This form, an Agreement to Retire Subordinated Debt, is usable in mortgages within the state of Mississippi to retire a previously-subordinated debt.

Mississippi Agreement to Retire Subordinated Debt

Description

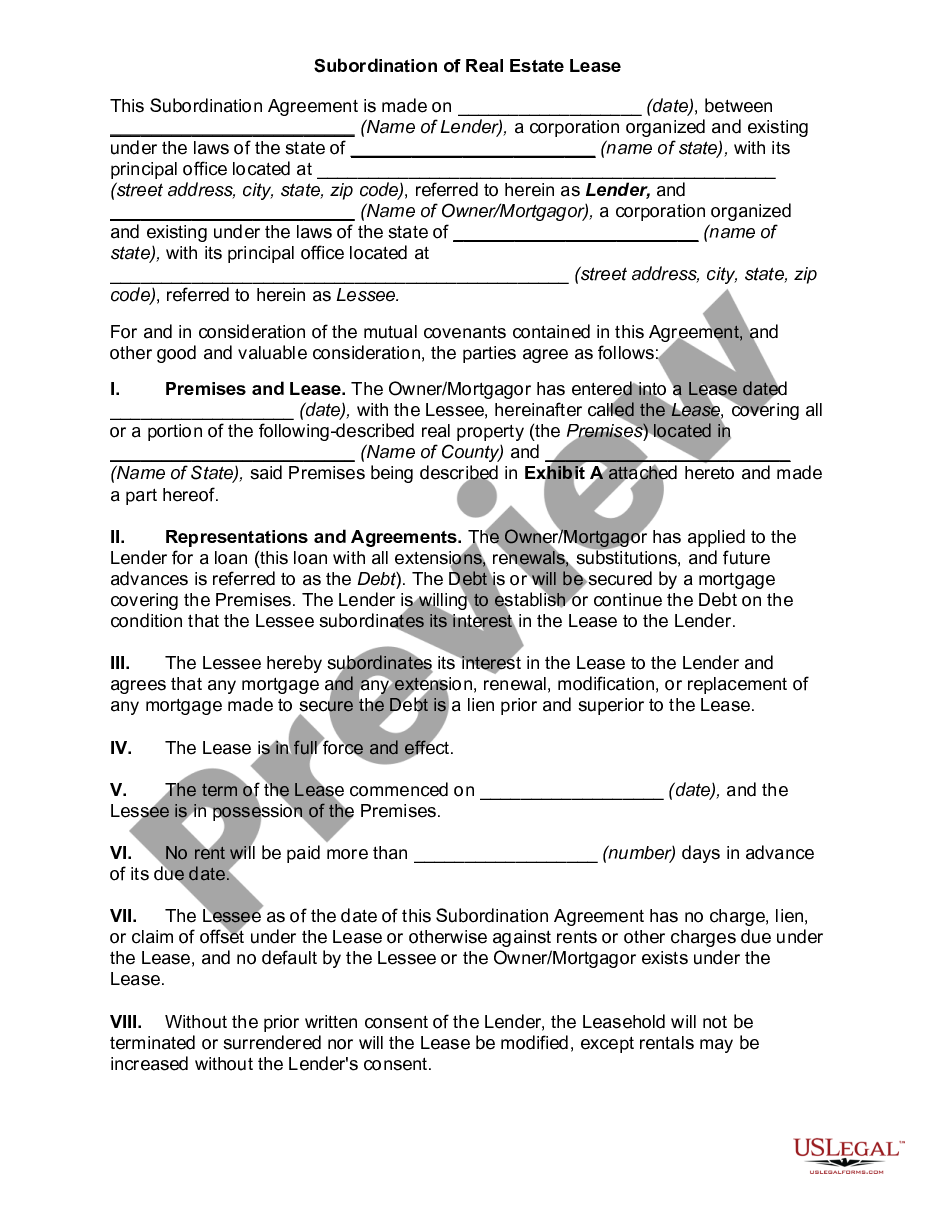

How to fill out Mississippi Agreement To Retire Subordinated Debt?

Obtain a printable Mississippi Agreement to Retire Subordinated Debt in just several clicks from the most complete catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of reasonably priced legal and tax forms for US citizens and residents on-line since 1997.

Customers who have already a subscription, must log in in to their US Legal Forms account, down load the Mississippi Agreement to Retire Subordinated Debt see it stored in the My Forms tab. Customers who never have a subscription are required to follow the tips listed below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If available, preview the form to see more content.

- As soon as you are sure the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or bank card.

- Download the form in Word or PDF format.

Once you have downloaded your Mississippi Agreement to Retire Subordinated Debt, you can fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

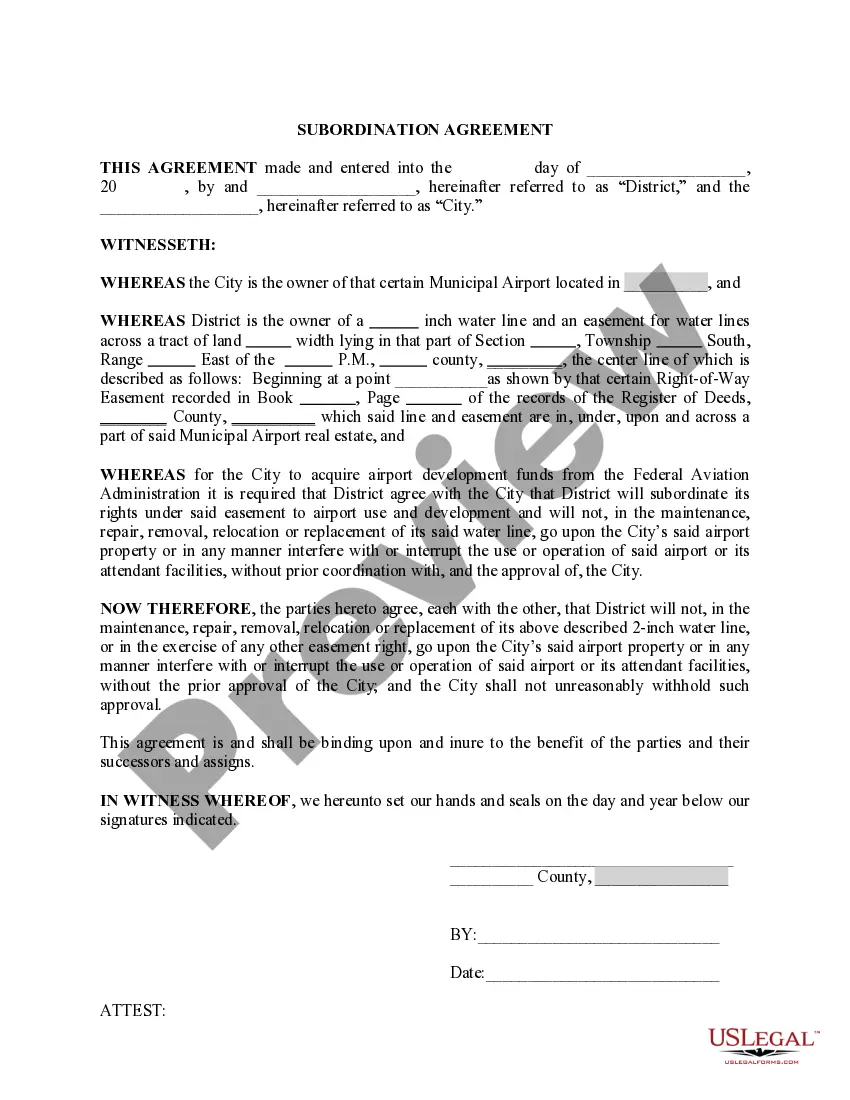

A subordination agreement prioritizes collateralized debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

- A subordination agreement is an agreement between two lien holders to modify the order of lien priority.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

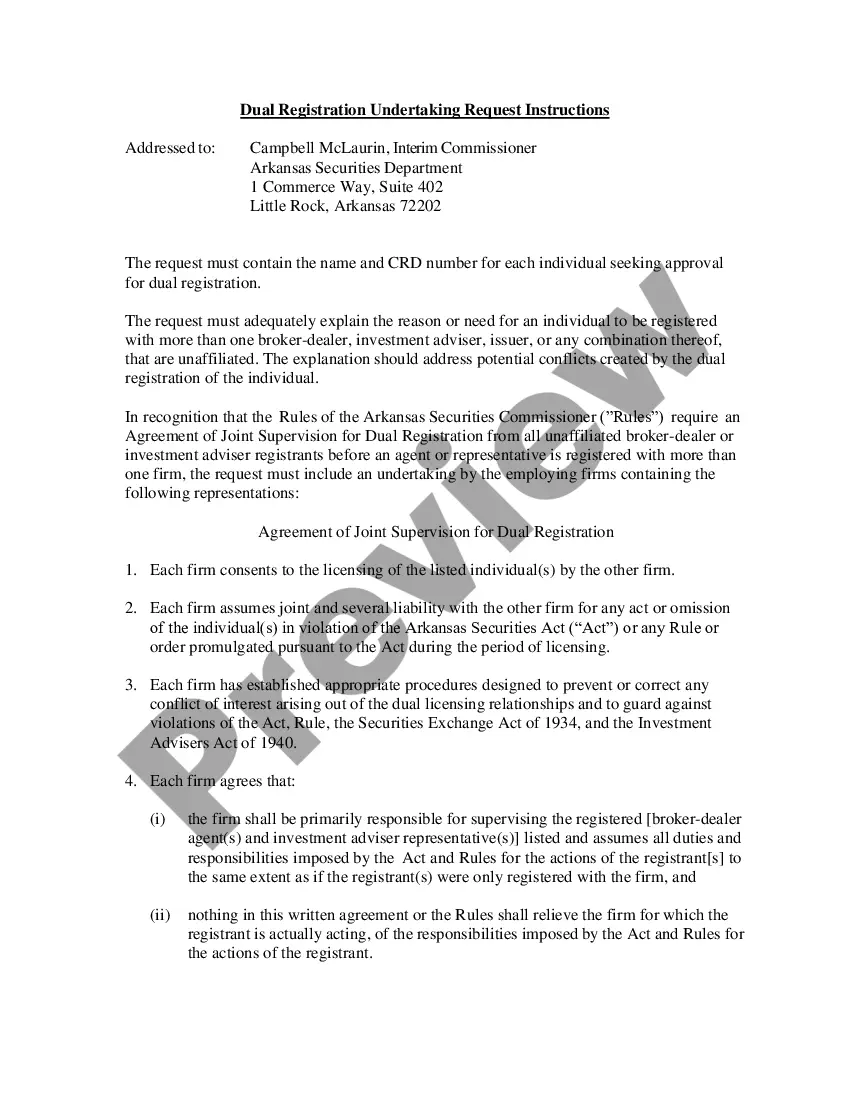

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

Subordination clauses in mortgages refer to the portion of your agreement with the mortgage company that says their lien takes precedence over any other liens you may have on your property.The primary lien on a house is usually a mortgage. However, it's also possible to have other liens.

Subordinated debt, sub-debt or mezzanine, is capital that is located between debt and equity on the right hand side of the balance sheet. It is more risky than traditional bank debt, but more senior than equity in its liquidation preference (in bankruptcy).

Subordinated debt offers business owners access to capital they may be unable to obtain from a bank due to a lack of tangible assets to offer as collateral.This is because bankers may consider it part of the "equity cushion" that supports the senior bank debt.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit.