Missouri Accredited Investor Veri?cation Letter - Individual Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

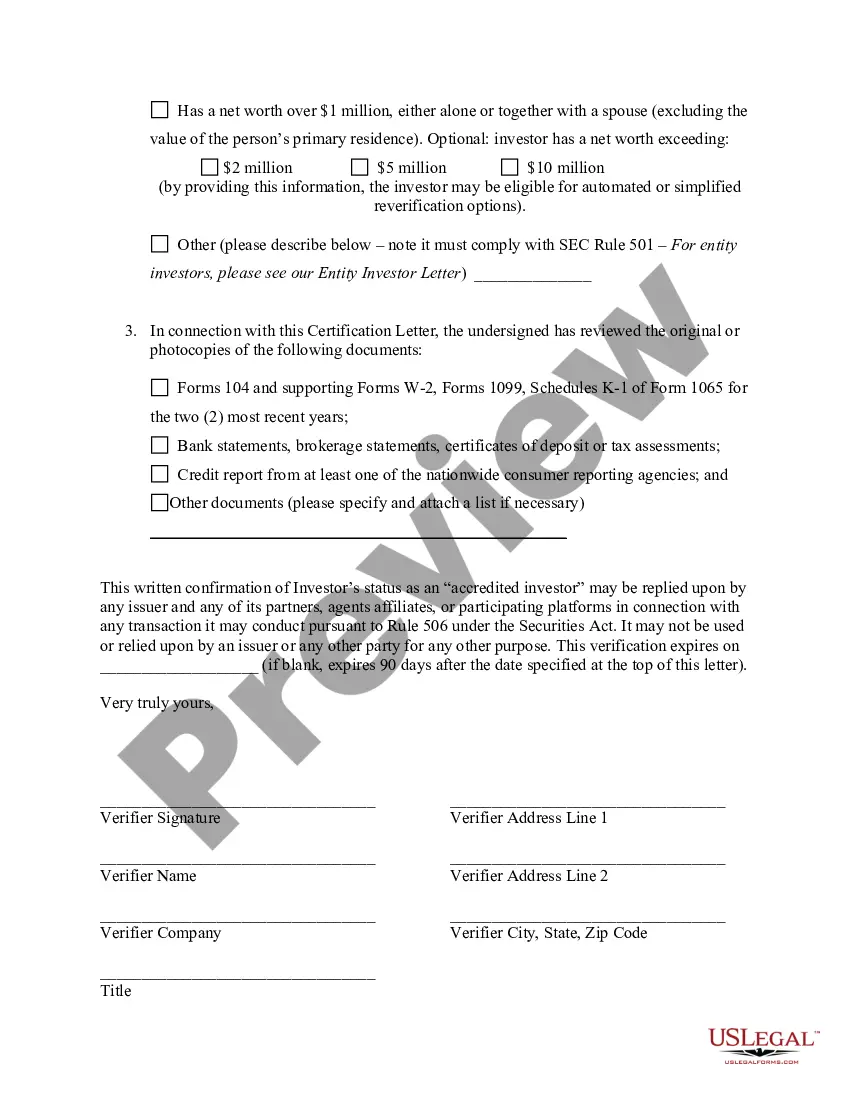

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Veri?cation Letter - Individual Investor?

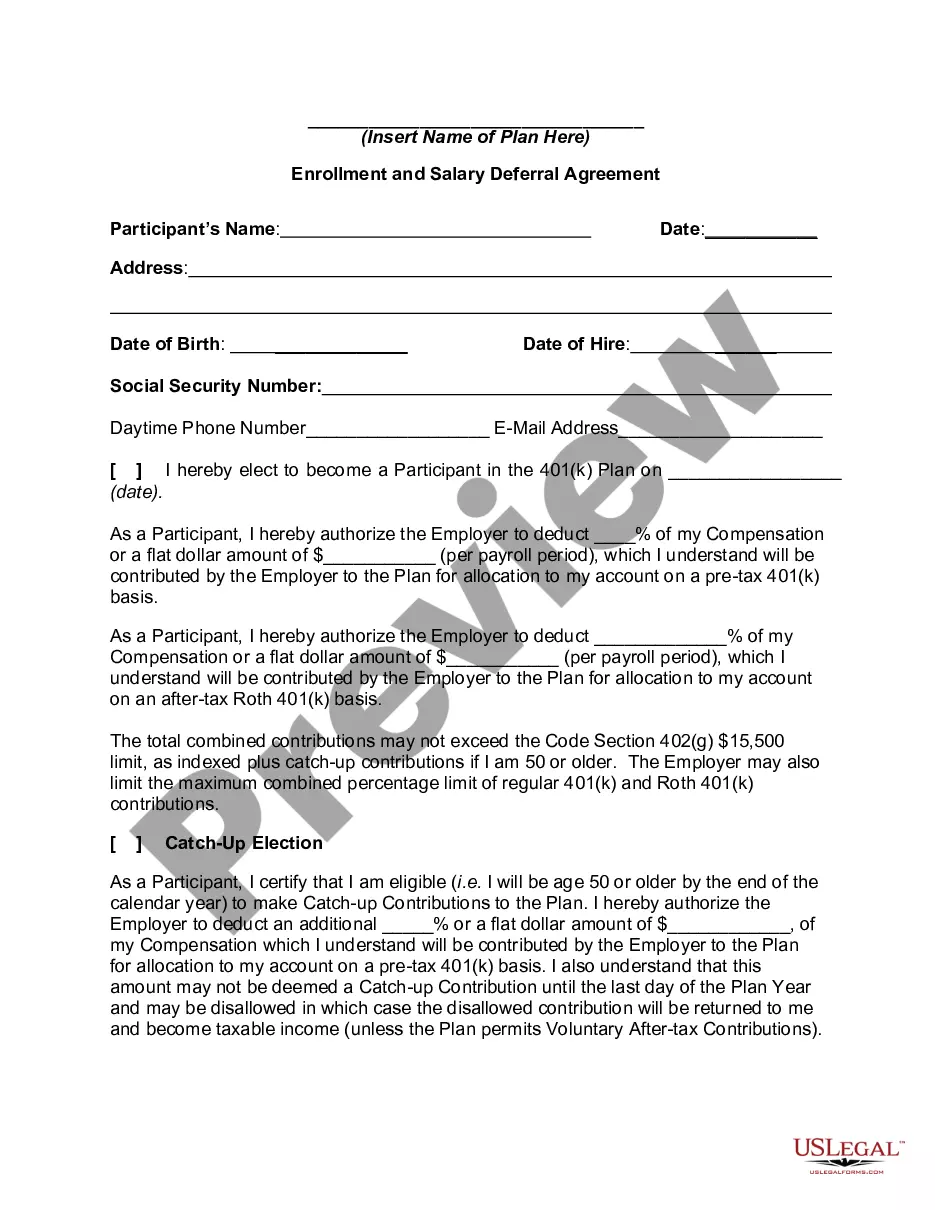

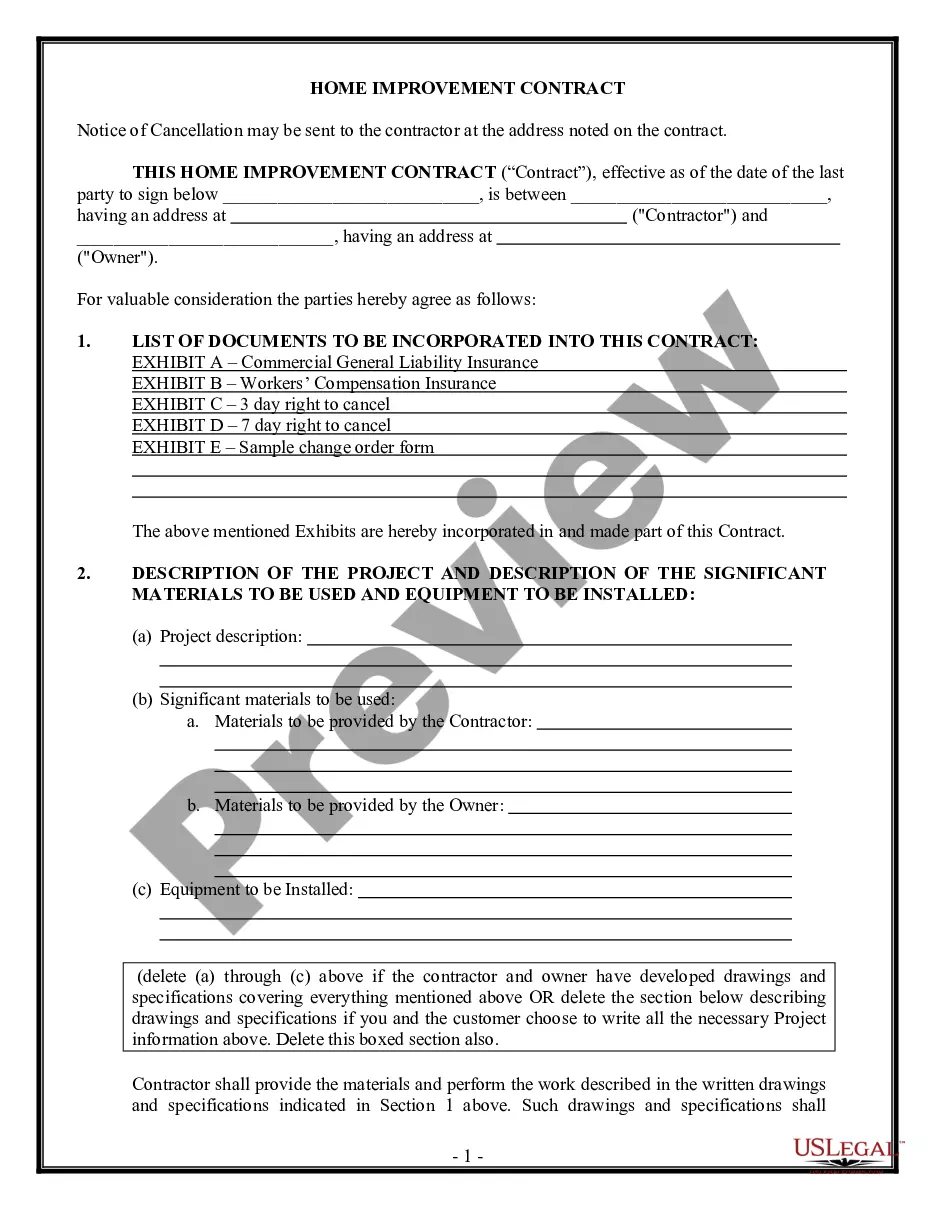

If you need to full, down load, or produce authorized document templates, use US Legal Forms, the biggest assortment of authorized forms, that can be found on the Internet. Make use of the site`s basic and practical search to discover the files you require. Different templates for company and specific reasons are categorized by groups and says, or keywords. Use US Legal Forms to discover the Missouri Accredited Investor Veri?cation Letter - Individual Investor within a number of clicks.

When you are presently a US Legal Forms consumer, log in to the accounts and click the Obtain option to find the Missouri Accredited Investor Veri?cation Letter - Individual Investor. You can also accessibility forms you formerly acquired from the My Forms tab of the accounts.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/country.

- Step 2. Use the Review choice to look through the form`s content material. Never overlook to read the information.

- Step 3. When you are not happy using the kind, make use of the Search industry at the top of the screen to find other models from the authorized kind design.

- Step 4. After you have found the shape you require, select the Purchase now option. Pick the prices plan you favor and put your qualifications to sign up for an accounts.

- Step 5. Method the financial transaction. You can use your charge card or PayPal accounts to perform the financial transaction.

- Step 6. Select the format from the authorized kind and down load it in your system.

- Step 7. Full, edit and produce or sign the Missouri Accredited Investor Veri?cation Letter - Individual Investor.

Every authorized document design you buy is yours permanently. You possess acces to every single kind you acquired inside your acccount. Select the My Forms section and decide on a kind to produce or down load again.

Compete and down load, and produce the Missouri Accredited Investor Veri?cation Letter - Individual Investor with US Legal Forms. There are many skilled and condition-specific forms you may use for your company or specific requirements.

Form popularity

FAQ

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Both are designations of investors that are permitted to invest in non-public investments. The difference between the two is that accredited investors must meet certain income, net worth or securities licensing criteria, while a qualified purchaser must simply have more than $5 million to make a large investment.

Non-accredited investors are limited by the SEC from some investment opportunities for their own financial safety. The SEC also set regulations on the disclosure and documentation of the investments available to the investors. For example, non-accredited investors are eligible to invest in mutual funds.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...