Missouri Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

Locating the appropriate legal document format can be challenging.

Naturally, there is a range of templates available online, but how can you acquire the legal document you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Missouri Pool Services Agreement - Self-Employed, that you can utilize for business and personal purposes.

If the document does not fulfill your requirements, utilize the Search field to find the appropriate form. When you are certain that the form is correct, click on the Acquire now button to download the document. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Finally, complete, edit, print, and sign the downloaded Missouri Pool Services Agreement - Self-Employed. US Legal Forms is the largest repository of legal forms where you will discover numerous document templates. Use the service to download properly crafted paperwork that adheres to state requirements.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the Missouri Pool Services Agreement - Self-Employed.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- Firstly, ensure you have selected the correct form for your city/region. You can view the document using the Preview option and read the form description to confirm this is suitable for you.

Form popularity

FAQ

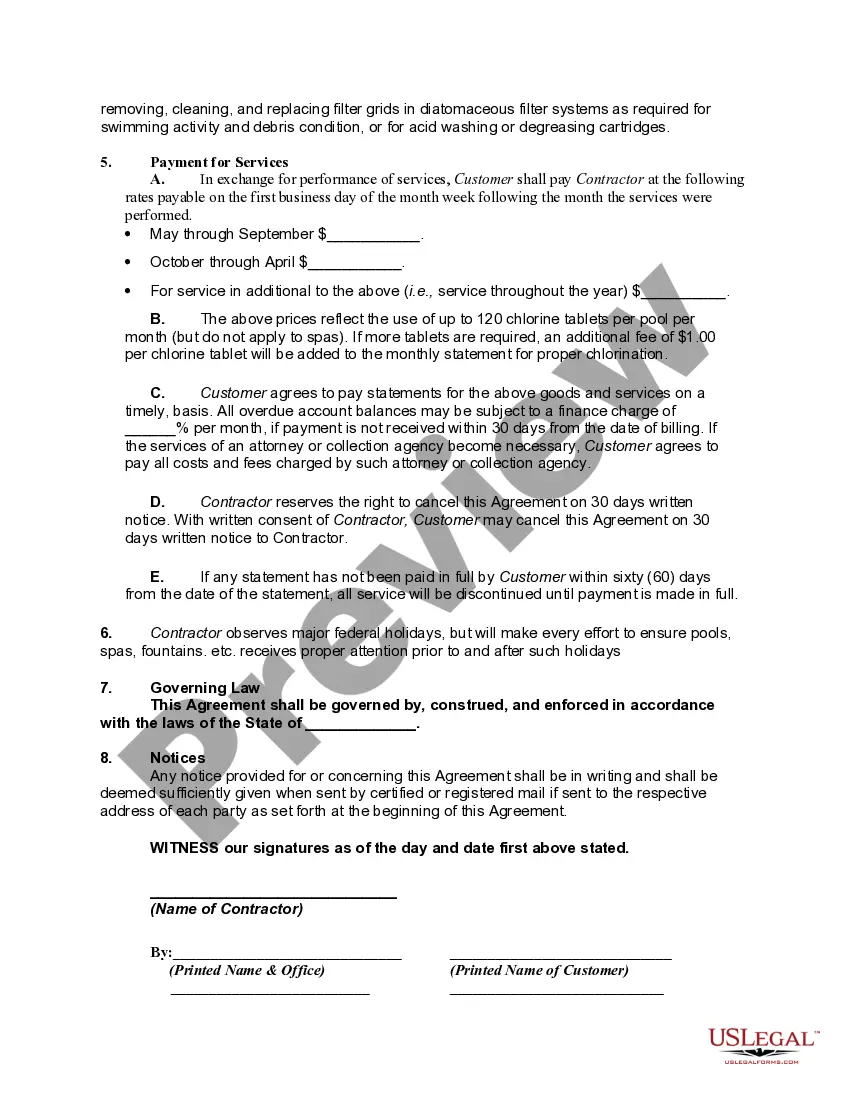

To write a swimming pool contract, begin by outlining the scope of services you will provide and the payment terms. Be sure to include details about maintenance schedules, responsibilities, and liability clauses. Utilizing a Missouri Pool Services Agreement - Self-Employed can streamline this process and ensure all necessary elements are included.

A good profit margin for a service business often lies between 15% and 30%. Each business is unique, and your service quality and efficiency can significantly affect margins. By using a Missouri Pool Services Agreement - Self-Employed, you can establish clear expectations and reduce costs, thereby improving your profit margin.

Pool service owners generally make between $40,000 and $100,000 a year, depending on the size and market of their business. Experienced owners can increase their earnings by expanding their service offerings. Crafting a solid Missouri Pool Services Agreement - Self-Employed can enhance your business reputation and attract more clients.

Pool service routes can be very profitable, especially if you target areas with many pools. Consistent service and customer satisfaction can lead to steady income. Establishing clear terms with a Missouri Pool Services Agreement - Self-Employed can enhance profitability by securing your commitments and customer relationships.

Yes, you can certainly service your own pool if you have the time and skills. However, keep in mind that regular maintenance can be time-consuming. Using a well-crafted Missouri Pool Services Agreement - Self-Employed can help if you decide to hire professionals for specific tasks, ensuring clarity in responsibilities.

The profit a pool installer makes can vary based on experience, location, and the scope of services offered. On average, many pool installers see profits in the range of $50,000 to $100,000 annually. If you consider using a Missouri Pool Services Agreement - Self-Employed, you can better outline your financial expectations and ensure long-term success.

Yes, a sole proprietor may need to obtain a business license in Missouri, depending on the nature of the business. While some small ventures might operate without a formal license, it is often necessary to comply with local regulations. To ensure you meet all requirements under a Missouri Pool Services Agreement - Self-Employed, check with your local government for specific licensing info.

For business taxes, you typically need profit and loss statements, receipts for expenses, and payroll records if you have employees. Additionally, having your LLC formation documents and any pertinent licenses is essential. When you have a solid Missouri Pool Services Agreement - Self-Employed, it creates a clear framework for all documentation, making the tax process more manageable.

To file taxes in Missouri, LLCs need to gather their income statements, expense records, and any other relevant documentation. Additionally, it's vital to have your federal tax identification number and your operating agreement handy. Using a well-structured Missouri Pool Services Agreement - Self-Employed will help in organizing your finances effectively, making tax filing simpler.

The self-employment tax in Missouri includes Social Security and Medicare taxes, which apply to individuals who work for themselves. Currently, the rate is 15.3% on your net earnings from self-employment. Understanding this tax is crucial for anyone operating under a Missouri Pool Services Agreement - Self-Employed. Keep track of your earnings to ensure you are paying the correct amount.