Mississippi Assignment to Living Trust

What this document covers

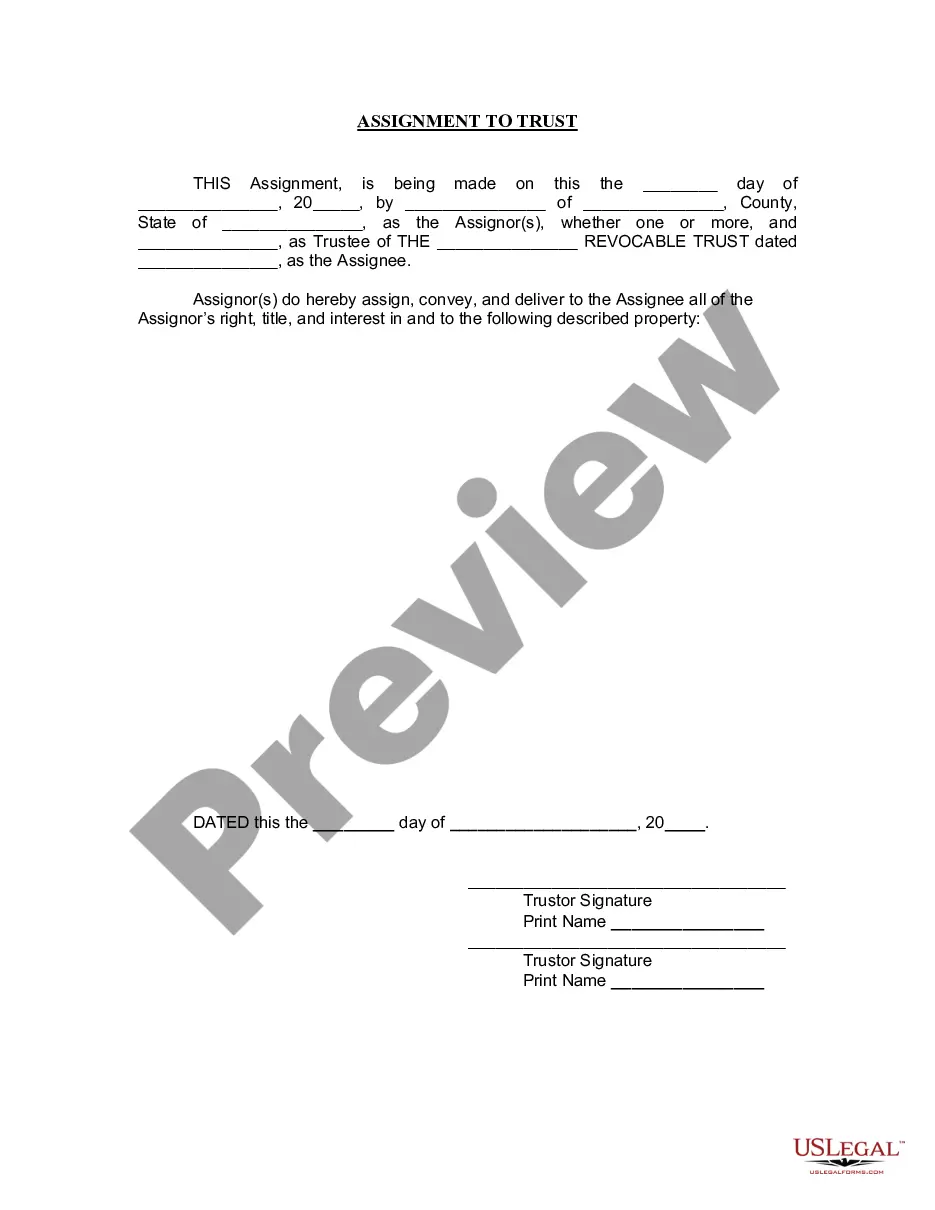

The Assignment to Living Trust form is used to transfer ownership of specific property rights, titles, and interests into a Living Trust. Unlike a standard property transfer, this form specifically aids in estate planning by ensuring that assets are managed according to the terms of a trust established during the individual's lifetime. This process helps avoid probate and can provide tax benefits.

Key components of this form

- Assignor Information: This section captures the names and addresses of the individual(s) transferring the property.

- Trustee Information: Identifies the trustee of the Living Trust who will manage the assigned property.

- Property Description: Clearly states the specific property being assigned to the trust.

- Signature Requirements: Includes required signatures and dates indicating the parties' agreement.

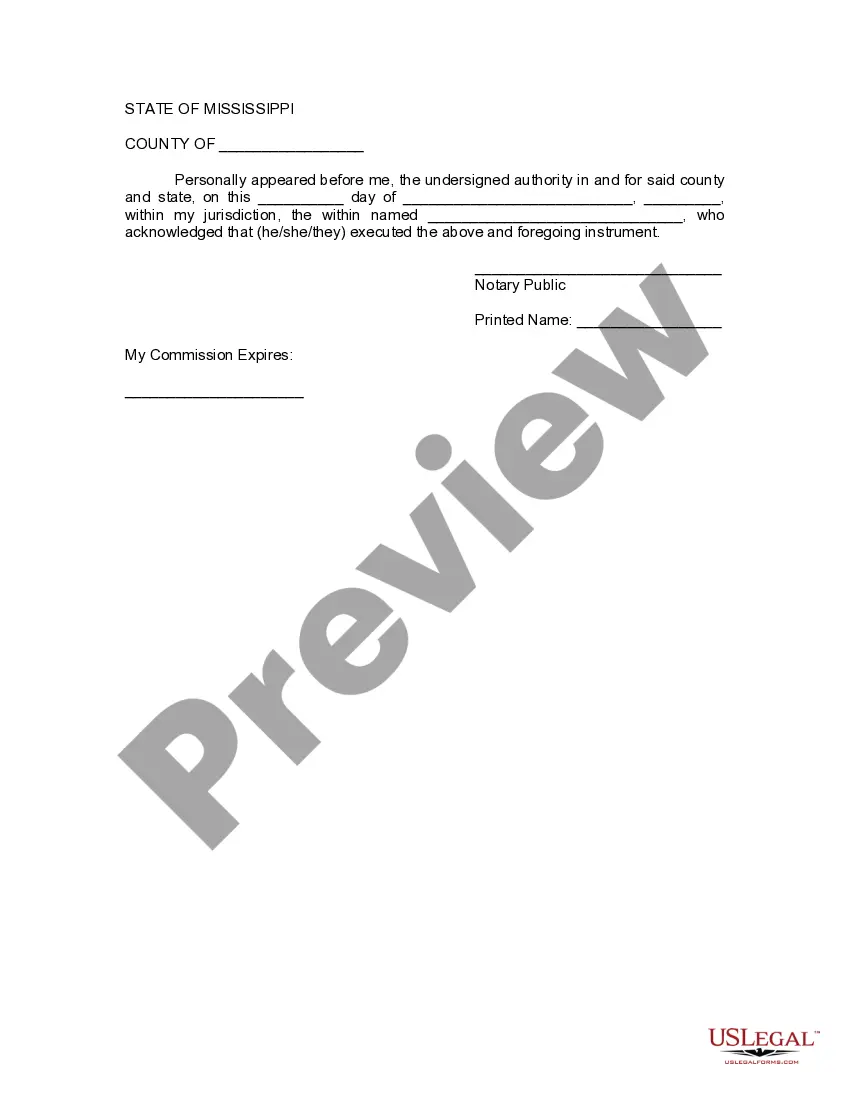

- Notary Public Certification: Ensures the document is notarized to verify authenticity.

Situations where this form applies

This form should be utilized when individuals decide to place certain assets into a Living Trust as part of their estate planning strategy. This might occur when someone wants to manage how their assets will be distributed after their passing, minimize probate costs, or simplify the estate management process for their beneficiaries.

Who this form is for

- Individuals creating a Living Trust to manage their estate.

- Property owners looking to streamline their estate planning.

- Those seeking to avoid probate complications for their heirs.

- People wanting to ensure specific instructions are followed regarding asset distribution.

How to prepare this document

- Identify the Assignor(s) and provide their full name and address.

- Designate the Trustee by including their name and identify the specific Living Trust.

- Clearly describe the property that is being transferred into the trust.

- Secure signatures from the Assignor(s) and date the document.

- Have the form notarized to confirm its legal validity.

Notarization requirements for this form

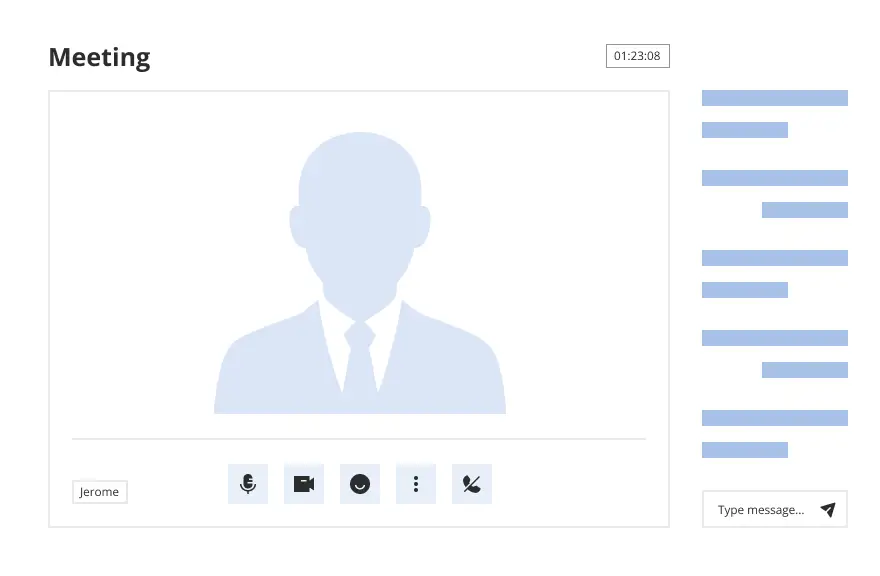

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

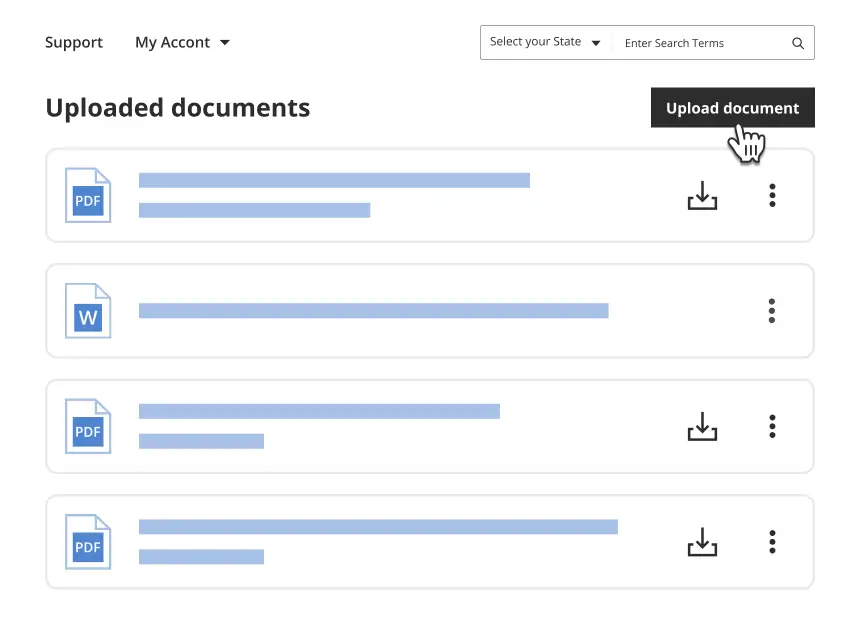

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide a clear description of the property being assigned.

- Not signing the document in front of a notary public.

- Leaving out important details about the trust or trustee.

- Not dating the form correctly.

Benefits of using this form online

- Convenient access to legal templates 24/7.

- Editable forms you can customize to fit your specific needs.

- Reliability of documents drafted by licensed attorneys.

- Quick downloads to expedite your estate planning process.

Main things to remember

- The Assignment to Living Trust form is vital for transferring property into a trust.

- Proper completion, including notarization, is essential for legal validity.

- This form aids in effective estate planning and can help avoid probate.

Looking for another form?

Form popularity

FAQ

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

You don't need a lawyer to complete most of your tasks during the first few months of a trust administration.If you'll be distributing all the trust property to beneficiaries quickly, you'll probably get most of your work done in about six months.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

Locate the original trust. The grantor must locate the original trust documents and identify the specific provisions that require amendment. Prepare an amendment form. Get the amendment form notarized. Attach amendment form to original trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.