Missouri Insulation Services Contract - Self-Employed

Description

How to fill out Insulation Services Contract - Self-Employed?

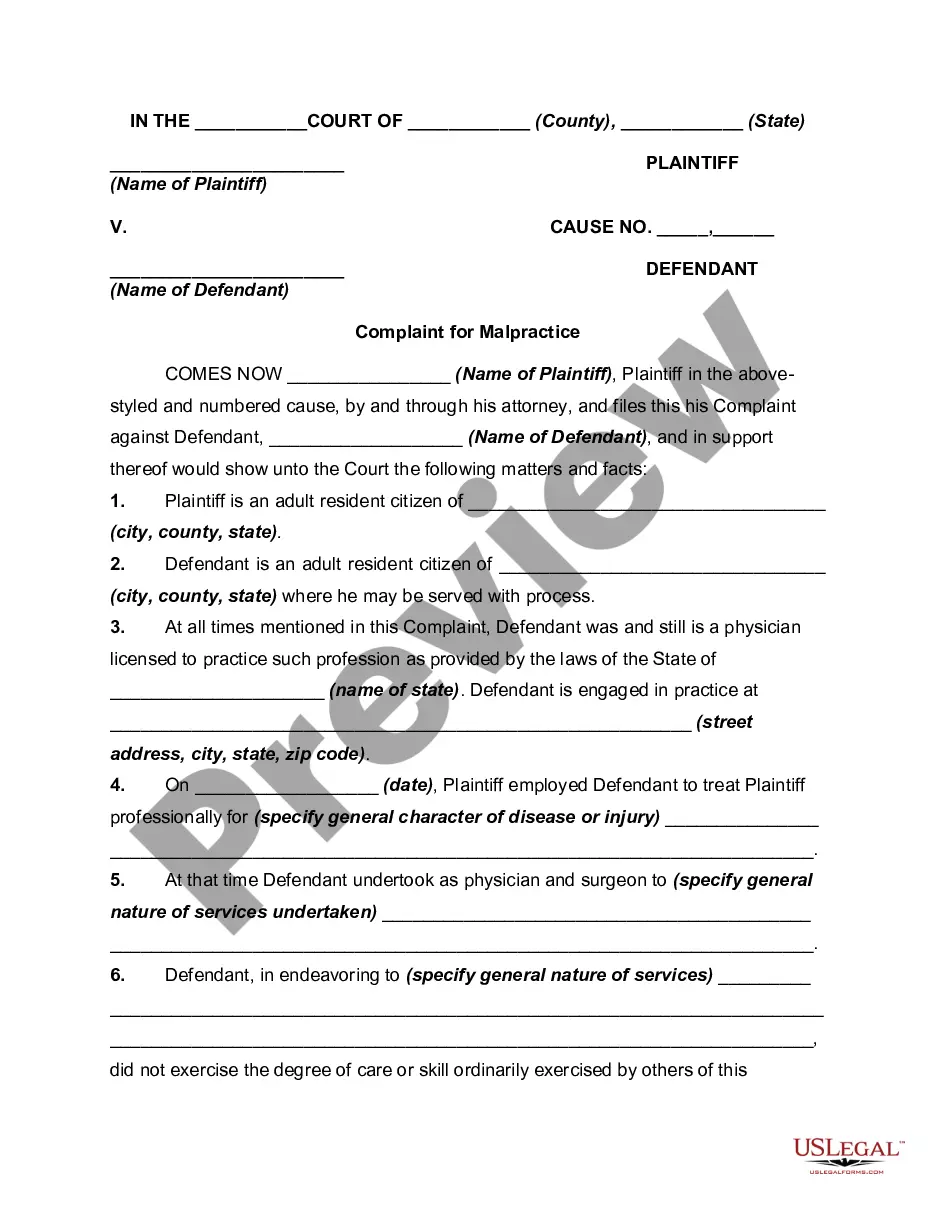

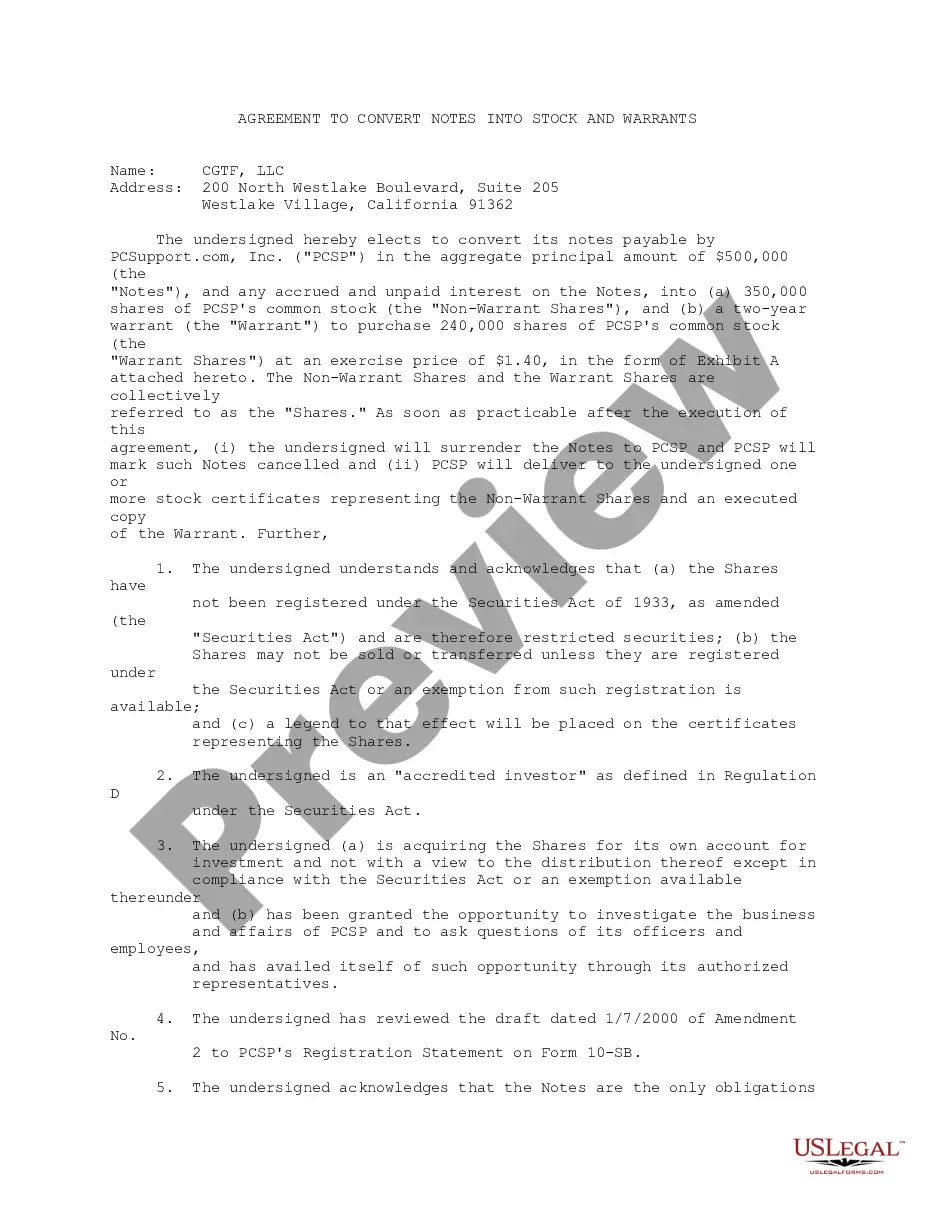

You can spend several hours online attempting to locate the legal document template that meets the federal and state regulations you need.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

It is easy to obtain or print the Missouri Insulation Services Contract - Self-Employed from their service.

If available, use the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Missouri Insulation Services Contract - Self-Employed.

- Every legal document template you purchase is yours indefinitely.

- To get an additional copy of any acquired form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for the county/city of your choice.

- Review the form details to ensure you have chosen the right form.

Form popularity

FAQ

To protect yourself as an independent contractor, ensure you have a well-drafted Missouri Insulation Services Contract - Self-Employed that clearly outlines your rights, payment terms, and obligations. Additionally, keep good records of your work and communications with clients. Utilizing platforms like uslegalforms can provide you with the necessary templates to construct solid agreements that safeguard your interests.

Yes, it is possible for someone to be labeled as an independent contractor while actually functioning as an employee, based on the level of control exercised by the employer. This misclassification can lead to legal and financial repercussions. Therefore, carefully review your Missouri Insulation Services Contract - Self-Employed to ensure your status is accurately represented and protects your rights.

A Missouri employment contract outlines the terms of employment and can specify whether a worker is considered an employee or an independent contractor. This document is fundamental in clarifying rights and responsibilities under a Missouri Insulation Services Contract - Self-Employed. It's important for both parties to fully understand the terms to avoid potential disputes down the line.

In Missouri, a contractor has six months from the date of the last service performed or materials supplied to file a lien. This timeline is vital for securing payment under your Missouri Insulation Services Contract - Self-Employed. It's essential to stay organized and timely in this process, as missing the deadline can jeopardize your ability to claim payment for your work.

The classification of an individual as an employee or independent contractor is determined by several factors, including the degree of control the employer has over the work process, the financial arrangement, and the nature of the relationship. In the context of a Missouri Insulation Services Contract - Self-Employed, you should also consider how you market your services, the terms of your agreements, and your method of payment. Understanding these distinctions is crucial for compliance and tax purposes.

While it is often beneficial to start a business when becoming an independent contractor, it is not strictly required in Missouri. You can operate as a sole proprietor without formally registering a business, but this may limit your credibility. A Missouri Insulation Services Contract - Self-Employed can provide a professional framework for your client relationships, reinforcing the perception of your services regardless of your business status.

Independent contractors in Missouri must comply with various legal requirements, including obtaining necessary licenses and permits for their specific services. Additionally, maintaining accurate financial records and understanding tax liabilities is crucial. Using a Missouri Insulation Services Contract - Self-Employed can assist you in addressing these legal aspects effectively and ensuring you adhere to regulations.

Becoming an independent contractor in Missouri begins with defining your services and establishing your business structure. Register your business with the state if required, and explore the specifications needed for your niche, like insulation services. Completing a Missouri Insulation Services Contract - Self-Employed can help streamline this process, providing clarity in contracts with clients.

To be an independent contractor in Missouri, you must have a clear understanding of your business model and the services you will provide. You will also need to handle your taxes, obtain necessary licenses, and manage your own insurance. By utilizing a Missouri Insulation Services Contract - Self-Employed, you can ensure that you meet all necessary obligations while delineating your responsibilities and rights.

The main difference between an independent contractor and an employee in Missouri lies in the level of control. An independent contractor has more freedom in deciding how to perform their work, while an employee typically follows an employer's set guidelines. Understanding this difference is critical when working under a Missouri Insulation Services Contract - Self-Employed, as it influences your tax responsibilities and benefits.