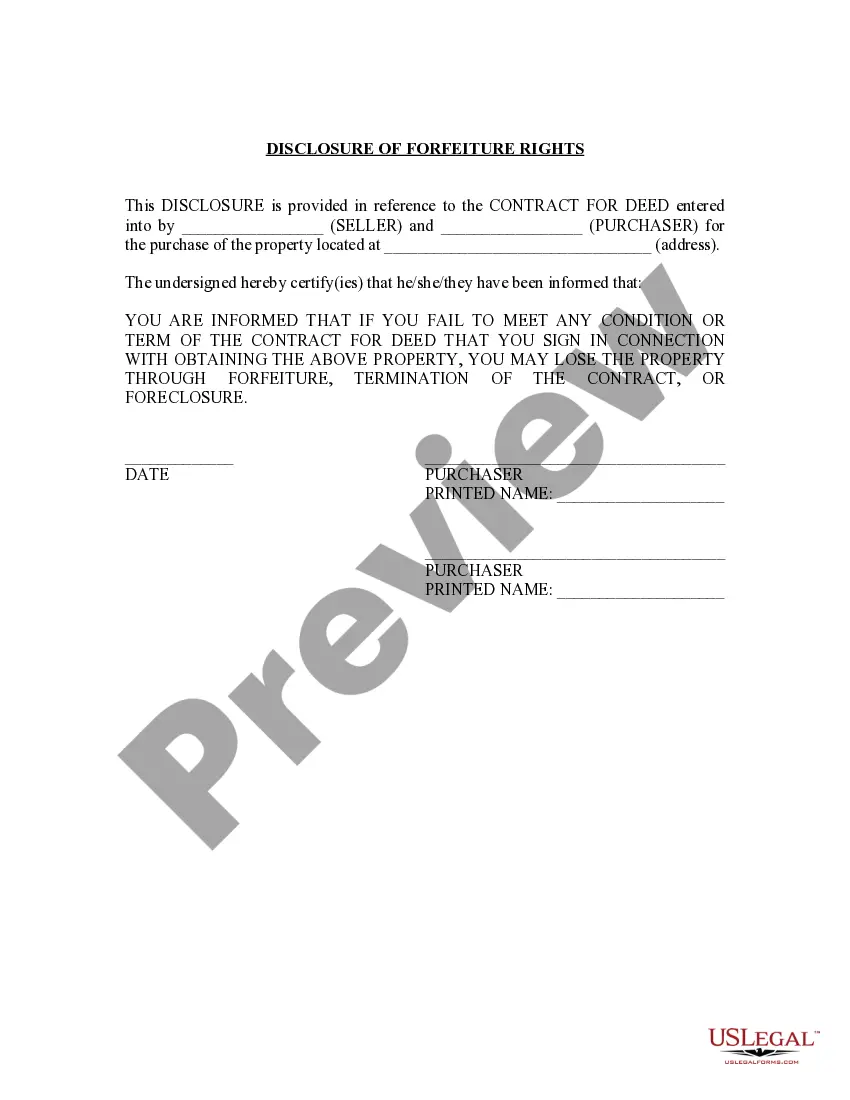

Mississippi Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

How to fill out Mississippi Seller's Disclosure Of Forfeiture Rights For Contract For Deed?

Use US Legal Forms to get a printable Mississippi Seller's Disclosure of Forfeiture Rights for Contract for Deed. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms catalogue on the internet and provides affordable and accurate samples for consumers and legal professionals, and SMBs. The templates are grouped into state-based categories and some of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Press Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Mississippi Seller's Disclosure of Forfeiture Rights for Contract for Deed:

- Check out to ensure that you have the correct form in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Hit Buy Now if it’s the template you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it many times.

- Make use of the Search field if you need to find another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including Mississippi Seller's Disclosure of Forfeiture Rights for Contract for Deed. Above three million users have already used our service successfully. Choose your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Monetary Damages If the Seller decides to breach the contract and keep their home, they may do so, but the court may order the Buyer receive money for the resulting breach. Generally, the money owed to Buyer may include reimbursing the Buyer with: The buyer's temporary housing costs.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

Backing out of a home sale can have costly consequences A home seller who backs out of a purchase contract can be sued for breach of contract. A judge could order the seller to sign over a deed and complete the sale anyway. The buyer could sue for damages, but usually, they sue for the property, Schorr says.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

But unlike buyers, sellers can't back out and forfeit their earnest deposit money (usually 1-3 percent of the offer price). If you decide to cancel a deal when the home is already under contract, you can be either legally forced to close anyway or sued for financial damages.

If a seller defaults, he must return all deposits, plus added reasonable expenses, to the buyer. The other party may also seek to compel the erring party to complete the deal under specific performance. From a buyer's point of view, it is advisable to get the sale agreement registered.

If a seller is actually breaching a contract and you can prove you have been financially damaged, you could sue. However, the amount you can sue for depends on the law in your individual state.With that said, if you can show the seller acted in bad faith, your state may allow you to seek additional damages.