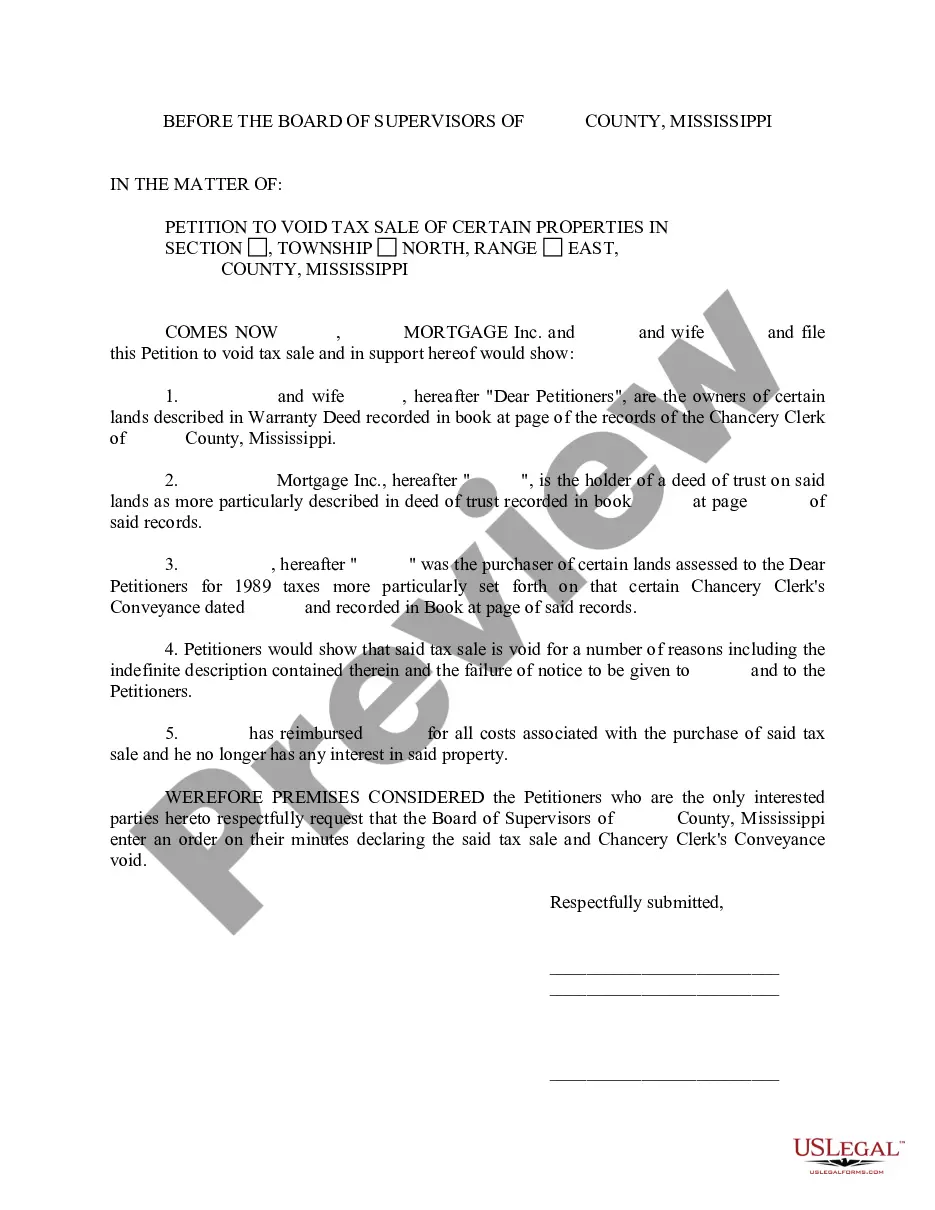

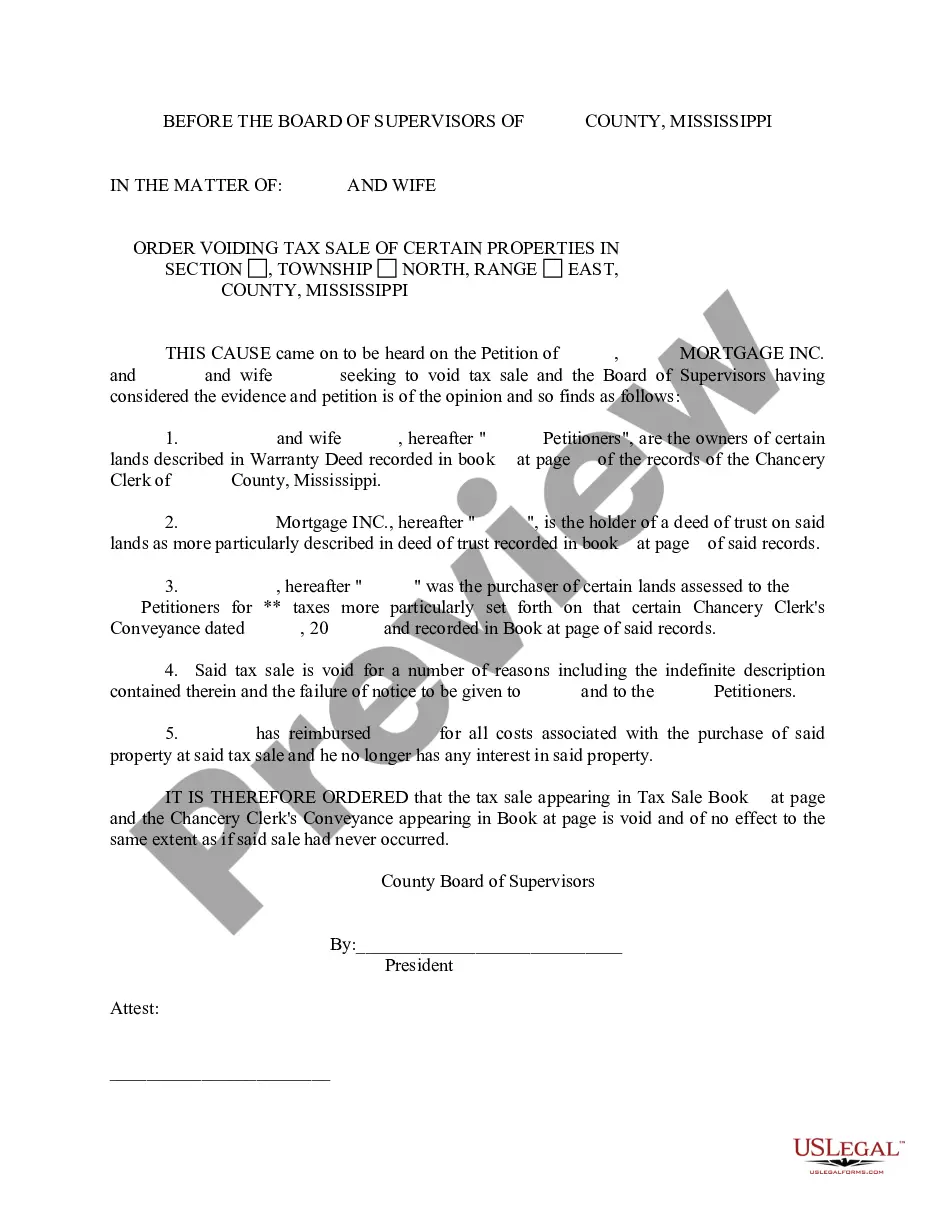

Mississippi Petition to Void Tax Sale of Certain Properties

Description

How to fill out Mississippi Petition To Void Tax Sale Of Certain Properties?

Get a printable Mississippi Petition to Void Tax Sale of Certain Properties within several clicks in the most complete catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax forms for US citizens and residents on-line since 1997.

Users who have a subscription, must log in straight into their US Legal Forms account, get the Mississippi Petition to Void Tax Sale of Certain Properties and find it stored in the My Forms tab. Customers who don’t have a subscription are required to follow the tips below:

- Make certain your form meets your state’s requirements.

- If available, look through form’s description to find out more.

- If offered, preview the form to view more content.

- As soon as you’re confident the form meets your requirements, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Mississippi Petition to Void Tax Sale of Certain Properties, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

In Mississippi, a tax sale will eventually take place if you don't pay the property taxes on your home. At the sale, the winning bidder buys the tax debt and gets a lien on the property. The purchaser receives a receipt along with the right to eventually get ownership of your property if you don't pay off the debt.

The answer is simple no. In Mississippi, paying the property taxes on someone else's land does not affect ownership in any manner. You simply cannot obtain title to someone's land by paying their taxes for them.

In cases where the mortgage lender recorded its lien (the mortgage) before the IRS records a Notice of Federal Tax Lien, the mortgage has priority. This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure.

When you buy a tax lien certificate, you're buying the right to receive a debt payment, not the deed to the house. The homeowner is still the legal owner of the home. If he does not pay the tax debt, then you can foreclose. But you cannot buy a tax lien, turn around and foreclose on the property the next day.

Federal tax liens do not take precedence over purchase money mortgages or mortgage loans. The IRS considers a purchase money security interest or mortgage to be valid under local laws, so it is protected even though it may arise after a notice of Federal tax lien has been filed.

After a tax sale happens, the homeowner might be able to redeem the property. "Redemption" is the right of the property owner to reclaim the property by paying the entire sale price, plus certain additional costs and interest, after the sale so long as it is within the time period allowed by statute.

The property at a tax deed sale is usually sold for the amount due in unpaid taxes, plus fees and interest charges.Before being transferred to the winning bidder, the property should be cleared of all mortgages and liens against it.

Mortgage Lien Survival In California, most tax foreclosure-selling counties issue tax deeds free of all title encumbrances except for other tax liens.Suddenly discovered mortgage liens on your newly bought tax-foreclosed property should be removed by the county in which you bought it.