Missouri Diver Services Contract - Self-Employed

Description

How to fill out Diver Services Contract - Self-Employed?

You can spend numerous hours online searching for the official document template that meets the federal and state regulations you need. US Legal Forms offers thousands of legal forms that are reviewed by professionals.

It is easy to download or print the Missouri Diver Services Contract - Self-Employed from your account. If you already have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, modify, print, or sign the Missouri Diver Services Contract - Self-Employed. Every legal document template you obtain is yours forever. To get an additional copy of any purchased form, visit the My documents section and click on the corresponding button.

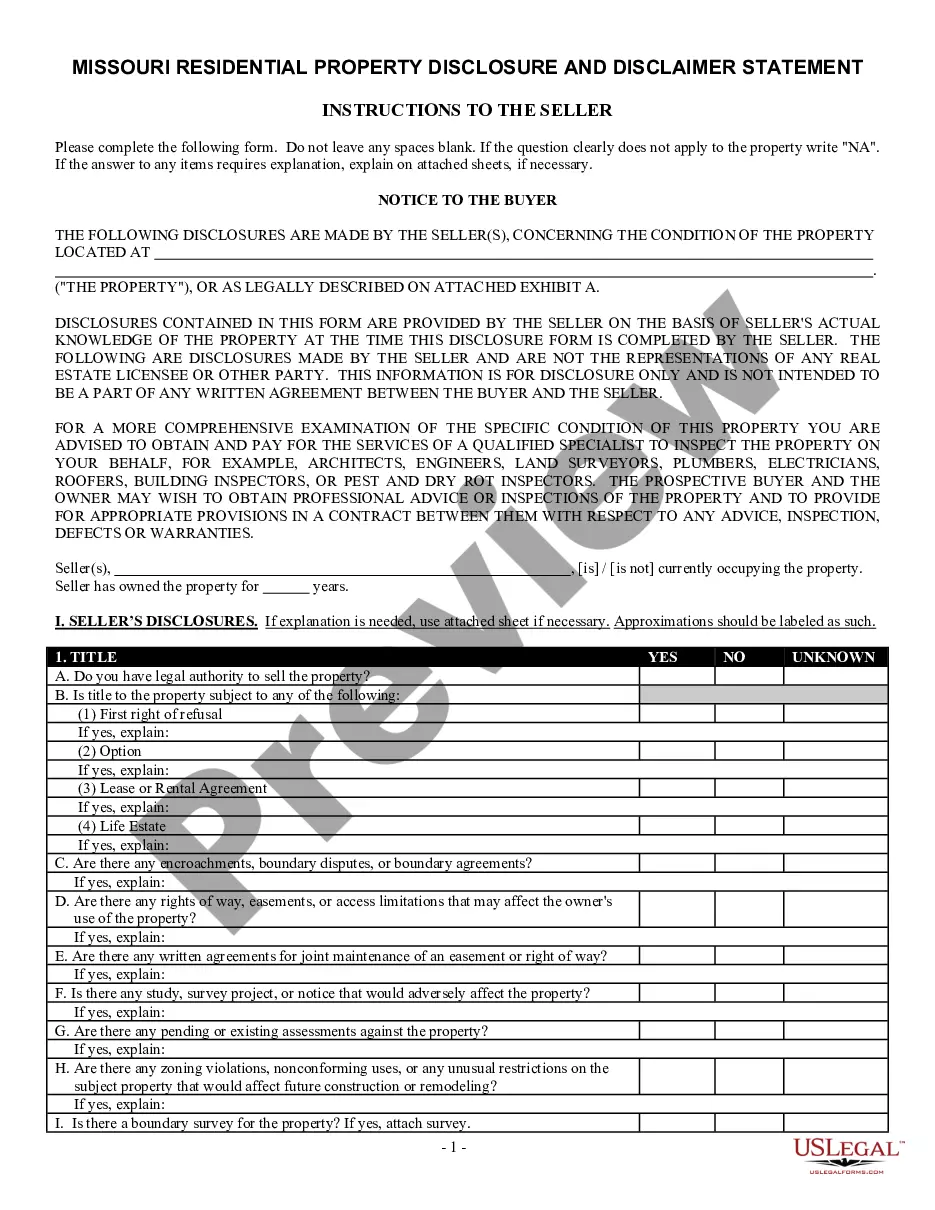

If you are using the US Legal Forms website for the first time, follow the straightforward instructions below: First, ensure that you have selected the correct document template for the area/city you desire. Read the form description to confirm you have chosen the right form. If available, use the Review button to browse through the document template as well. If you want to find another version of the form, use the Search field to locate the template that fulfills your needs and requirements.

- Once you have identified the template you need, click Purchase now to proceed.

- Select the pricing plan you want, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to buy the legal form.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, edit, sign, and print the Missouri Diver Services Contract - Self-Employed.

- Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

To set up as a self-employed contractor in Missouri under the Missouri Diver Services Contract - Self-Employed, start by registering your business. You can choose a suitable business structure, such as an LLC or sole proprietorship, and obtain the necessary licenses. Additionally, consider acquiring liability insurance to protect yourself and your business. Finally, utilize uslegalforms to access templates and resources that will guide you through the necessary paperwork and requirements.

Yes, you can write your own legally binding contract as long as it meets legal requirements. Ensure that it includes the necessary elements, such as the parties involved, clear terms of service, and payment details. A well-structured Missouri Diver Services Contract - Self-Employed can serve as a reliable template to help you draft your own contract effectively while ensuring compliance with legal standards.

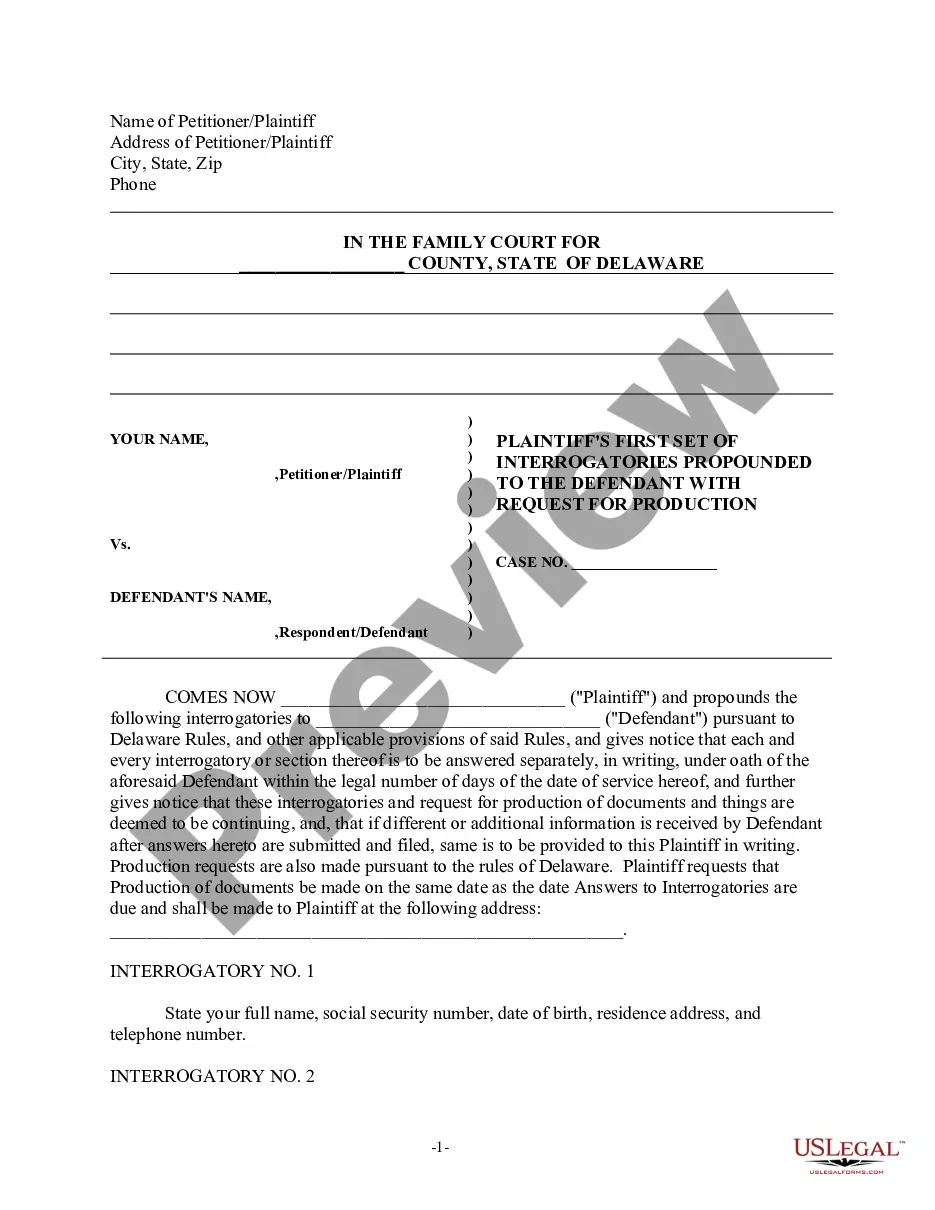

Writing a contract for a 1099 employee involves clearly stating the nature of the services provided and the payment terms. Define the responsibilities and expectations to avoid misunderstandings later. It’s crucial to note that, unlike W-2 employees, 1099 workers typically have more flexibility in how they complete their tasks. Utilizing a Missouri Diver Services Contract - Self-Employed can clarify the roles and responsibilities appropriately.

To prove self-employment, you can provide documents such as tax returns, a business license, or a dedicated business bank account. Additionally, a Missouri Diver Services Contract - Self-Employed signed by your clients can serve as valid proof of your services and income. Having organized documentation enhances your credibility and fulfills any requirements from potential clients or financial institutions.

Writing a self-employment contract involves several key steps. Start by identifying all parties and outlining the services and expectations clearly. Specify payment details, such as rate and frequency, and add any necessary legal clauses, such as dispute resolution. A comprehensive Missouri Diver Services Contract - Self-Employed can guide you through this process effectively.

Begin your contract agreement for services by stating the names of the parties and the purpose of the contract. Describe the scope of work in detail, along with timelines and payment conditions. Consider including provisions that address changes to the agreement and dispute resolution methods. Using a standard Missouri Diver Services Contract - Self-Employed can provide a solid framework for your agreement.

To write a self-employed contract, start by clearly identifying the parties involved, including their legal names and addresses. Next, outline the services to be provided, ensuring to detail specific tasks and deliverables. Incorporate payment terms, such as rates and schedules, and include any important clauses like confidentiality or termination. Finally, ensure both parties sign the Missouri Diver Services Contract - Self-Employed to make it legally binding.

To become an independent contractor in Missouri, begin by registering your business and obtaining any necessary permits. Next, establish a clientele and discuss terms using a Missouri Diver Services Contract - Self-Employed, which lays out expectations and project details. Finally, keep accurate records of your income expenses to simplify tax time. With the right foundation, you will pave the way for a successful independent career.

One key requirement for classification as an independent contractor is having the ability to control how tasks are completed. This means you decide on methods, schedules, and work locations. By using a Missouri Diver Services Contract - Self-Employed, you can outline these responsibilities clearly, thereby solidifying your status and protecting yourself legally.

To set up as an independent contractor, start by obtaining the necessary licenses and permits for your trade. You'll also need to consider creating a business structure, such as an LLC or sole proprietorship, to protect your personal assets. Additionally, utilizing a Missouri Diver Services Contract - Self-Employed can help formalize your relationship with clients, ensuring clear expectations and legal compliance.