Mississippi Qualified Domestic Relations Order

What this document covers

A Qualified Domestic Relations Order (QDRO) is a legal document that allows a court to divide retirement plan benefits between spouses following a divorce. Unlike other divorce forms, the QDRO specifically addresses the division of retirement assets, ensuring that both parties receive their fair share of the benefits accrued during the marriage. This form is crucial in protecting the financial interests of the receiving spouse while adhering to federal and state laws governing retirement plans.

Key parts of this document

- Findings of Facts: Establishes jurisdiction and outlines residency requirements of the parties involved.

- Pension Benefit Division: Specifies the portion of the defendant's retirement benefits to be assigned to the plaintiff.

- Payment Options: Details how and when the plaintiff can access their portion of the retirement benefits.

- Jurisdiction Retention: Allows the court to make amendments to the order to ensure compliance with legal standards.

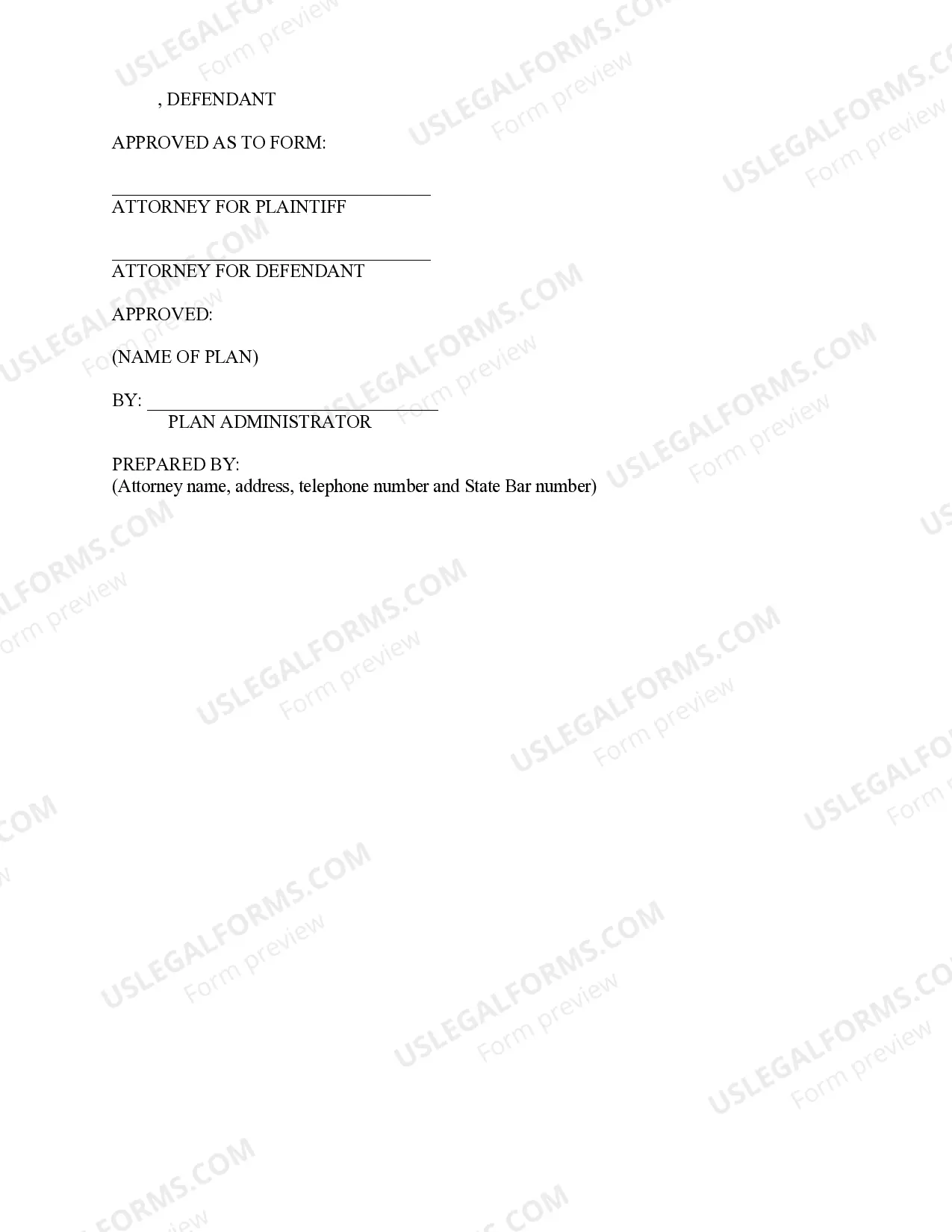

- Plan Administrator Information: Includes details of the plan administrator who will oversee the implementation of the QDRO.

When to use this document

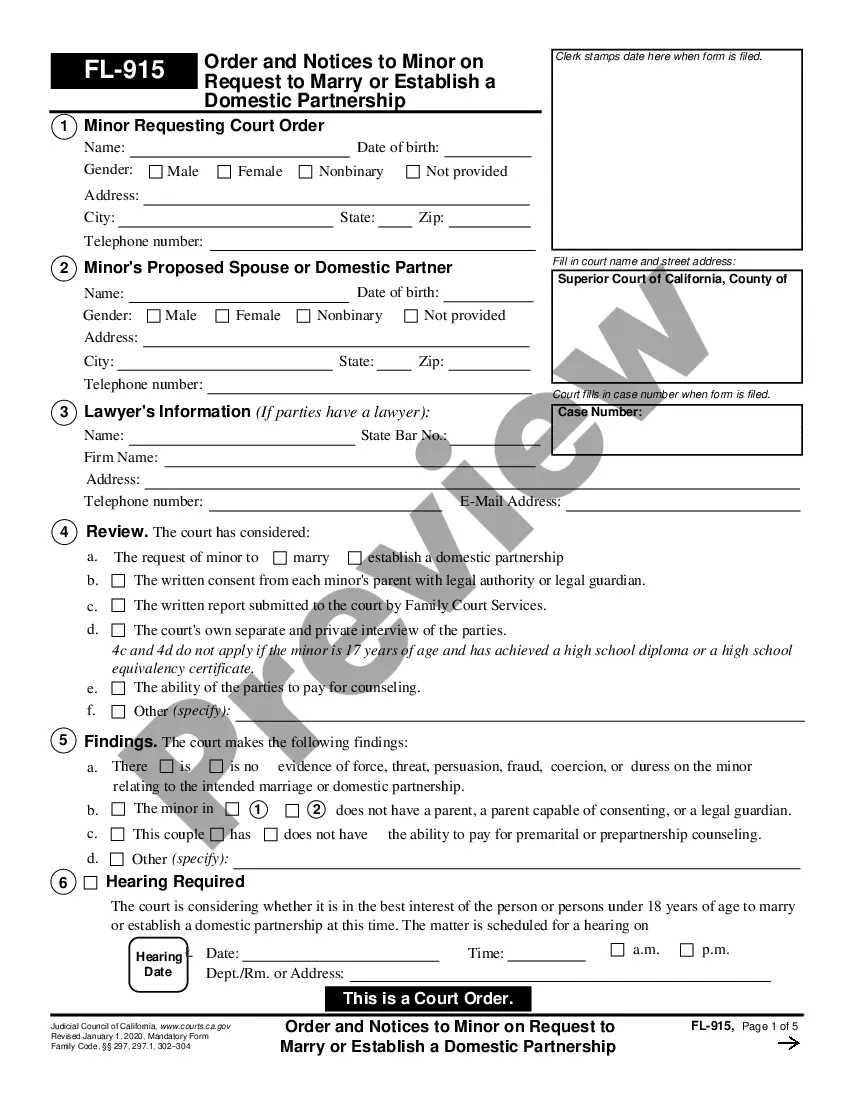

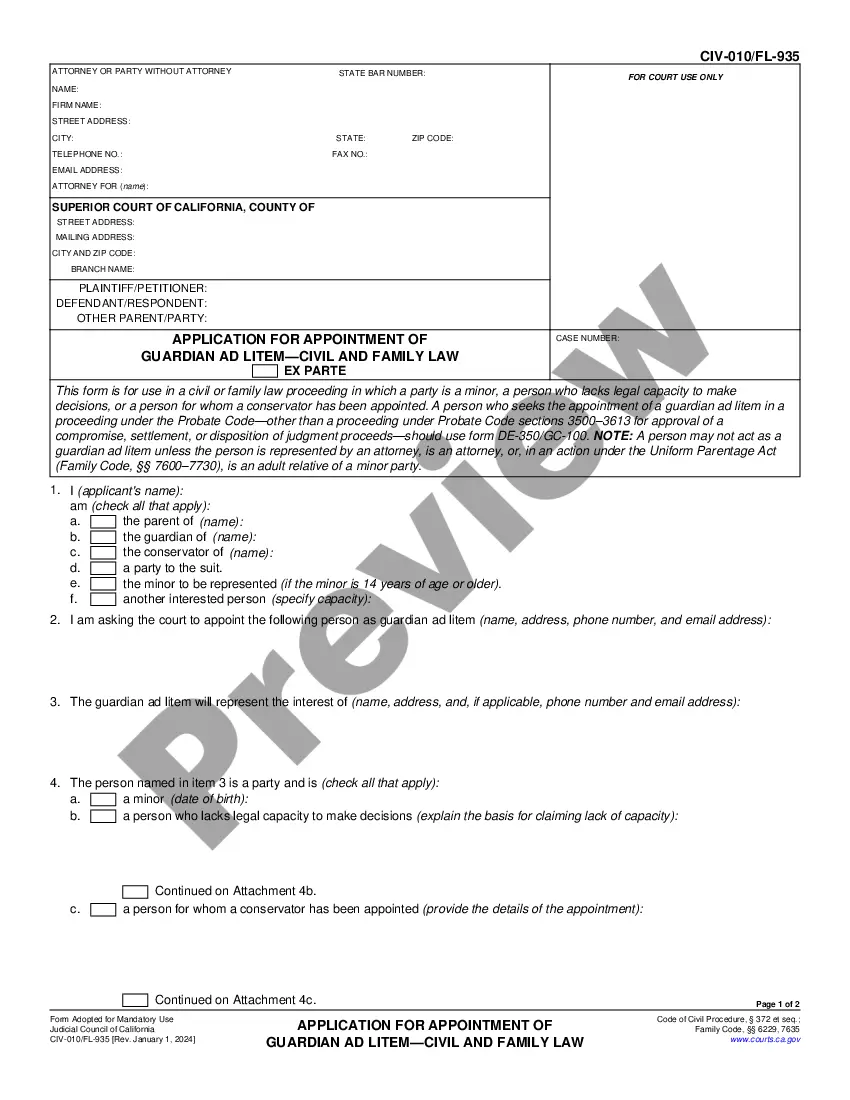

You should use the Qualified Domestic Relations Order when you are going through a divorce and need to divide retirement benefits between you and your spouse. This form is necessary when one party has a defined pension or retirement plan that must be apportioned as part of the marital assets. It is essential to utilize a QDRO to ensure a legal and equitable distribution of those retirement benefits as agreed upon in the divorce settlement.

Who can use this document

- Individuals who are filing for divorce and need to address retirement benefit division.

- Parties that have reached an agreement on how to divide retirement benefits as part of their divorce settlement.

- Spouses of participants in a retirement plan who wish to claim their share of the vested benefits.

- Divorce attorneys seeking to formalize the division of retirement assets for their clients.

Completing this form step by step

- Identify the parties: Include the names of the plaintiff and defendant along with their contact details.

- Specify residency: Provide details confirming that both parties have been residents of Mississippi for the required period.

- Outline the pension division: Clearly describe the portion of the retirement benefit to be awarded to the plaintiff.

- Include payment options: Specify how and when the plaintiff can access their share of the retirement funds.

- Sign and date: Ensure that both parties and their legal representatives sign and date the order to validate it.

Does this form need to be notarized?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Avoid these common issues

- Failing to specify the exact percentage of pension benefits to be divided.

- Not including pertinent information about the retirement plan administrator.

- Overlooking the requirements of ERISA or state law concerning QDROs.

- Neglecting to obtain signatures from all parties involved.

Benefits of using this form online

- Immediate access: Download the form instantly for your convenience.

- Editability: Customize the form with your specific information before printing.

- Reliability: The form is drafted to comply with current legal standards and requirements.

- Guidance: Online platforms often provide helpful tips and resources for completing the form correctly.

Form popularity

FAQ

Distributions made pursuant to QDROs are generally taxed in the same manner as any other typical plan distribution. One key difference is that a cash-out distribution from a QDRO is not subject to the 10% early withdrawal penalty.

If you don't have a lawyer, you can also use the model template given to you by the plan administrator to create a QDRO that you can submit to the court for approval and signature.

The answer to this question depends on what type of retirement plan is being divided. If it is a defined contribution plan (a 401(k), 457, 403(b) or similar plan), or an IRA, the funds are typically transferred into an account in the alternate payee's name within two to five weeks.

Despite common belief, you do not need to hire an attorney to file a QDRO after divorce in California.

A QDRO will instruct the plan administrator on how to pay the non-employee spouse's share of the plan benefits. A QDRO allows the funds in a retirement account to be separated and withdrawn without penalty and deposited into the non-employee spouse's retirement account (typically an IRA).

Generally, a court must order the implementation of a QDRO. Check with the clerk of the court to see if the QDRO was entered into the file.

QDRO Completion: Once a Judge signs a QDRO it is an order of the court and can be sent to the plan administrator. Quickly after the court has filed the QDRO, we package and send it to you to forward to the administrator so they can start dividing your benefits.

Step 1 Gathering Information. Step 2 Drafting your QDRO. Step 3 Approval By the Other Party. Step 4 Approval by Plan as Draft. Step 5 Signature of QDRO by Judge of the State Divorce Court. Step 6 Obtain a Certified Copy of the QDRO. Step 7 Final Acceptance by the Plan.