Missouri Settlement Statement of Personal Injury Case and Receipt

Description

How to fill out Settlement Statement Of Personal Injury Case And Receipt?

You may spend time online searching for the authorized file template that suits the state and federal requirements you will need. US Legal Forms offers a huge number of authorized varieties which can be evaluated by professionals. It is simple to down load or print the Missouri Settlement Statement of Personal Injury Case and Receipt from my assistance.

If you already have a US Legal Forms profile, you can log in and click the Obtain option. Afterward, you can total, modify, print, or signal the Missouri Settlement Statement of Personal Injury Case and Receipt. Each authorized file template you purchase is the one you have forever. To acquire one more backup for any obtained form, check out the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site for the first time, adhere to the straightforward recommendations listed below:

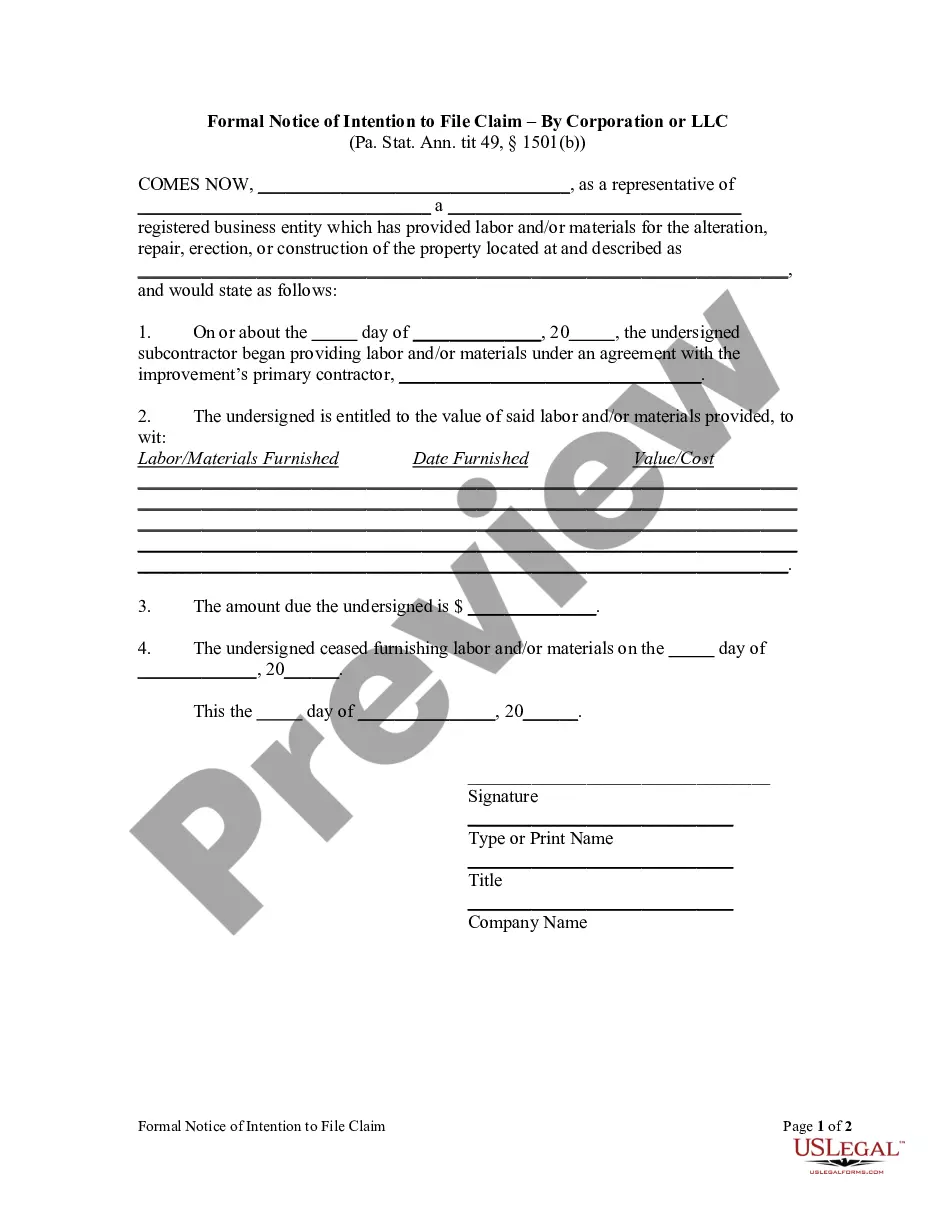

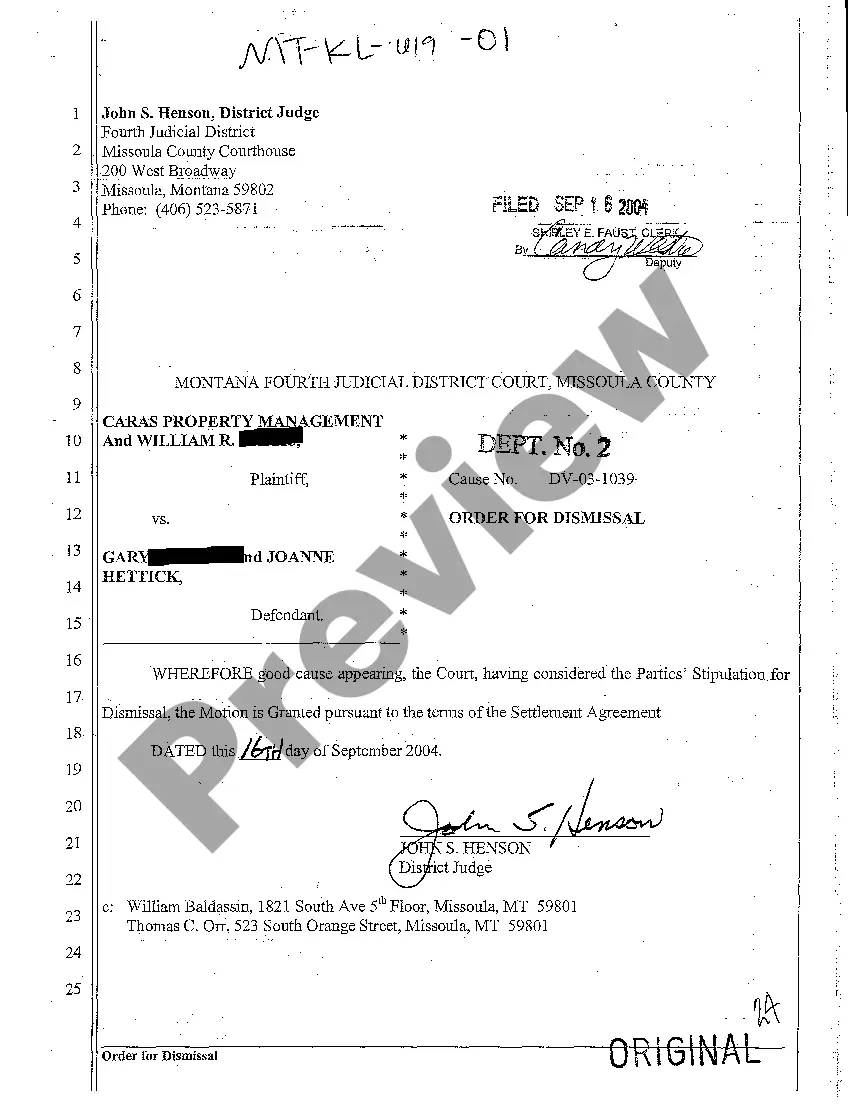

- Initial, make sure that you have chosen the right file template to the area/city of your choosing. Browse the form information to ensure you have picked the right form. If readily available, make use of the Review option to appear with the file template also.

- If you would like find one more edition from the form, make use of the Research area to find the template that suits you and requirements.

- After you have found the template you want, just click Acquire now to move forward.

- Pick the costs plan you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal profile to cover the authorized form.

- Pick the structure from the file and down load it in your device.

- Make changes in your file if possible. You may total, modify and signal and print Missouri Settlement Statement of Personal Injury Case and Receipt.

Obtain and print a huge number of file themes using the US Legal Forms site, that offers the most important assortment of authorized varieties. Use professional and condition-certain themes to take on your business or person requires.

Form popularity

FAQ

Under 26 U.S. Code § 104(a)(2), compensation that you recover for your medical expenses for your physical injuries is excluded from your gross income and is generally not taxable by the IRS or the State of California.

If the compensation was awarded because of physical injury or illness, the money will not be taxable. Punitive damages are, however, treated differently. If the victim received punitive damages in an injury, the amount awarded as compensatory damages is taxable to the plaintiff.

(2) ?Disbursement of settlement proceeds? means the payment of all proceeds of a transaction by a settlement agent to the persons entitled to receive the proceeds.

The general rule is that lawsuit settlements are taxable, except in cases that involve an actual, physical injury (?observable bodily harm?) or illness that you suffered. In other words: personal injury settlements usually aren't taxable, while other types of settlements usually are.

In Missouri, the statute of limitations for filing a personal injury claim is 5 years (Missouri Code section 516.120). This means that claims must be filed within 5 years of discovering the injury.

In short, any compensation you received for the direct financial, physical and emotional harm you sustained because of your injuries will not be taxed. Anything "extra" or deemed to be over that amount, is taxable as income.

For example, if you make claims for emotional distress, your damages are taxable. If you claim the defendant caused you to become physically sick, those can be tax free. If emotional distress causes you to be physically sick, that is taxable. The order of events and how you describe them matters to the IRS.

There is no legal formula for calculating pain and suffering under Missouri or Kansas law. As a result, pain and suffering is determined by subjective criteria, and the amount you may receive is uncertain and will vary greatly from case to case.