This is a license to transmit audio-visual content. The license agreement is between the "channel-owner," who owns and operates an internet broadcast service, and the "content-owner."

Missouri Media Streaming Agreement

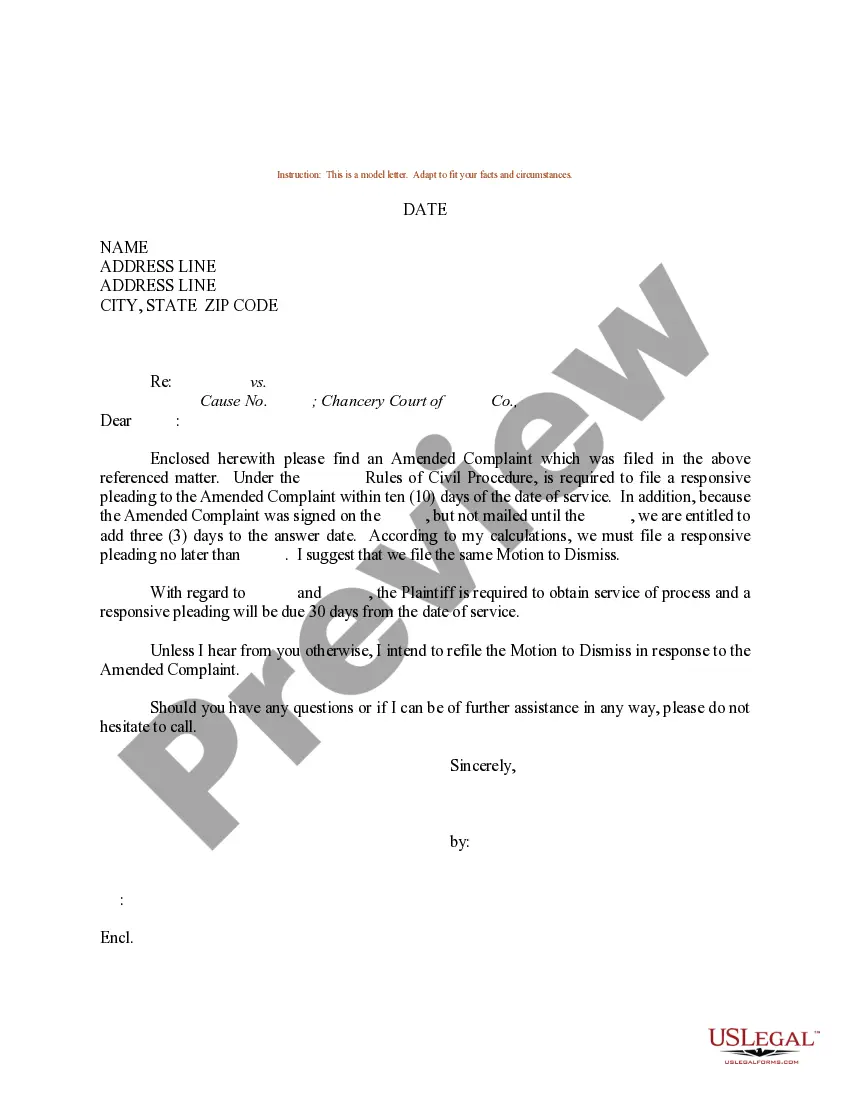

Description

How to fill out Media Streaming Agreement?

Choosing the right authorized document format might be a have difficulties. Naturally, there are tons of web templates available online, but how will you discover the authorized form you will need? Make use of the US Legal Forms internet site. The support provides a huge number of web templates, like the Missouri Media Streaming Agreement, which can be used for business and private requirements. Every one of the kinds are examined by experts and meet state and federal needs.

When you are presently listed, log in to your profile and then click the Obtain switch to get the Missouri Media Streaming Agreement. Make use of your profile to look through the authorized kinds you have ordered formerly. Check out the My Forms tab of your own profile and get another duplicate from the document you will need.

When you are a fresh customer of US Legal Forms, listed here are easy instructions that you should comply with:

- Initial, ensure you have chosen the correct form for your personal area/state. You are able to look through the form using the Review switch and look at the form information to ensure it is the best for you.

- In the event the form fails to meet your expectations, take advantage of the Seach discipline to obtain the correct form.

- When you are sure that the form would work, click on the Get now switch to get the form.

- Opt for the prices program you would like and type in the essential details. Design your profile and purchase an order using your PayPal profile or credit card.

- Choose the file file format and obtain the authorized document format to your product.

- Complete, revise and print and indicator the received Missouri Media Streaming Agreement.

US Legal Forms is the biggest collection of authorized kinds in which you can discover a variety of document web templates. Make use of the company to obtain appropriately-created files that comply with state needs.

Form popularity

FAQ

The State of Missouri mandates the filing of 1099 forms, including 1099-NEC, 1099-MISC, 1099-INT, 1099-DIV, 1099-R, 1099-B, 1099-G, 1099-K, 1099-OID, and W-2G. The State of Missouri also mandates the filing of Form MO W-3, Transmittal of Tax Statements.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

Find Your Missouri Tax ID Numbers and Rates You can find your Employer Account Number on any previous quarterly report, or on any notices you've received from the Department of Labor and Industrial Relations. If you're unable to locate this, contact the agency at (573) 751-1995.

Yes. Any time an employee is performing services for an employer in exchange for wages in Missouri, those wages are subject to Missouri withholding. This applies in the case of ?remote work? where an employee is located in Missouri and performs services for the employer on a remote basis.

More In Help An employer identification number (EIN) is a nine-digit number assigned by the IRS. It's used to identify the tax accounts of employers and certain others who have no employees. The IRS uses the number to identify taxpayers who are required to file various business tax returns.

Where do I find my Employer ID Number (EIN)? - YouTube YouTube Start of suggested clip End of suggested clip Leave it blank you won't be able to e-file. But you can still file a paper return to learn moreMoreLeave it blank you won't be able to e-file. But you can still file a paper return to learn more about your EIN. Or for more help completing your return Please visit turbotax.com support.