Missouri Term Royalty Deed

Description

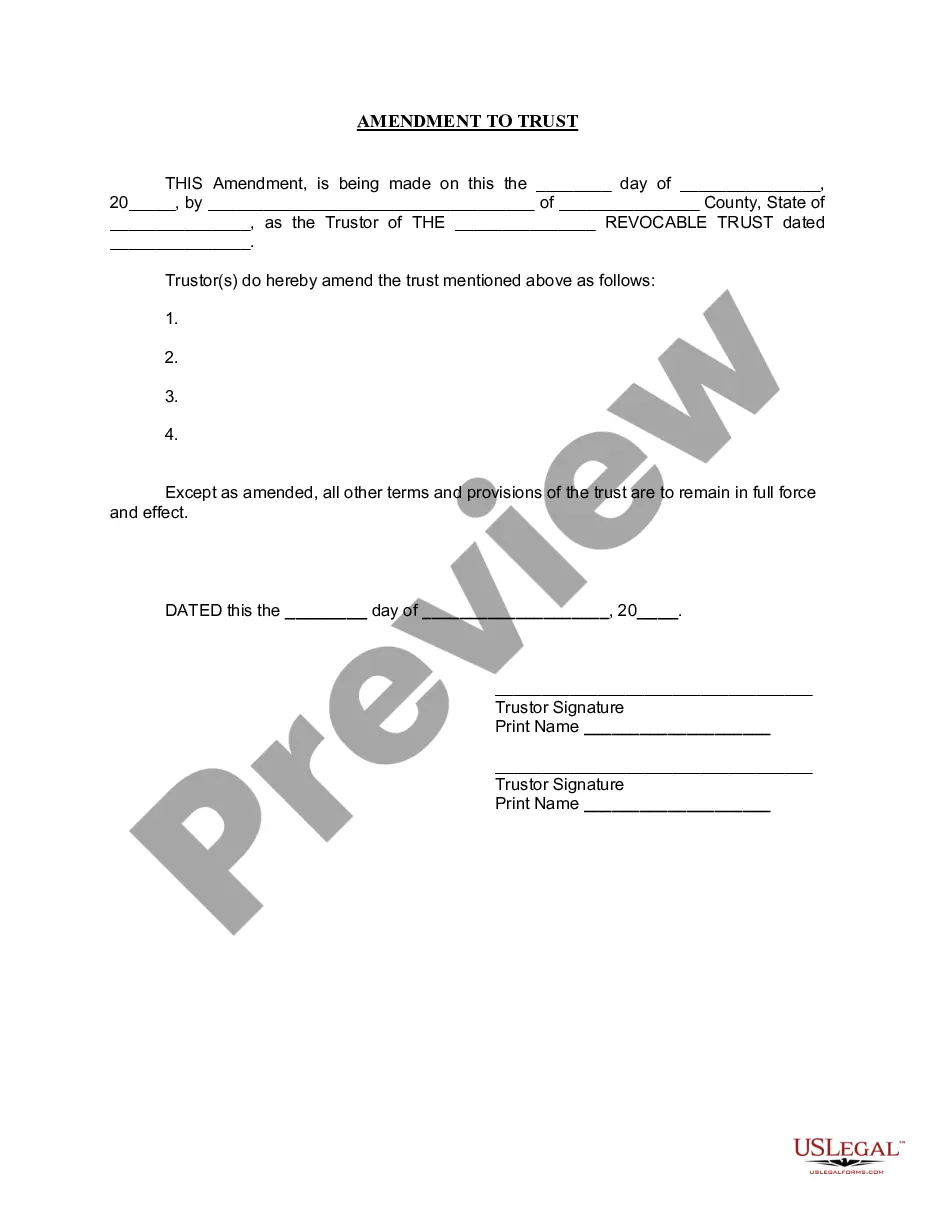

How to fill out Term Royalty Deed?

If you wish to complete, obtain, or print out authorized record themes, use US Legal Forms, the biggest variety of authorized types, that can be found on-line. Use the site`s easy and hassle-free lookup to obtain the documents you want. Various themes for business and person purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to obtain the Missouri Term Royalty Deed in just a couple of click throughs.

When you are previously a US Legal Forms client, log in in your account and click on the Acquire button to obtain the Missouri Term Royalty Deed. Also you can entry types you earlier downloaded within the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for that appropriate metropolis/land.

- Step 2. Make use of the Review method to look through the form`s content material. Do not overlook to learn the information.

- Step 3. When you are not satisfied together with the kind, utilize the Research discipline towards the top of the display screen to find other models from the authorized kind web template.

- Step 4. Upon having located the shape you want, select the Acquire now button. Choose the rates strategy you favor and add your references to register on an account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Select the formatting from the authorized kind and obtain it on the product.

- Step 7. Complete, change and print out or indicator the Missouri Term Royalty Deed.

Each authorized record web template you buy is the one you have for a long time. You might have acces to every single kind you downloaded in your acccount. Go through the My Forms portion and select a kind to print out or obtain once again.

Be competitive and obtain, and print out the Missouri Term Royalty Deed with US Legal Forms. There are millions of expert and condition-specific types you can utilize for the business or person demands.

Form popularity

FAQ

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

In Arkansas, there are a number of different situations in which real property is transferred from one person to another, but they each have one thing in common ? a deed. A deed is the legal document which officially transfers ownership of a piece of property. Without a deed, there cannot be an actual transfer.

Arkansas charges a real property transfer tax for real estate transfers involving more than $100.00 in payment. The total transfer tax rate is $3.30 per $1,000.00 of consideration?two-thirds of which is expressly the new owner's responsibility.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

In the State of Arkansas when a person sells a piece of property the mineral rights automatically transfer with the surface rights, unless otherwise stated in the deed.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.