Missouri Form - Multimedia Product Publication Agreement

Description

How to fill out Form - Multimedia Product Publication Agreement?

Have you been in the place that you need paperwork for either organization or person uses almost every working day? There are a variety of legitimate file templates accessible on the Internet, but discovering ones you can trust is not easy. US Legal Forms offers a huge number of develop templates, just like the Missouri Form - Multimedia Product Publication Agreement, that are composed to fulfill state and federal demands.

If you are presently knowledgeable about US Legal Forms website and also have your account, just log in. Afterward, you may download the Missouri Form - Multimedia Product Publication Agreement design.

Should you not provide an account and want to begin to use US Legal Forms, adopt these measures:

- Get the develop you need and ensure it is for that correct city/county.

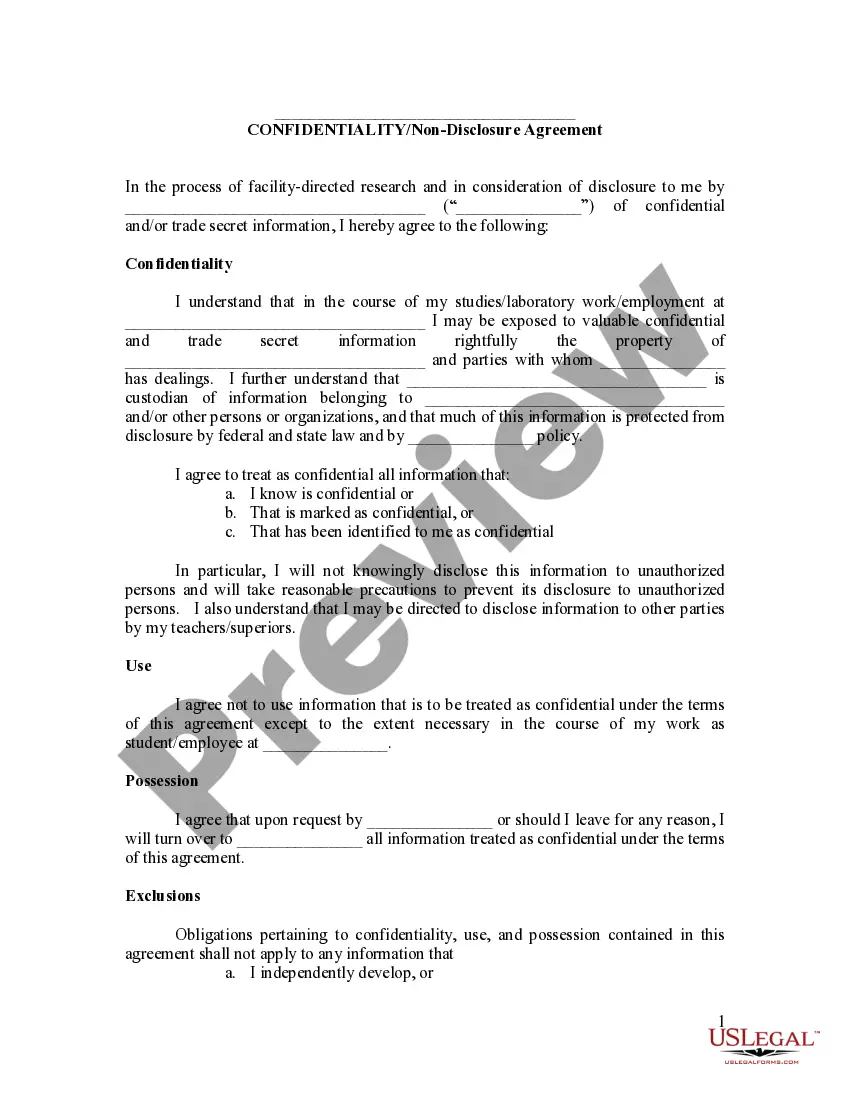

- Make use of the Review button to check the shape.

- Browse the information to ensure that you have chosen the proper develop.

- When the develop is not what you`re trying to find, take advantage of the Look for field to get the develop that suits you and demands.

- Once you obtain the correct develop, simply click Purchase now.

- Choose the costs strategy you want, submit the desired details to make your bank account, and pay for an order making use of your PayPal or bank card.

- Choose a hassle-free data file formatting and download your version.

Get all the file templates you possess bought in the My Forms food selection. You can obtain a additional version of Missouri Form - Multimedia Product Publication Agreement at any time, if needed. Just click the required develop to download or print the file design.

Use US Legal Forms, one of the most considerable assortment of legitimate varieties, to save lots of efforts and stay away from blunders. The service offers appropriately produced legitimate file templates that you can use for a selection of uses. Make your account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

For example, in California, the sales tax rate and use tax rate are equal at 7.25%. California sales tax is a tax that passes through the business and onto the customer at the time of purchase.

Generally, the sale of advertising is subject to tax if it involves the transfer of tangible personal property. Sales of tangible personal property that are not advertising but may contain advertising, such as specialty advertising, are also subject to tax, even if the sale is made by an exempt business.

Use Tax is defined as a tax on the storage, use, or consumption of a taxable item or service on which no sales tax has been paid. Use tax is a complementary or compensating tax to the sales tax and does not apply if the sales tax was charged.

Unlike sales tax, which requires a sale at retail in Missouri, use tax is imposed directly upon the person that stores, uses, or consumes tangible personal property in Missouri. Use tax does not apply if the purchase is from a Missouri retailer and subject to Missouri sales tax.

Examples: A person buys a vehicle from a dealer in a neighboring state and the dealer does not charge sales tax on the vehicle. The buyer must pay use tax on the purchase price of the vehicle when he/she returns to his/her state and/or city.

Filing Requirement Once you have accumulated $2,000 in taxable purchases in a calendar year, you must pay tax on all your purchases subject to consumer's use tax. Compute consumer's use tax based on the purchase price of the goods.

The non-reusable items of tangible personal property furnished in hotels and motels are not subject to sales tax. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items.

Fees paid for Internet access is not taxable. Sales over the Internet are subject to sales tax, if the sales transaction's shipping and delivery point is within the state of Missouri.