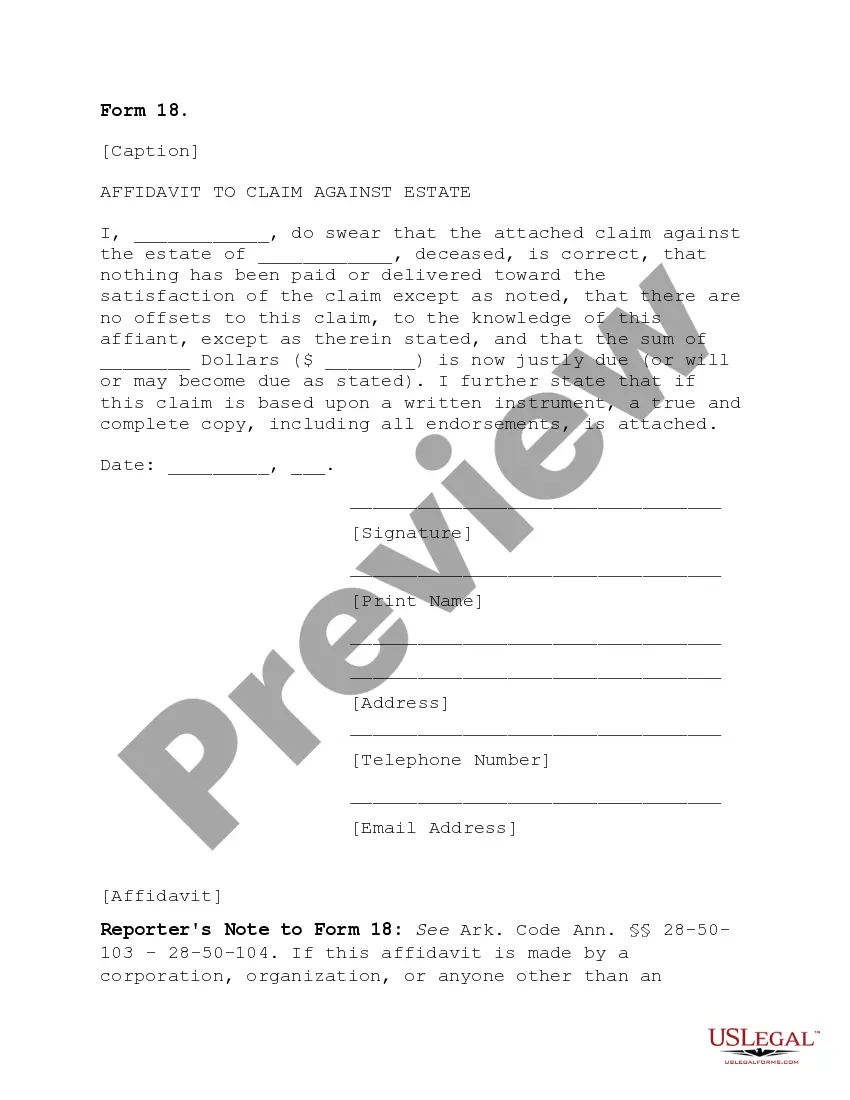

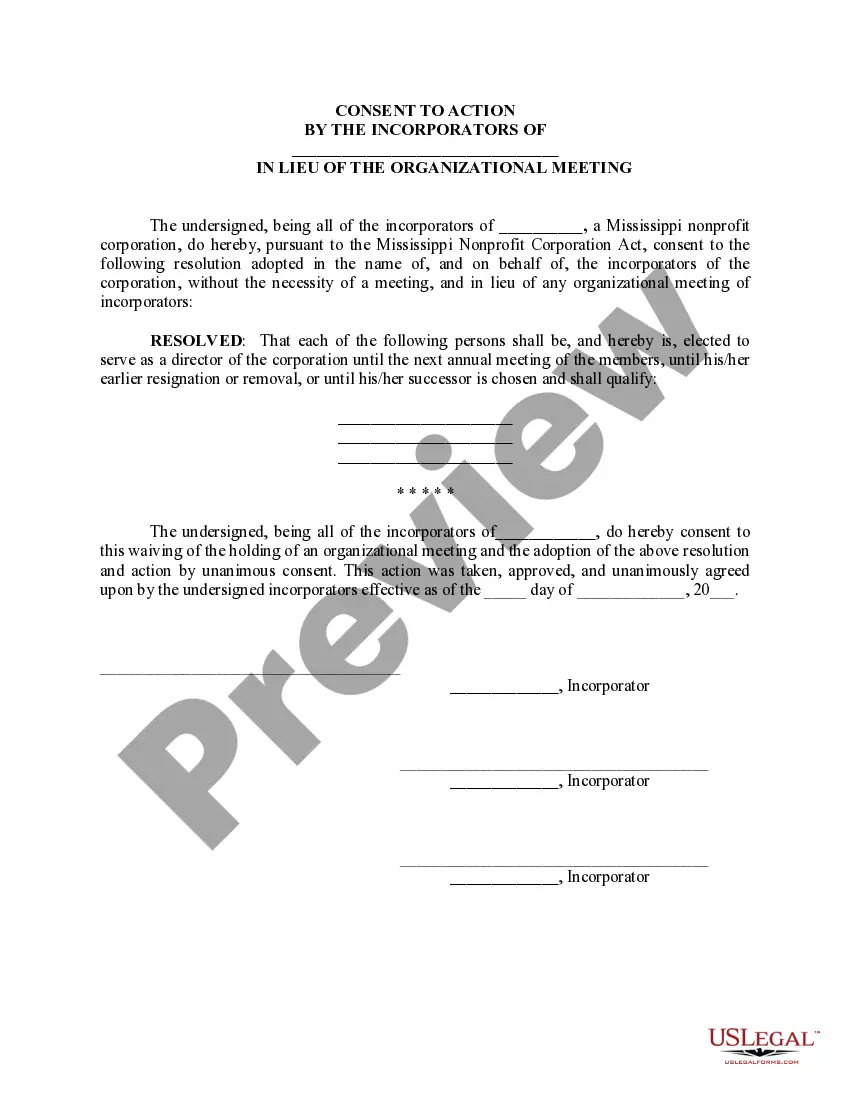

This form is a Consent to Action by the Incorporators of a Mississippi Nonprofit that consents to the election of directors without the necessity of and in lieu of an organizational meeting held for that purpose.

Incorporators Consent To Action Mississippi Nonprofit

Description

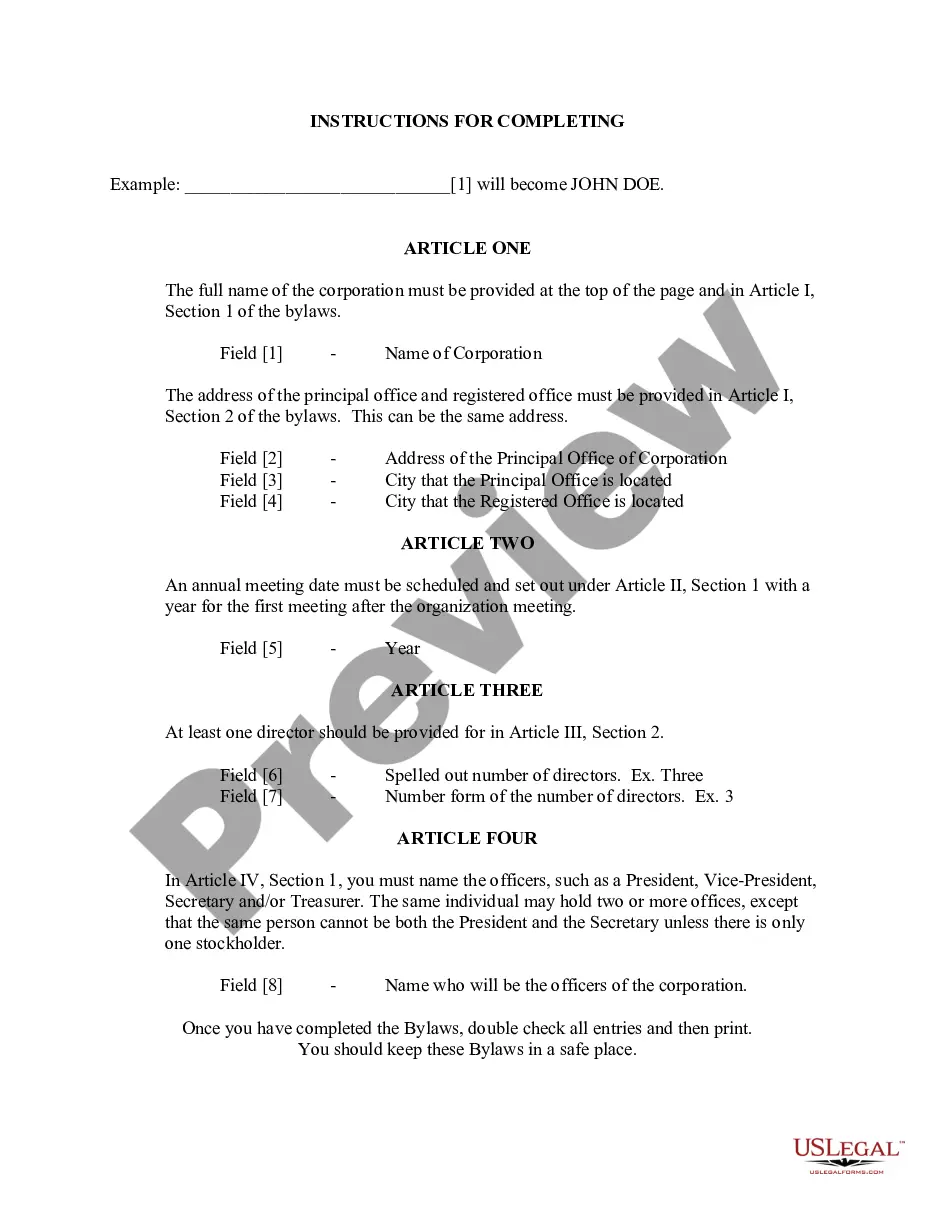

How to fill out Incorporators Consent To Action Mississippi Nonprofit?

Acquire a printable Incorporators Consent To Action Mississippi Nonprofit in just a few mouse clicks from the most comprehensive collection of legal e-documents.

Discover, download and print professionally prepared and certified samples on the US Legal Forms website. US Legal Forms has been the top provider of affordable legal and tax forms for US citizens and residents online since 1997.

Once you’ve downloaded your Incorporators Consent To Action Mississippi Nonprofit, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to access 85,000 professionally drafted, state-specific forms.

- Users with a subscription must Log In to their US Legal Forms account, download the Incorporators Consent To Action Mississippi Nonprofit and find it saved in the My documents section.

- Clients without a subscription should follow the steps outlined below.

- Ensure your template complies with your state’s regulations.

- If available, browse the form’s description for additional information.

- If accessible, examine the form to learn more content.

- When you are confident the form meets your requirements, click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay using PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

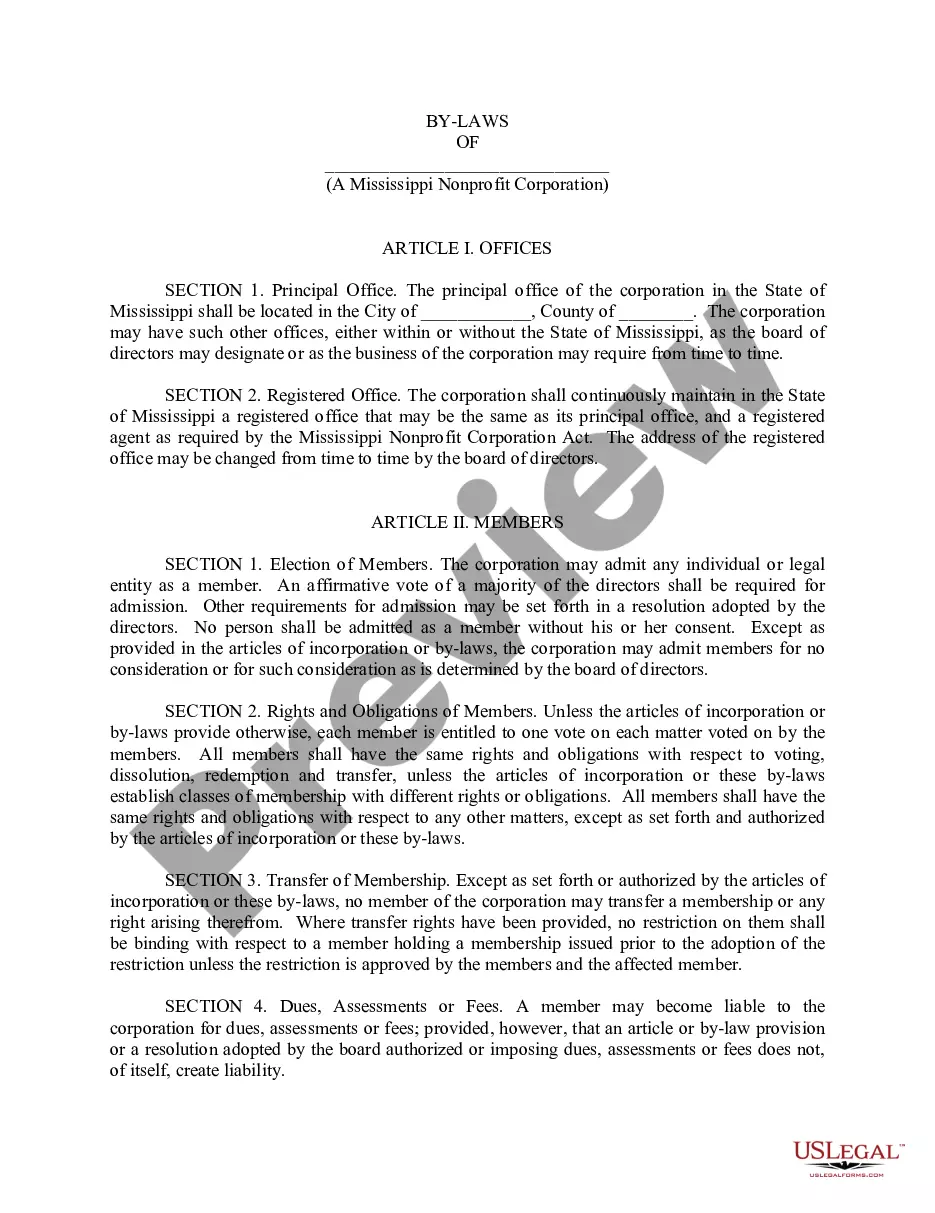

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Definition: A business organization that serves some public purpose and therefore enjoys special treatment under the law. Unlike a for-profit business, a nonprofit may be eligible for certain benefits, such as sales, property and income tax exemptions at the state level.

Section 501(c)(4): civic leagues and social welfare organizations, homeowners associations, and volunteer fire companies. Section 501(c)(5): such as labor unions. Section 501(c)(6): such as chambers of commerce.

In the absence of a standard definition, let's consider a small organization as having 20 or fewer staff members and a large organization as having 100 or more.

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

A nonprofit designation and tax-exempt status are given only to organizations that further religious, scientific, charitable, educational, literary, public safety or cruelty-prevention causes or purposes. Examples of nonprofit organizations include hospitals, universities, national charities, churches, and foundations.

Fiscal sponsorship is an arrangement in which one entity agrees to accept and manage funds for another.Having a fiscal sponsor, like ioby, can help you fundraise if you're not a 501(c)3 nonprofit. Better still, your donations can be tax deductible!

What is a nonprofit organization? A nonprofit organization is one that qualifies for tax-exempt status by the IRS because its mission and purpose are to further a social cause and provide a public benefit. Nonprofit organizations include hospitals, universities, national charities and foundations.

The highest-paid nonprofit leaders CEOs, Executive Directors, etc. all earn at least $900k per year, and into the tens of millions for the largest of hospitals and health systems.