Mississippi Complaint to Probate Will and Appoint Executor

About this form

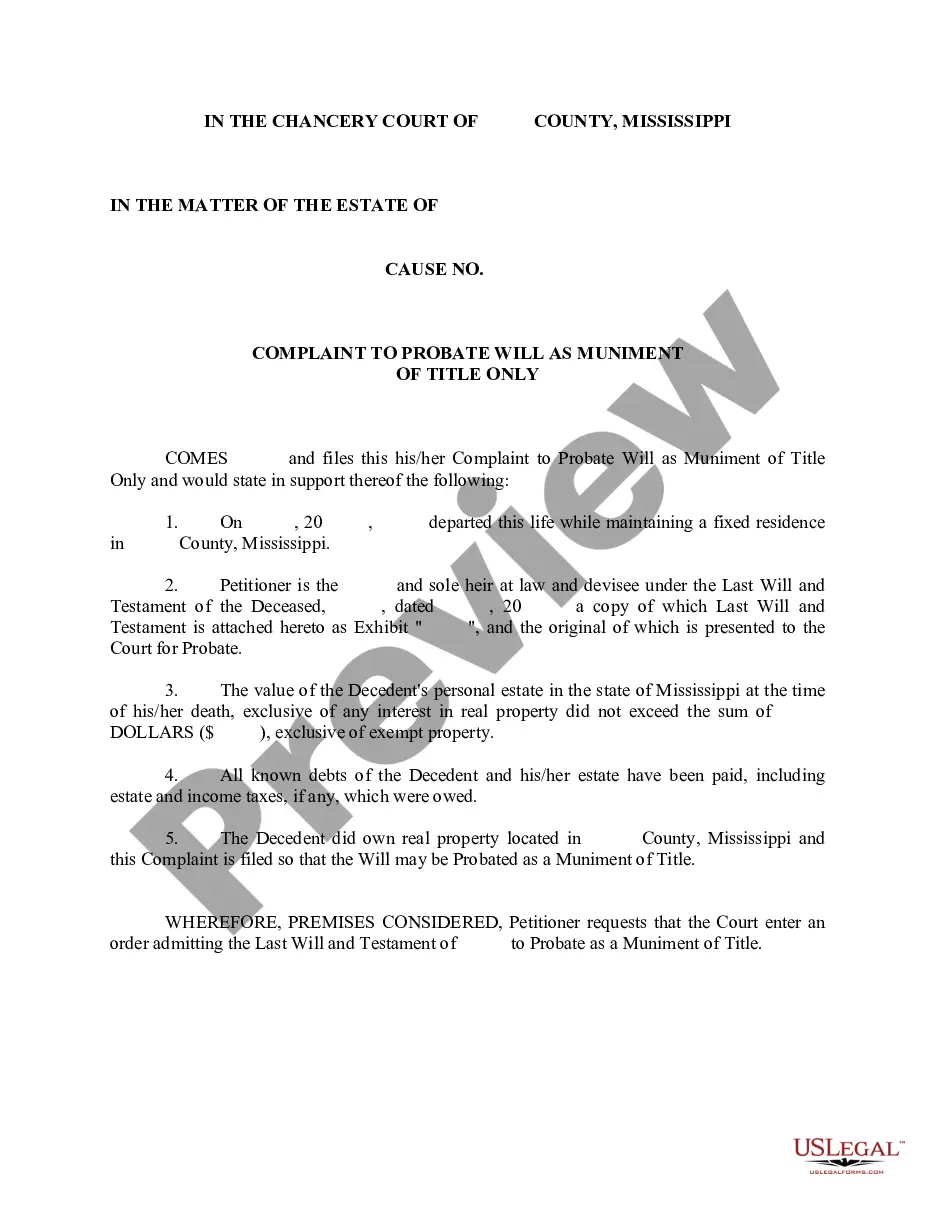

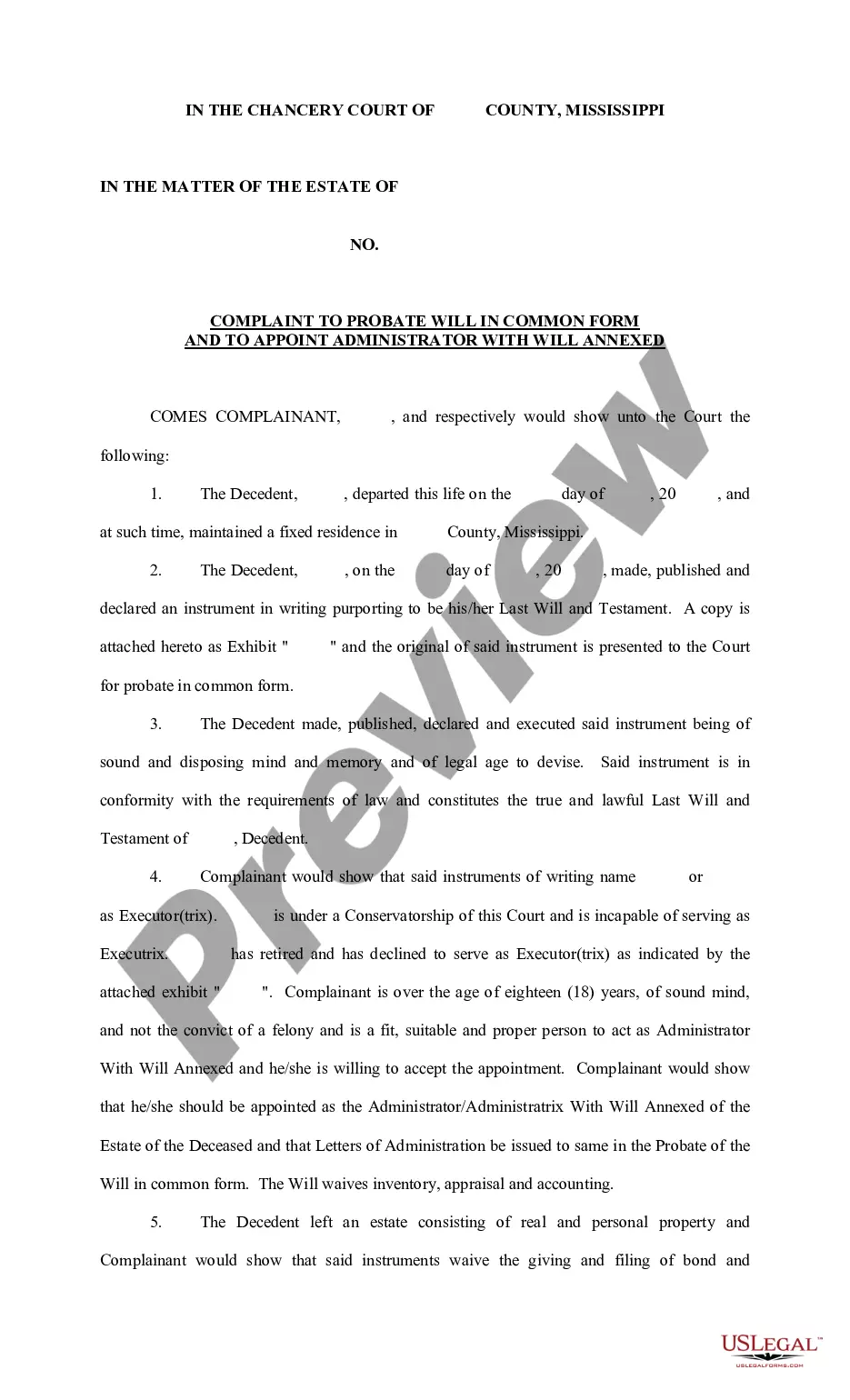

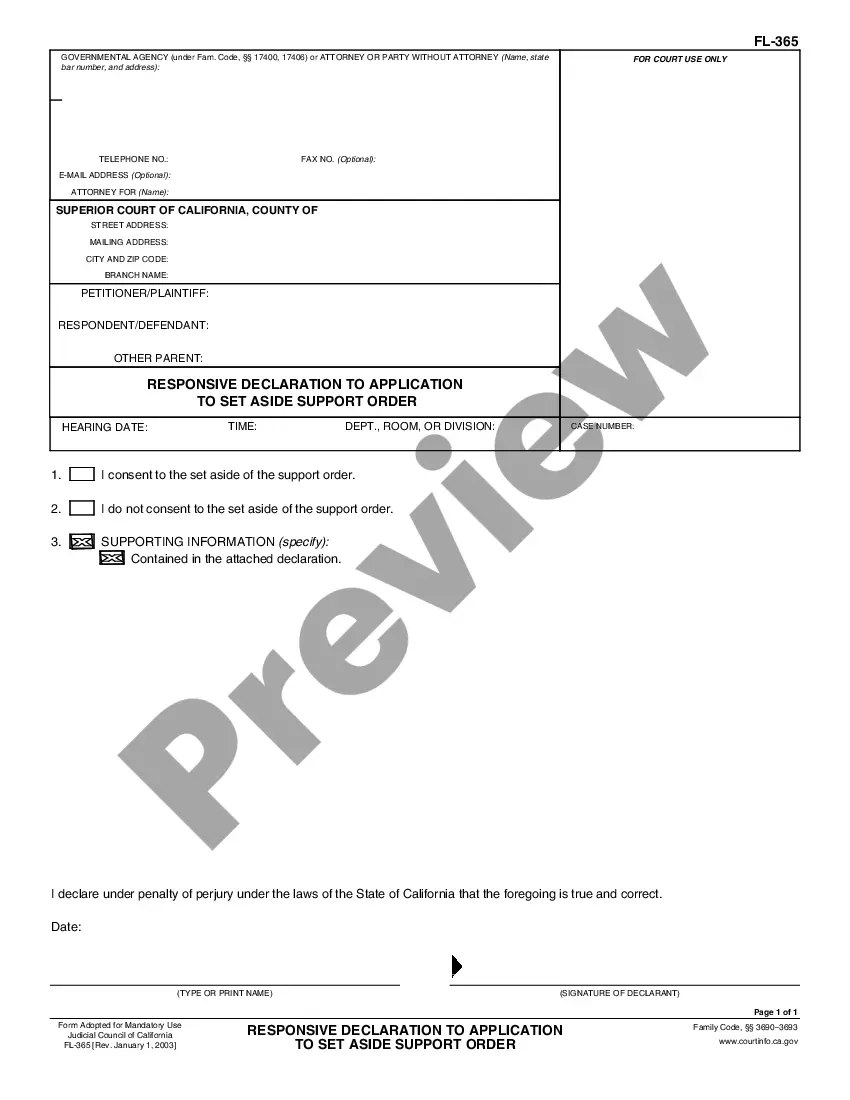

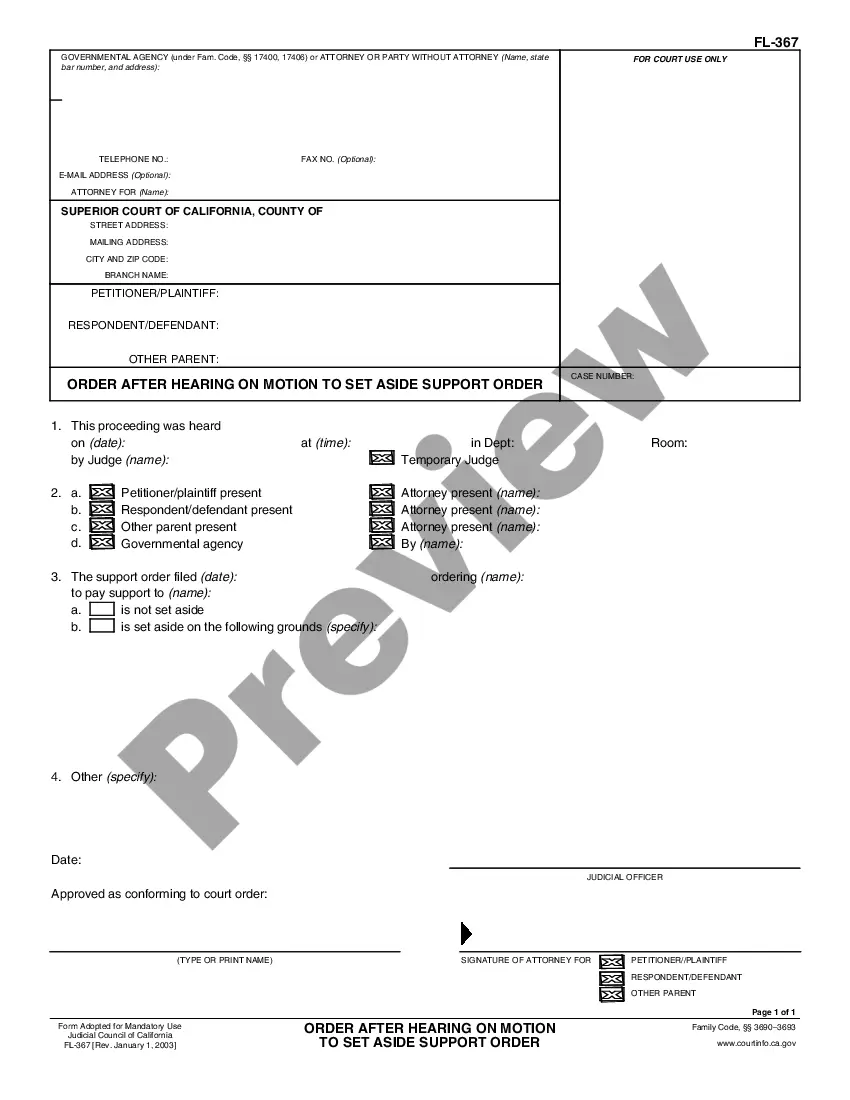

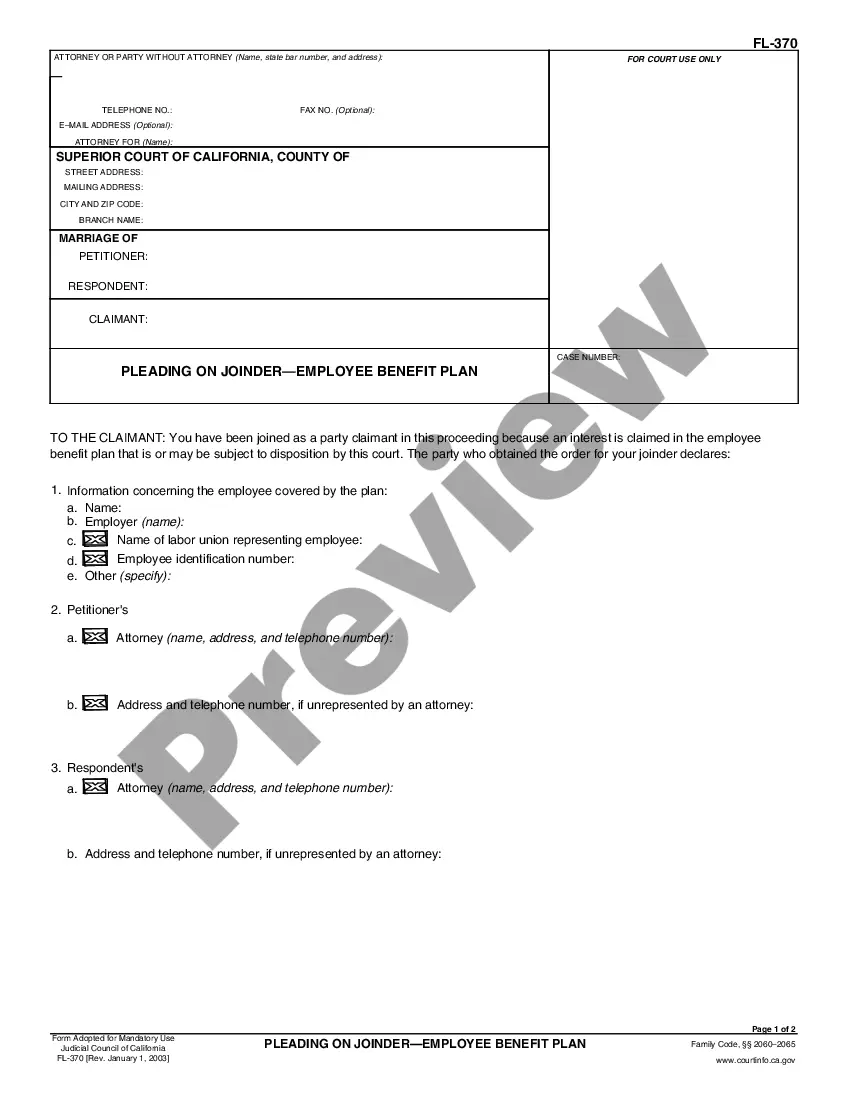

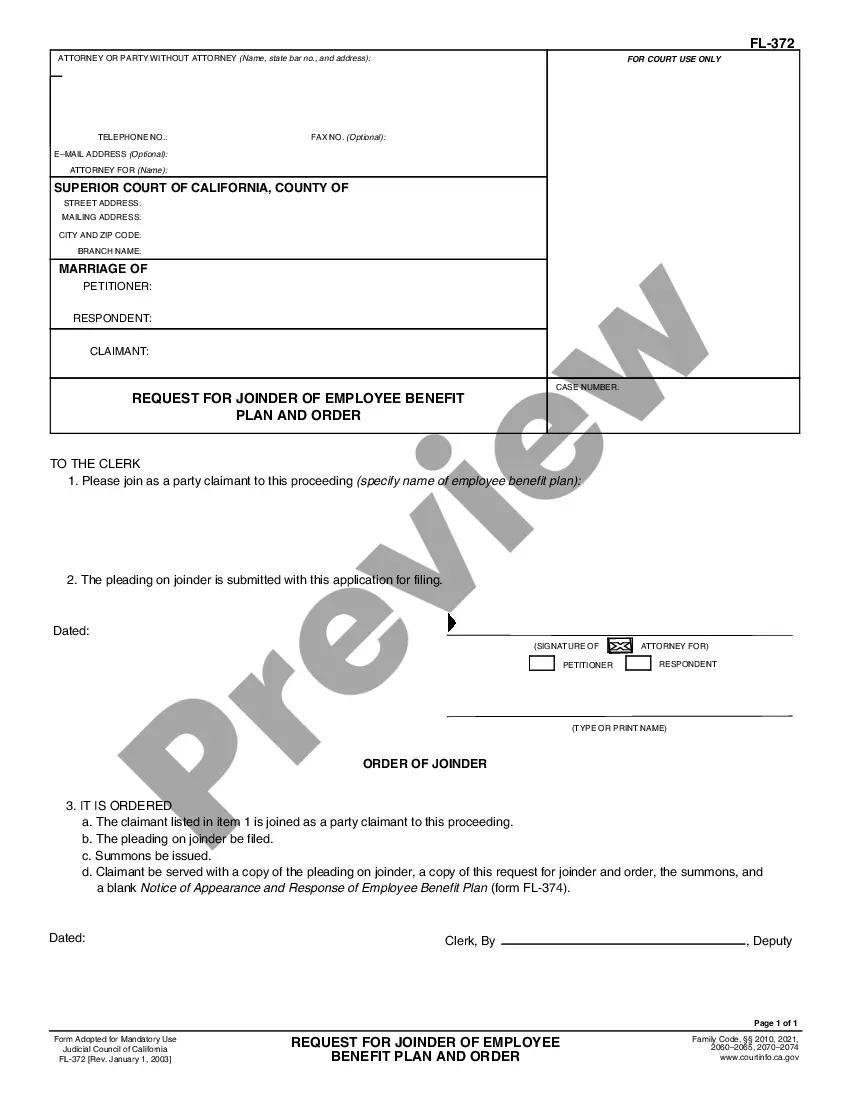

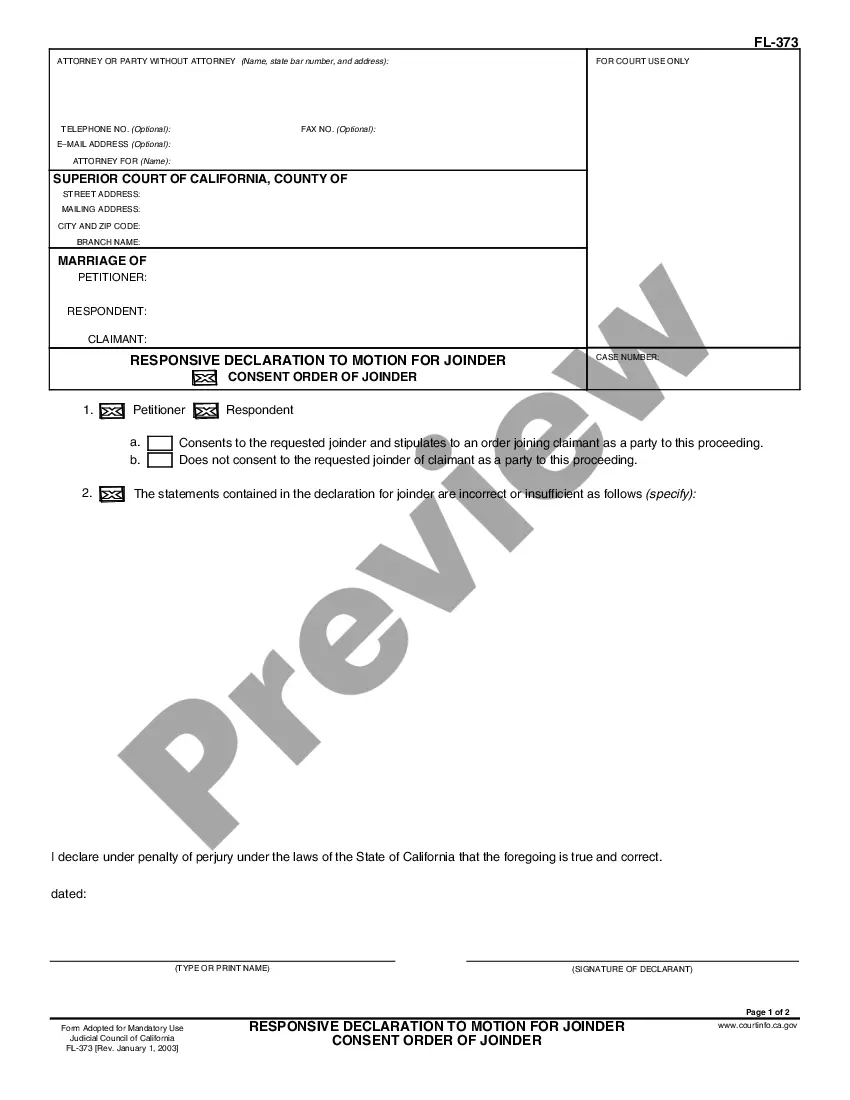

The Complaint to Probate Will and Appoint Executor is a legal document used to initiate a lawsuit regarding the validity of a will and the appointment of an executor for the deceased's estate. This form outlines the plaintiff's allegations against the defendant and distinguishes itself from other probate-related forms by its specific focus on both contesting the will and appointing an executor as part of the legal proceedings.

What’s included in this form

- Caption: Identifies the court and parties involved in the case.

- Introduction: States the basis for the complaint, including jurisdiction and plaintiff's standing.

- Allegations: Details the specific claims against the defendant, including reasons for contesting the will.

- Prayer for relief: Outlines the specific outcomes the plaintiff is seeking from the court.

- Signature section: Provides space for the plaintiff's signatures to validate the complaint.

Situations where this form applies

This form should be used when there is a disagreement over the validity of a will. Situations may include when the will is believed to be a product of undue influence, lack of capacity, or improper execution. Additionally, this form is vital when an executor needs to be legally appointed to manage the estate of the deceased, especially if more than one party is claiming this role.

Intended users of this form

- Individuals contesting a deceased person's will.

- Beneficiaries or heirs seeking clarification on the appointment of an executor.

- Personal representatives aiming to establish authority over estate administration.

How to complete this form

- Begin by filling out the caption with the court name and the parties involved.

- Clearly state the allegations against the defendant in the designated section.

- Outline your reasons for contesting the will and why specific relief is sought.

- Sign the complaint in the signature section, ensuring it meets local legal requirements.

- File the completed form with the appropriate court after checking for any specific local filing rules.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include necessary details in the allegations section.

- Not signing the complaint, which can result in a rejection of the filing.

- Overlooking local court rules regarding filing procedures and requirements.

Benefits of completing this form online

- Convenience of downloading the form anytime, anywhere.

- Editability allows users to customize the form to fit their specific situation.

- Access to templates prepared by licensed attorneys ensures legal accuracy.

Looking for another form?

Form popularity

FAQ

Forcing the probate will be easy. This is done by filing a petition to probate the estate as a creditor, which you do have a right to do. The family, will probably object but if a family member is awarded Letters, then you will be able to file a creditor...

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

Can an executor change a will after the death of the testator? No. The executors of a will have a duty to act in the best interests of the estate and the people named in it. So, an executor can't change the will without the permission of the beneficiaries.

Do you need an executor? Technically, you do not need to appoint an executor. But somebody will have to deal with winding up your estate when you die, no matter how little you own. If you haven't appointed at least one executor, or if you named executor has died, then someone else will step in as an administrator.

Only parties with legal standing can force an executor to finalize an estate. Individuals with a legal interest in an estate have standing. Examples of interested parties would be beneficiaries and heirs, or conservators or guardians named in a will.

Technically, you do not need to appoint an executor. But somebody will have to deal with winding up your estate when you die, no matter how little you own. If you haven't appointed at least one executor, or if you named executor has died, then someone else will step in as an administrator.

If an executor fails to carry out what the will asks for, a beneficiary or other interested person, such as a creditor, may petition the probate court to have the executor removed.

If after a reasonable time (6-9 months) you can demand that the executor provide an accounting of all estate assets. If the executor does not respond, you can ask the court to issue a. If the executor still does not respond, you can as the judge to.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.