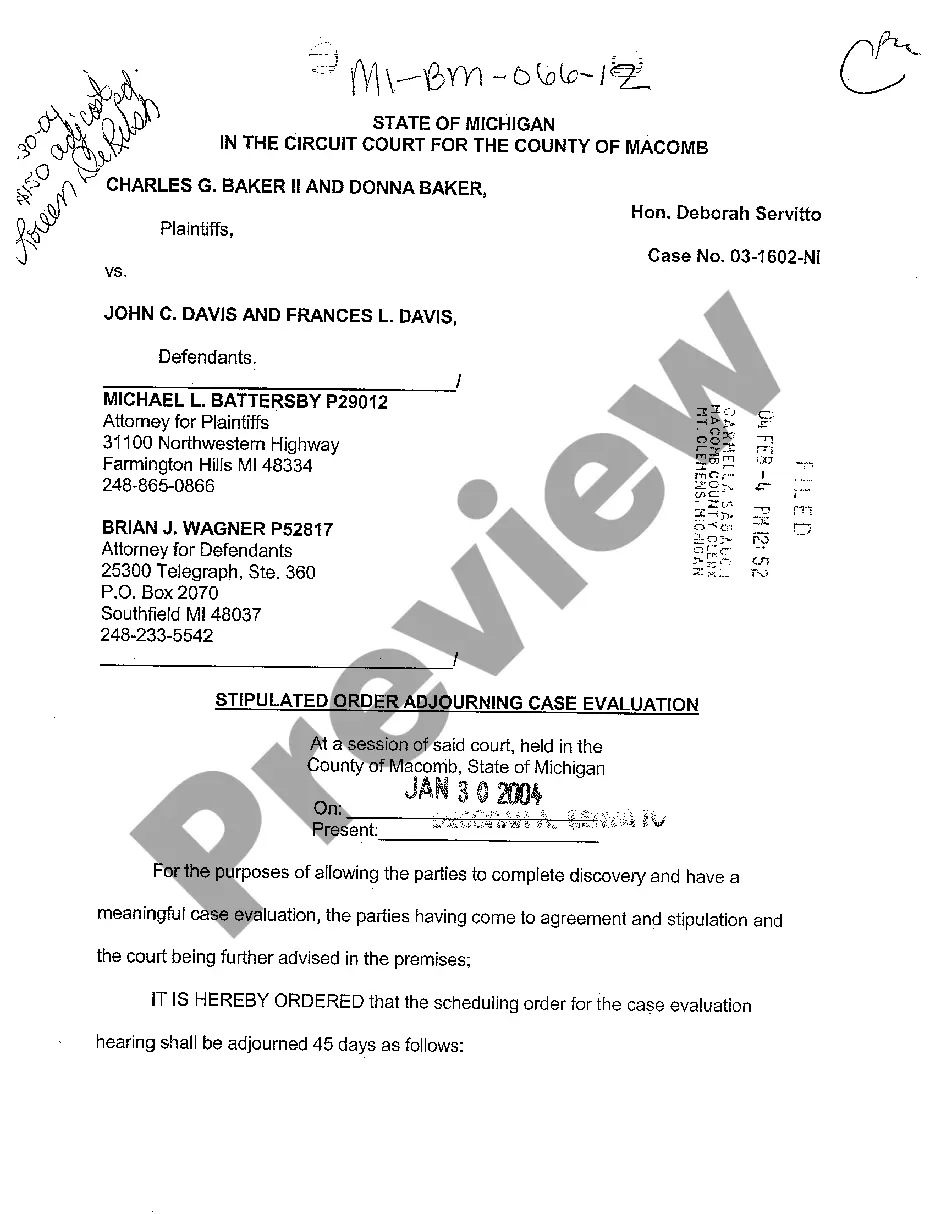

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Mississippi Direct Deposit Form for IRS.

Form popularity

FAQ

Not everyone will receive $3,000 from the IRS. This amount pertains to specific relief measures or credits, which may vary based on individual circumstances, such as income level and family size. To determine your eligibility, review the IRS guidelines and consider using the Mississippi Direct Deposit Form for IRS to ensure you receive any applicable refunds directly to your bank account. Stay informed, as this information can change over time.

To properly fill out a Mississippi Direct Deposit Form for IRS, start by entering your personal information, including your name and Social Security Number. Next, provide your bank account details, which include your bank's routing number and your account number. Make sure to double-check all entries for accuracy, as errors may delay your refund. Finally, sign and date the form to complete the submission process.

IRS Form 982 is used to discharge indebtedness income and to apply for a reduction of tax attributes due to that discharge. This form is particularly useful if you have experienced cancellation of debt. It helps you report the necessary information accurately to the IRS. Remember to consult the Mississippi Direct Deposit Form for IRS if you're expecting a refund related to this situation.

Yes, Mississippi has specific state income tax forms that residents must complete when filing their taxes. These forms include necessary information about your income and deductions. To ensure you are using the correct form, refer to the Mississippi Direct Deposit Form for IRS for any direct deposit needs related to your tax refund.

You should use IRS Form 8888 when you want to allocate your tax refund to multiple accounts. This form allows you to split your refund into different bank accounts, making it easy to manage your funds. Using the Mississippi Direct Deposit Form for IRS in conjunction with Form 8888 can streamline your refund process.

Yes, you can print out a direct deposit form. Many platforms, like USLegalForms, offer downloadable versions of the Mississippi Direct Deposit Form for IRS. Printing the form allows you to fill it out manually or electronically. Ensure all your banking details are accurate to avoid delays in receiving your payments.

Yes, Mississippi provides various state tax forms for residents. These forms cater to different tax situations, including income, property, and sales taxes. You can easily access these forms online, including the Mississippi Direct Deposit Form for IRS, to facilitate your filing process.

If you earn income in Mississippi, you typically must file a state tax return. There are specific thresholds based on your income and filing status. Filing on time helps you avoid interest and penalties. Consider using the Mississippi Direct Deposit Form for IRS to ensure your refund is processed quickly.

Yes, Mississippi does have a state income tax. The tax system includes rates that vary depending on your income level. Filing your state taxes accurately is essential to avoid penalties. You can find the necessary forms, including the Mississippi Direct Deposit Form for IRS, on platforms like USLegalForms.

If you need to update your direct deposit information with the IRS, you can do so by submitting a new Mississippi Direct Deposit Form for IRS. Ensure you provide your updated banking details on the form. This update is essential, especially if you’ve changed accounts or financial institutions. Using reliable resources like US Legal Forms can assist you in correctly completing and submitting your updated information.