Missouri Clauses Relating to Venture IPO

Description

How to fill out Clauses Relating To Venture IPO?

If you wish to comprehensive, download, or produce lawful record templates, use US Legal Forms, the largest selection of lawful types, which can be found on the web. Utilize the site`s simple and practical look for to discover the papers you require. A variety of templates for company and personal reasons are sorted by classes and says, or keywords. Use US Legal Forms to discover the Missouri Clauses Relating to Venture IPO in a number of click throughs.

When you are previously a US Legal Forms customer, log in to your accounts and click on the Obtain switch to obtain the Missouri Clauses Relating to Venture IPO. You may also access types you previously saved within the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for your right city/region.

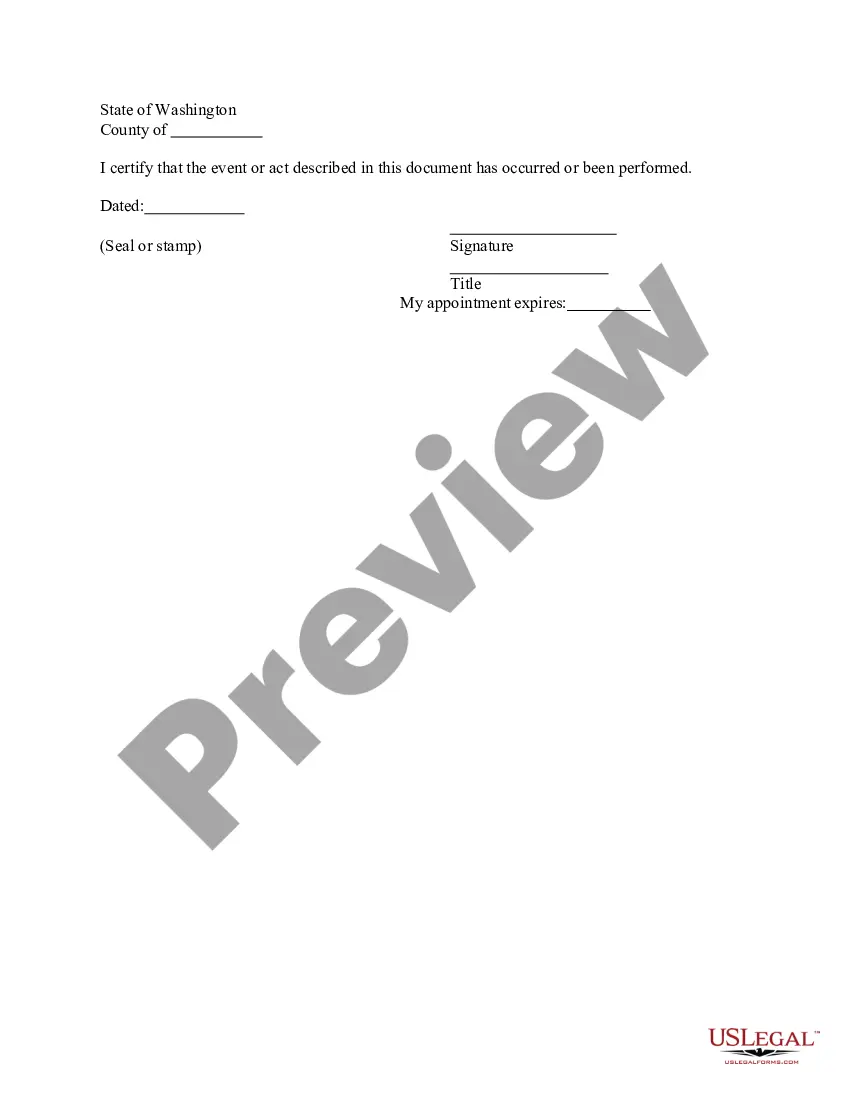

- Step 2. Make use of the Preview option to look over the form`s content. Never forget to see the outline.

- Step 3. When you are not satisfied together with the kind, take advantage of the Search area near the top of the display screen to get other versions from the lawful kind format.

- Step 4. After you have identified the form you require, select the Buy now switch. Pick the prices program you like and add your credentials to register for an accounts.

- Step 5. Process the deal. You can utilize your bank card or PayPal accounts to perform the deal.

- Step 6. Select the formatting from the lawful kind and download it on your own gadget.

- Step 7. Comprehensive, modify and produce or indicator the Missouri Clauses Relating to Venture IPO.

Every lawful record format you get is the one you have permanently. You may have acces to each kind you saved within your acccount. Select the My Forms portion and select a kind to produce or download once again.

Remain competitive and download, and produce the Missouri Clauses Relating to Venture IPO with US Legal Forms. There are millions of expert and condition-distinct types you can utilize for the company or personal requirements.